Catherine Wood's Strategic Acquisition of PagerDuty Inc Shares

Introduction to the Transaction

On May 31, 2024, Catherine Wood (Trades, Portfolio)'s investment firm made a notable addition to its portfolio by acquiring 187,039 shares of PagerDuty Inc (NYSE:PD) at a price of $18.97 per share. This transaction increased the firm's total holdings in PagerDuty to 9,611,132 shares, reflecting a significant commitment to the company. The trade had a modest impact of 0.02% on the portfolio, positioning PagerDuty at a 1.26% portfolio ratio and 10.05% holding ratio within the firm's investments.

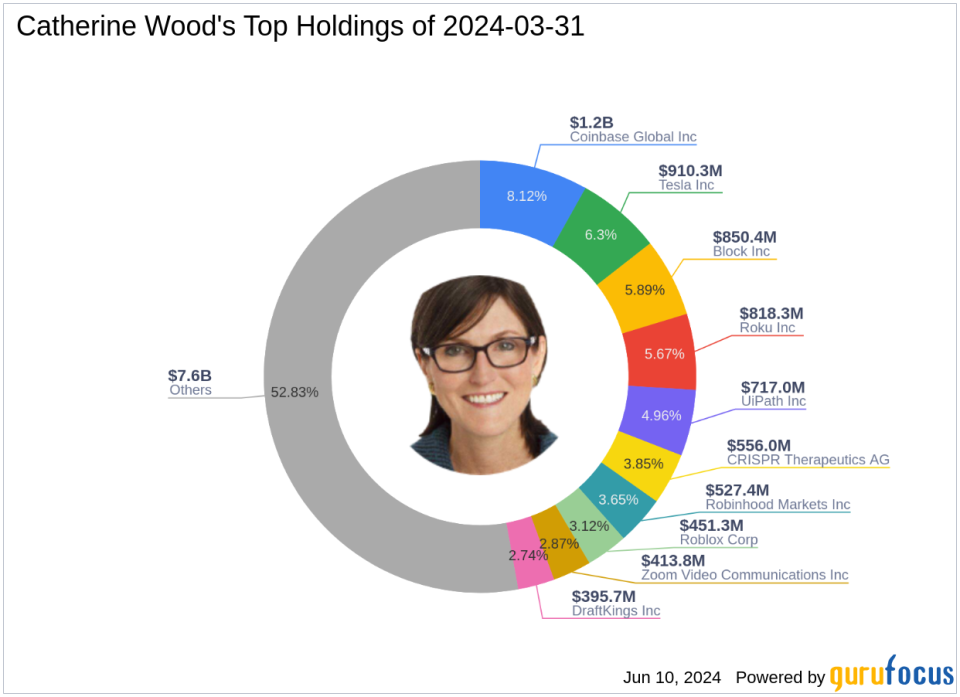

Profile of Catherine Wood (Trades, Portfolio)

With over four decades of experience in the investment field, Catherine Wood (Trades, Portfolio) founded ARK Investment Management LLC in 2014, focusing on disruptive innovation. The firm's investment philosophy is centered on identifying and capitalizing on technological advancements in sectors like AI, robotics, and blockchain. As the chief investment officer, Wood has been pivotal in shaping the firm's strategic direction and investment decisions. ARK is known for its open research approach, which helps in recognizing early investment opportunities that could deliver substantial long-term returns.

Overview of PagerDuty Inc

PagerDuty Inc operates as a digital operations management platform, essential for modern digital businesses managing urgent tasks. Since its IPO on April 11, 2019, the company has developed solutions like incident management and AIOPs, which integrate digital signals from various systems with human response data to optimize real-time operations. This capability positions PagerDuty as a critical tool for companies in managing their digital operations seamlessly.

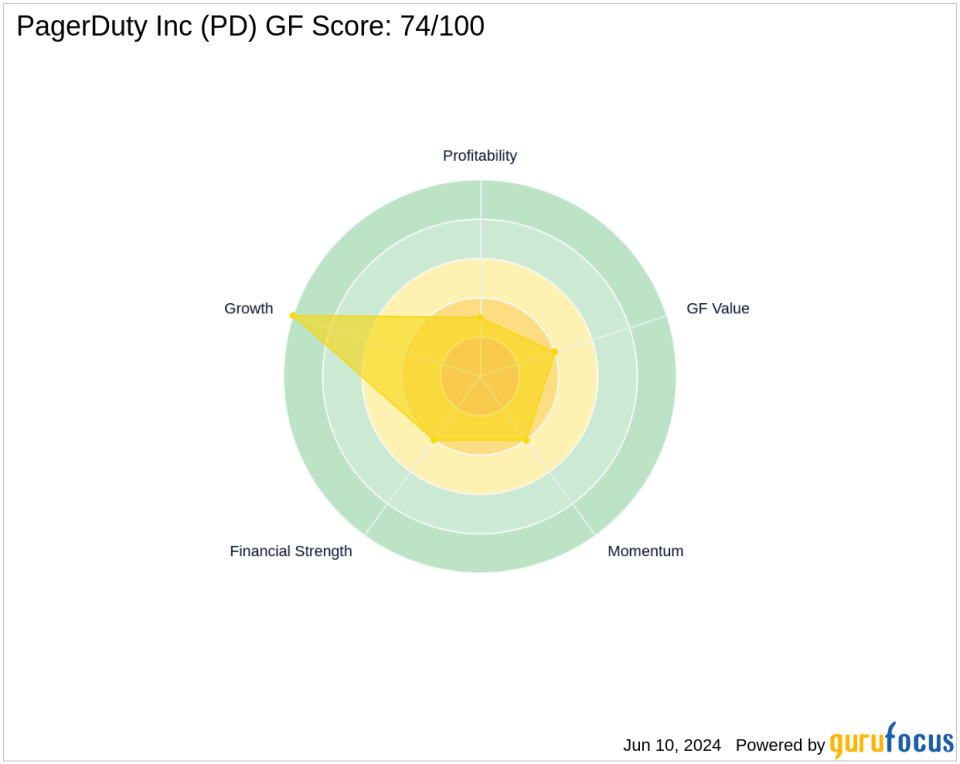

Financial and Market Analysis of PagerDuty Inc

Currently, PagerDuty Inc holds a market capitalization of $1.92 billion with a stock price of $20.12, reflecting a 6.06% gain since the recent transaction. Despite showing a potential value trap with a GF Value of $33.39 and a price to GF Value ratio of 0.60, the company's financial metrics suggest caution. The firm's profitability and financial strength have been underwhelming, with a Profitability Rank of 3/10 and a Financial Strength rank of 4/10. However, its growth rank stands impressively at 10/10, indicating strong future potential.

Impact of the Trade on Catherine Wood (Trades, Portfolio)s Portfolio

The acquisition of additional PagerDuty shares further diversifies ARK's portfolio, which is heavily inclined towards technology and healthcare sectors. This strategic move not only enhances the firm's stake in a promising technology company but also aligns with its focus on investing in innovative and disruptive business models.

Sector and Market Considerations

Technology and healthcare are the predominant sectors in Wood's investment focus, with PagerDuty fitting well within this framework. The firm's capabilities in digital operations management are crucial for the ongoing digital transformation in various sectors, making it a valuable addition to ARK's technology-oriented portfolio.

Comparative Analysis with Other Major Investors

Leucadia National currently stands as the largest guru shareholder in PagerDuty, highlighting the stock's appeal to prominent investors. The investment strategies between Catherine Wood (Trades, Portfolio) and other major shareholders may vary, but the focus on innovative companies like PagerDuty is a common thread.

Future Outlook and Stock Performance Potential

Despite the current financial metrics indicating some risks, PagerDuty's strong growth rank and ongoing relevance in digital operations management present a promising outlook. Investors should weigh the high growth potential against the financial challenges and market volatility. The firm's strategic investment in PagerDuty could yield significant returns if the company continues to expand and innovate in its offerings.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance