BMO vs. BNS: Which Bank Stock Is a Better Buy?

Written by Kay Ng at The Motley Fool Canada

The stocks of both Bank of Montreal (TSX:BMO) and Bank of Nova Scotia (TSX:BNS) offer nice dividend income to investors. Let’s explore which might be a better buy today seeing as they have experienced a dip in their shares recently. BMO is down about 11% from this year’s high, while BNS stock has declined approximately 8%.

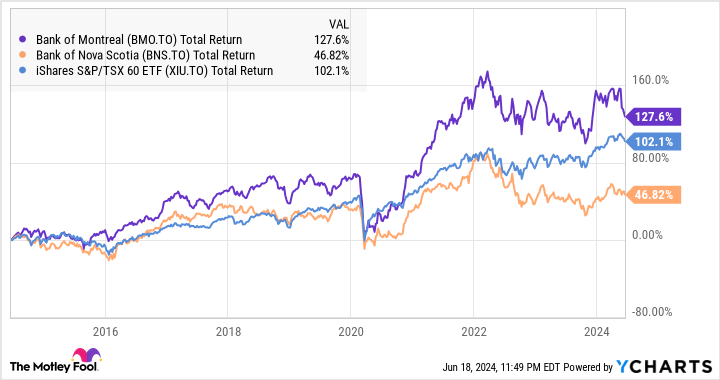

BMO, BNS, and XIU 10-year Total Return Level data by YCharts

Past performance

Let’s compare their past performance, which could give some insight into their future return potential. According to data from YCharts, in the last 10 years, BMO and BNS stock delivered annualized returns of about 8.6% and 3.9%, respectively, per year.

In comparison, the Canadian stock market, using iShares S&P/TSX 60 Index ETF as a proxy, delivered total returns of about 7.3% per year in the period. So, BMO slightly outperformed the market, while BNS stock greatly underperformed.

Dividend

At writing, Bank of Nova Scotia stock offers a juicy dividend yield of almost 6.7%. However, its payout ratio is higher than normal, with the trailing 12-month (TTM) payout ratio being 76% of its net income available to common stockholders. Based on adjusted earnings, BNS stock’s payout ratio is estimated to be approximately 66% this fiscal year.

Bank of Montreal stock offers a lower dividend yield of about 5.4%. Its TTM payout ratio was safer at 47% of its net income available to common stockholders. Based on adjusted earnings this fiscal year, BMO stock’s payout ratio is estimated to be approximately 57%.

Although BMO stock offers a smaller dividend yield, its dividend appears to be safer. Besides, a dividend yield of over 5% is pretty good for a blue-chip dividend stock. Its 10-year dividend-growth rate of 7.0% is also higher than BNS stock’s 5.7%.

Recent results

In the first half of the fiscal year, Bank of Nova Scotia reported revenue growth of 5.7% to $16.8 billion, while its non-interest expenses rose 4.6% year over year to $9.5 billion. Provision for credit losses (PCL) of almost $2 billion was another drag on earnings. Thankfully, the income tax expense in the period was about a third lower than a year ago. As a result, it reported net income of $4.3 billion, up 10% year over year. And the diluted earnings per share (EPS) climbed 7.6% to $3.25. The adjusted EPS fell 7.4% to $3.27.

In the same period, Bank of Montreal reported revenue growth of 21% to $15.6 billion. The bank kept good control of non-interest expenses, which rose 3.5% year over year to $10.2 billion. PCL of $1.3 billion was a drag on earnings. Ultimately, its adjusted earnings per share (EPS) fell 13.5% to $5.14.

Which bank stock is a better buy?

Both stocks have been in a downtrend since early 2022. However, given BMO’s better long-term track record of delivering returns and the fact that it offers a lower dividend yield today, which indicates the market thinks it’s a lower-risk stock, BMO is probably a better buy.

Unless an investor wants more income now, there’s not much reason to buy BNS over BMO at the moment. Of course, there’s nothing stopping an investor from buying a mix of both to get a blend of their yield and return prospects.

The post BMO vs. BNS: Which Bank Stock Is a Better Buy? appeared first on The Motley Fool Canada.

Should you invest $1,000 in Bank of Montreal right now?

Before you buy stock in Bank of Montreal, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bank of Montreal wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $17,363.76!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 26 percentage points since 2013*.

See the 10 stocks * Returns as of 6/3/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Kay Ng has positions in Bank Of Montreal and Bank Of Nova Scotia. The Motley Fool recommends Bank Of Nova Scotia. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance