3 Reasons to Buy Shopify Stock Right Now

Written by Brian Paradza, CFA at The Motley Fool Canada

A 30% pullback in global e-commerce software vendor Shopify (TSX:SHOP) stock from prior highs seen earlier this year seems like a potential buying opportunity for investors looking to hold a long-term growth stock. It’s not just the Canadian tech stock’s price action that makes it a compelling investment at current levels; Shopify’s consistently improving fundamentals present three strong reasons to buy SHOP stock right now.

Shopify’s growing cash flow generation capacity, improving earnings quality as revenue grows, and forward-looking valuation, as measured by its forward price-to-earnings-to-growth (PEG) ratio, present a compelling buy-and-hold thesis for long-term growth-oriented investors to scoop SHOP stock before it recovers to prior levels.

Shopify’s growing positive cash flow

Cash flow is the lifeblood of any business, including Shopify. While earnings may at times be elusive and operating margins may fluctuate, especially when a company is strategically transitioning to refined business models, cash flow usually doesn’t lie. It is currently speaking loudly in support of the buy-and-hold idea for Shopify stock.

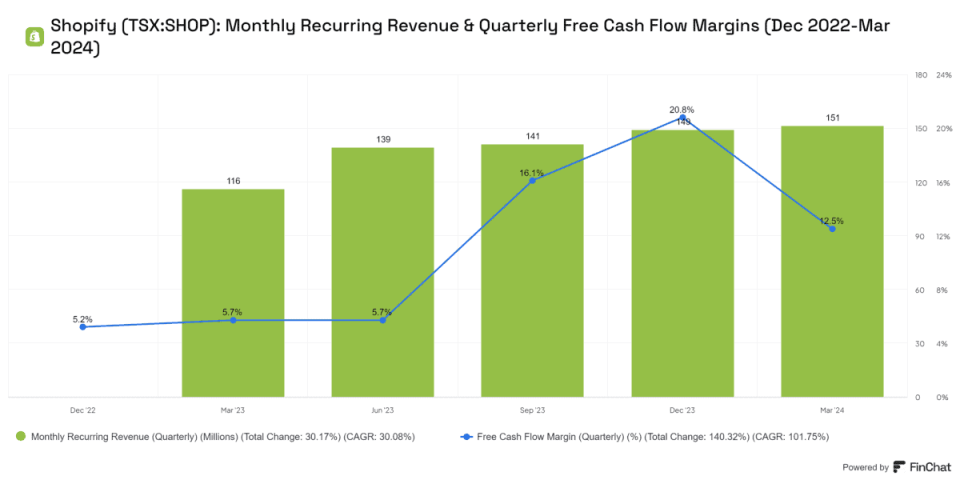

Shopify used to convert under 6% of its quarterly sales into free cash flow by December 2022. Fast forward to March this year, and the company can convert 12.5% of its quarterly sales into retainable cash from operations. Bay Street analysts’ projections for Shopify free cash flow to expand from US$900 million in 2023 to nearly US$1.7 billion by 2025 are even more encouraging.

Cash is king, and Shopify’s ability to build a treasure trove of free funds (free cash flow) could enable the company to make accretive acquisitions, consolidate, and bolster its market clout in a growing global e-commerce market. Expanding cash flow generation capacity makes Shopify stock more valuable in the future.

Improving earnings quality as revenue grows

Shopify is a consistently growing e-commerce stock. Its expanding total addressable market, approaching the US$900 billion mark, presents substantial growth opportunities for investors. Savvy investment banking analysts following Shopify project a strong near-term revenue growth outlook of 20% and a 27% earnings growth rate over the next year.

Most noteworthy is the company’s impressive growth in recurring revenue. Monthly recurring revenue increased from US$116 million a year ago to US$151 million by the end of March this year.

Sustained growth in recurring revenue is a strong testament to the company’s ability to capture and retain a growing number of loyal customers. These merchants’ repeated subscriptions and payments stabilize Shopify’s periodic cash flow receipts and enhance the company’s earnings quality and predictability. This sets the stage for Shopify to potentially become a formidable dividend stock as its software business matures over the next two decades.

Even better, the company is likely to have a better grip on operating expenses going forward after an expensive lesson on operating leverage post the pandemic. Shopify’s operating margins may expand with revenue growth over the next two to three years, improving the growth stock’s appeal to investors.

Shopify stock fairly valued

Following a substantial pullback in Shopify stock price so far this year, the e-commerce giant appears fairly valued, given its potential growth prospects over the next few years. Bay Street analysts forecast Shopify’s business to grow revenue and earnings at a double-digit annual clip over the next five years. With a long-term earnings growth outlook of 72% over the next five years and a forward PEG ratio of 0.9, Shopify stock is fairly valued relative to its potential earnings growth capacity.

Investor takeaway

Investing in Shopify stock right now offers a compelling opportunity for long-term, growth-oriented investors. The company’s robust cash flow generation, improving earnings quality, and fair valuation provide a strong buy-and-hold thesis. Shopify stock is well-positioned to deliver significant returns to shareholders as the company expands its market presence and capitalizes on growing e-commerce trends.

The post 3 Reasons to Buy Shopify Stock Right Now appeared first on The Motley Fool Canada.

Should you invest $1,000 in Shopify right now?

Before you buy stock in Shopify, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Shopify wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $17,363.76!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 26 percentage points since 2013*.

See the 10 stocks * Returns as of 6/3/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Brian Paradza has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Shopify. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance