BriaCell Therapeutics Corp. (BCT.TO)

| Previous Close | 1.0800 |

| Open | 1.0400 |

| Bid | 1.0300 x N/A |

| Ask | 1.0700 x N/A |

| Day's Range | 1.0300 - 1.0500 |

| 52 Week Range | 0.8400 - 10.1982 |

| Volume | |

| Avg. Volume | 12,577 |

| Market Cap | 19.199M |

| Beta (5Y Monthly) | 1.91 |

| PE Ratio (TTM) | N/A |

| EPS (TTM) | -0.5100 |

| Earnings Date | Oct 23, 2024 - Oct 28, 2024 |

| Forward Dividend & Yield | N/A (N/A) |

| Ex-Dividend Date | N/A |

| 1y Target Est | N/A |

GlobeNewswire

GlobeNewswireBriaCell Quadruples Progression Free Survival (PFS) in Patient with “Eye-Bulging” Metastatic Breast Cancer

Progression free survival (PFS) extended to 9.1 months in ADC resistant patient - quadruple the PFS of patients in similar studies 1, 2, 3Significant reduction of “Eye-Bulging” metastatic breast cancer tumor was previously reportedHeavily pre-treated patient had failed 8 prior regimens including antibody-drug conjugate (ADC) therapy and continues to receive BriaCell treatment PHILADELPHIA and VANCOUVER, British Columbia, July 18, 2024 (GLOBE NEWSWIRE) -- BriaCell Therapeutics Corp. (Nasdaq: BCTX

GlobeNewswire

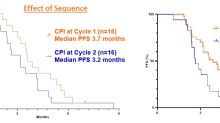

GlobeNewswireBriaCell Presents Clinical Efficacy Data at ASCO 2024

BriaCell doubles Progression-Free-Survival (PFS) and Clinical Benefit Rate vs historical results in the literatureBria-IMT™ PFS compares favorably to PFS of most recent treatment in 48% of Antibody-Drug Conjugate (ADC) resistant patientsTherapy well-tolerated with no Bria-IMT™ related discontinuationsClinical data highlight significant potential of Bria-IMT™ in advanced metastatic breast cancerSuperiority of selected Phase 3 regimen and formulation confirmedOral presentation by Mayo Clinic Profe

GlobeNewswire

GlobeNewswireBriaCell Initiates Patient Enrollment in First-in-Human Study of Bria-OTS™ in Advanced Metastatic Breast Cancer

PHILADELPHIA and VANCOUVER, British Columbia, May 30, 2024 (GLOBE NEWSWIRE) -- BriaCell Therapeutics Corp. (NASDAQ: BCTX, BCTXW) (TSX: BCT) (“BriaCell” or the “Company”), a clinical-stage biotechnology company that develops novel immunotherapies to transform cancer care, announces initiation of a first-in-human, Phase 1/2 study evaluating safety and efficacy of Bria-OTS™, BriaCell’s personalized off-the-shelf next generation immunotherapy, as monotherapy and in combination with PD-1 inhibitor ti