Zscaler (NASDAQ:ZS) Posts Better-Than-Expected Sales In Q1, Stock Soars

Cloud security platform Zscaler (NASDAQ:ZS) reported Q1 CY2024 results beating Wall Street analysts' expectations , with revenue up 32.1% year on year to $553.2 million. The company expects next quarter's revenue to be around $566 million, in line with analysts' estimates. It made a non-GAAP profit of $0.88 per share, improving from its loss of $0.30 per share in the same quarter last year.

Is now the time to buy Zscaler? Find out in our full research report.

Zscaler (ZS) Q1 CY2024 Highlights:

Revenue: $553.2 million vs analyst estimates of $536.1 million (3.2% beat)

Billings: $628.0 million up 30.2% year on year and vs analyst estimates of $584.3 million (7.5% beat)

EPS (non-GAAP): $0.88 vs analyst estimates of $0.65 (35.9% beat)

Revenue Guidance for Q2 CY2024 is $566 million at the midpoint, roughly in line with what analysts were expecting

Billings, Revenue, non-GAAP operating income guidance for the full year all raised

Gross Margin (GAAP): 78.6%, up from 77.2% in the same quarter last year

Free Cash Flow of $123.1 million, up 22.2% from the previous quarter

Billings: $628 million at quarter end, up 30.2% year on year

Market Capitalization: $24.63 billion

"We delivered an outstanding quarter driven by growing customer interest in our Zero Trust Exchange platform," said Jay Chaudhry, Chairman and CEO of Zscaler.

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry's fifth venture, Zscaler (NASDAQ:ZS) offers software-as-a-service that helps companies securely connect to applications and networks in the cloud.

Network Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. The migration of businesses to the cloud and employees working remotely in insecure environments is increasing demand modern cloud-based network security software, which offers better performance at lower cost than maintaining the traditional on-premise solutions, such as expensive specialized firewall hardware.

Sales Growth

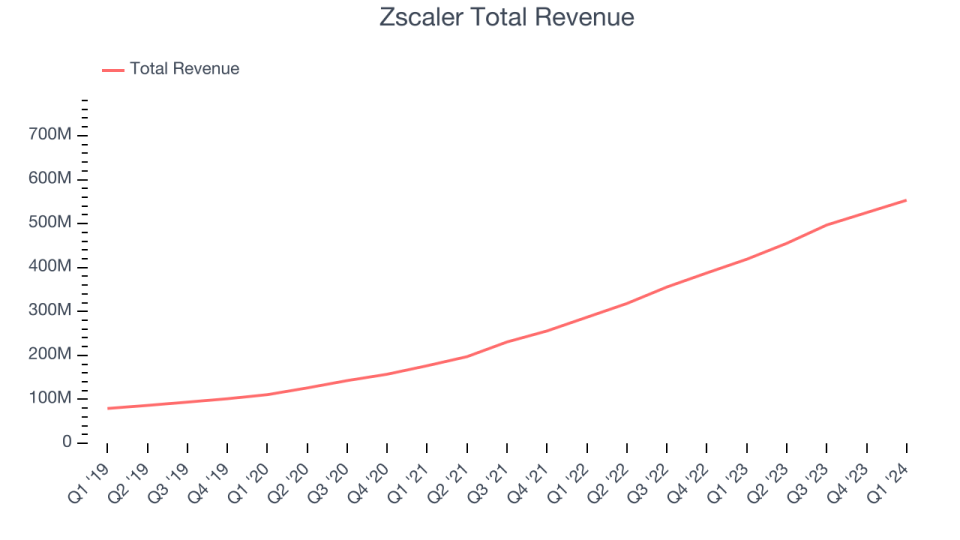

As you can see below, Zscaler's revenue growth has been impressive over the last three years, growing from $176.4 million in Q3 2021 to $553.2 million this quarter.

Unsurprisingly, this was another great quarter for Zscaler with revenue up 32.1% year on year. Quarter on quarter, its revenue increased by $28.2 million in Q1, which was roughly in line with the Q4 CY2023 increase. This steady growth shows that the company can maintain a strong growth trajectory.

Next quarter's guidance suggests that Zscaler is expecting revenue to grow 24.4% year on year to $566 million, slowing down from the 43.1% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 23.1% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

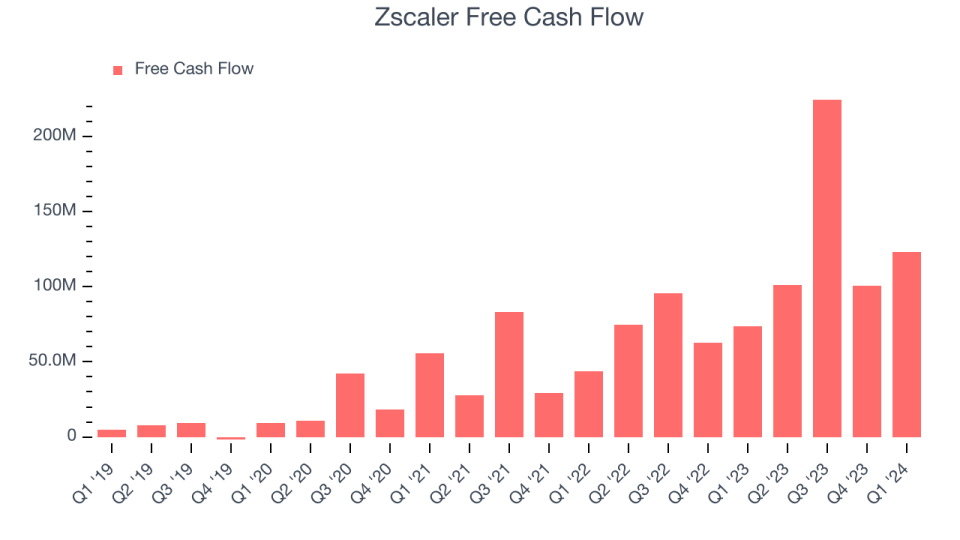

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Zscaler's free cash flow came in at $123.1 million in Q1, up 66.6% year on year.

Zscaler has generated $549.9 million in free cash flow over the last 12 months, an eye-popping 27.1% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Zscaler's Q1 Results

This was a beat and raise quarter. We were impressed by how strongly Zscaler blew past analysts' billings expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates while also exhibiting better profitability. Lastly, the company raised its full year guidance across the board for billings, revenue, and non-GAAP operating profit. Overall, we think this was a strong quarter that should satisfy shareholders. The stock is up 7.9% after reporting and currently trades at $167.80 per share.

Zscaler may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance