Pensioners: 2 Stocks That Cut You a Cheque Each Month

Written by Kay Ng at The Motley Fool Canada

With higher interest rates and a cost of living that’s on the rise, the pension payments you’re getting may not be enough, especially for Canadians who are playing it safe and putting their savings in low-risk investments, such as guaranteed investment certificates (GICs), which better protect your principal but have historically delivered lower long-term returns than higher-risk asset classes like stocks.

If you need a boost in your monthly income, you can make your very own personalized pension. Start by checking out these Canadian retail real estate investment trusts (REIT). It is a good area to begin your quest for monthly income (but don’t expect much growth).

CT REIT

The CT REIT (TSX:CRT.UN) portfolio consists of a more than 30 million gross leaseable area across over 370 retail properties, four industrial properties, a mixed-use commercial property, and a development property.

The retail REIT has generally been under pressure, as interest rates have gone higher since 2022, and its growth has slowed due to a higher cost of capital. However, its cash flows remain resilient with investment-grade Canadian Tire (TSX:CTC.A) as its major tenant.

Its other top 10 tenants, including Save on Foods, Bank of Montreal, Tim Hortons, Sleep Country, Dollarama, and Walmart, contribute approximately 4.2% of its annualized base rent.

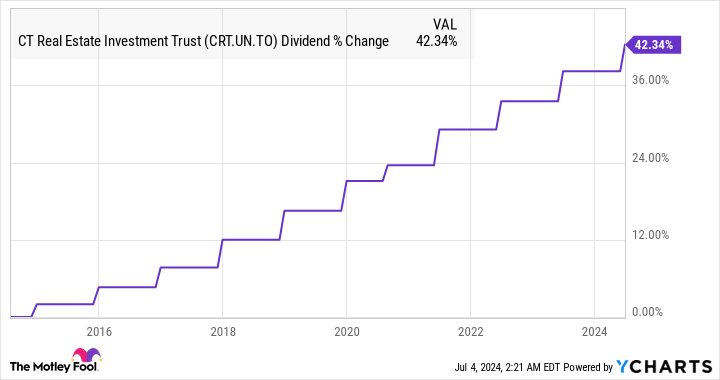

The stock has declined more than 20% since the beginning of 2022, while it has raised its monthly cash distribution by 10%. To be sure, the REIT has been increasing its cash distribution for about 11 consecutive years with a sustainable payout ratio. As a reference, its five-year cash distribution growth rate is 3.9%.

CRT.UN Dividend data by YCharts

CT REIT maintains a high occupancy rate of about 99.5% and has a weighted average lease term of roughly eight years – one of the longest in the sector.

Although its funds from operations have been resilient, its stock price has slid, resulting in an attractive yield of 6.9% at $13.36 per unit at writing. Valuation-wise, the stock is almost back at the 2020 pandemic low.

Currently, analysts target a 12-month stock price of $15.50, which represents near-term upside potential of 16%. If interest rates were to decline, it should help lift the stock.

Perhaps an area in Canadian REITs that could experience above-average growth compared to the rest of the industry is industrial REITs, for example, Dream Industrial REIT (TSX:DIR.UN).

Dream Industrial REIT

In its May presentation, Dream Industrial REIT noted that the market rent is much higher than its in-place rent. So, it could raise rents when it comes time to finding new tenants for leases that are maturing.

Specifically, management notes that the mark-to-market potential is 44% higher for its Canadian portfolio and 8% for its European portfolio. Over the last year, the market rent has also been increasing by 4.9% and 6.5%, respectively, in the respective markets, suggesting that demand for industrial properties persists. Dream Industrial REIT’s recent occupancy rate was 96%.

From $12.83 per unit at writing, analysts think the stock could potentially climb 24% over the next 12 months. The industrial REIT doesn’t tend to increase its cash distribution, but it offers a nice yield of about 5.5%, which appears to be safe.

The post Pensioners: 2 Stocks That Cut You a Cheque Each Month appeared first on The Motley Fool Canada.

Should you invest $1,000 in Ct Real Estate Investment Trust right now?

Before you buy stock in Ct Real Estate Investment Trust, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ct Real Estate Investment Trust wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $16,110.59!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 29 percentage points since 2013*.

See the 10 stocks * Returns as of 6/20/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Kay Ng has positions in Bank of Montreal and Canadian Tire. The Motley Fool recommends Dream Industrial Real Estate Investment Trust and Walmart. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance