Zomedica Corp (ZOM) Q1 2024 Earnings: Revenue Climbs Amidst Rising Costs, Aligns with Analyst ...

Revenue: Reported at $6.3 million for Q1 2024, marking a 14% increase year-over-year, but fell short of the estimated $8.18 million.

Gross Margin: Maintained a strong performance at 66%, consistent with company expectations.

Net Loss: Deepened to $9.2 million in Q1 2024 from $6.4 million in Q1 2023, with a per-share loss of $0.01, deviating from the estimated earnings per share.

Operating Expenses: Rose to $14.5 million, up 28% year-over-year, driven by integration and expansion efforts.

Research and Development: Expenses doubled to $1.8 million, reflecting ongoing investment in product development and regulatory compliance.

Liquidity: Ended the quarter with $90.9 million in cash, cash equivalents, and securities, a decrease from the previous quarter's $100.5 million.

2024 Outlook: Revenue expected to be between $31 million and $35 million, indicating a potential increase of up to 39% from 2023.

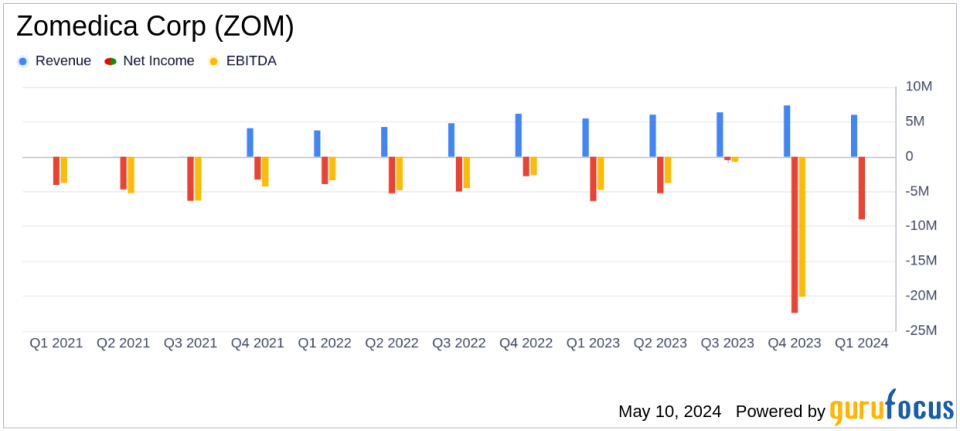

Zomedica Corp (ZOM) released its 8-K filing on May 9, 2024, unveiling a mixed financial performance for the first quarter of the year. The company, a key player in the veterinary health sector, reported a significant revenue increase but also faced heightened operating costs.

Zomedica, headquartered in Ann Arbor, Michigan, focuses on developing products for companion animals and equine care. The company's portfolio includes both diagnostic and therapeutic devices, with a notable emphasis on its TRUFORMA platform, designed to enhance thyroid and adrenal disorder detection in pets.

Financial Performance Overview

For Q1 2024, Zomedica recorded revenues of $6.3 million, marking a 14% increase from the $5.5 million reported in the same period last year. This growth was primarily driven by a robust performance in the Diagnostics segment, which saw an 86% increase, and a solid 9% growth in the Therapeutics Devices segment. The company's gross margin remained strong at 66%, reflecting efficient cost management despite rising expenses.

However, Zomedica's net loss widened to $9.2 million, or $0.01 per share, compared to a net loss of $6.4 million, or $0.007 per share, in the first quarter of 2023. This increase in net loss can be attributed to a significant rise in operating expenses, which surged by 28% to $14.5 million due to integration costs from recent acquisitions and increased investment in research and development.

Strategic Initiatives and Future Outlook

Zomedica's CEO, Larry Heaton, highlighted the company's strategic efforts to drive growth through an expanded product portfolio and optimized commercial operations. The company is actively working on integrating AI into its offerings and launching new assays for its TRUFORMA platform. These initiatives are part of Zomedica's broader strategy to achieve profitability and aim for a revenue target of $100 million in the foreseeable future.

For the full year 2024, Zomedica anticipates revenues to be in the range of $31 to $35 million, which would represent a substantial increase from the previous year. The company expects revenue growth to be driven by both existing and newly launched products, without considering potential benefits from any further acquisitions.

Liquidity and Capital Management

As of March 31, 2024, Zomedica reported having $90.9 million in cash, cash equivalents, and available-for-sale securities, a decrease from $100.5 million at the end of 2023. This reduction is primarily due to increased operational expenditures and costs associated with strategic acquisitions and compliance efforts.

In conclusion, while Zomedica faces challenges in managing rising costs and a widening net loss, its strategic initiatives and strong revenue growth in the first quarter demonstrate potential for future profitability and market expansion. Investors and stakeholders will likely watch closely as the company continues to execute its growth strategy in the competitive veterinary health market.

For detailed financial results and further information, please refer to Zomedica's filings on EDGAR and SEDAR or visit their website.

Explore the complete 8-K earnings release (here) from Zomedica Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance