3 Dividend Stocks With Attractive Yields for Sale Now

Written by Kay Ng at The Motley Fool Canada

Here are three dividend stocks that offer attractive yields and nice total returns potential. Some ideas are riskier (with businesses and stocks that are more unpredictable) than others, though.

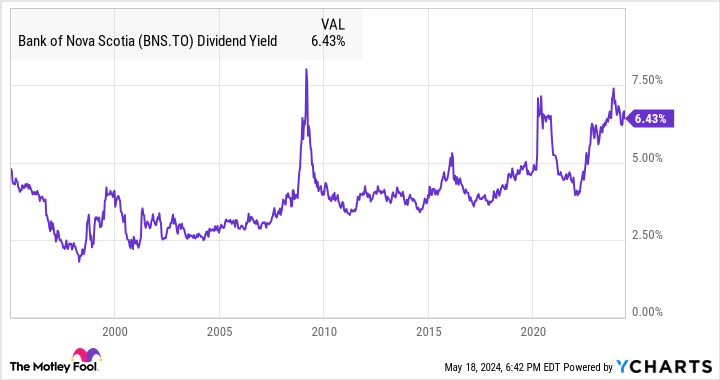

Scotia stock offers an attractive 6.4% dividend yield

Bank of Nova Scotia (TSX:BNS) stock is a turnaround story. It has been the worst-performing bank of the big Canadian bank stocks over the last decade because of its exposure to higher-risk developing markets that occasionally don’t work out and generally have higher levels of bad loans, particularly in a higher interest rate environment. Investors can view its larger dividend yield as higher compensation for holding the stock.

A reversion to the mean over the next five years could drive double-digit returns in the value stock. In the meantime, at $65.91 per share at writing, Scotia stock trades at about 10 times earnings and offers a 6.4% dividend yield.

BNS Dividend Yield data by YCharts

If you’re an income-focused investor, it’s not a bad idea to park some of your money in the bank stock. It produces 28% more income than a traditional one-year Guaranteed Investment Certificate (GIC). A reversion to the mean could drive total returns of more or less 14% per year over the next five years.

Fortis stock yields almost 4.3%

Fortis (TSX:FTS) stock currently trades at a discount to its long-term normal valuation because of higher interest rates and a higher cost of capital. It commands a premium long-term price-to-earnings ratio because of the predictability of its business. Despite higher rates, it’s still able to deliver steady earnings growth. Along with a sustainable payout ratio, it can continue increasing its dividend, and this is what long-term investors expect from the stock.

At $55.49 per share at writing, the utility stock offers a dividend yield of 4.25%. If interest rates come down over the next five years, it should push the stock back to its long-term normal valuation for total returns of approximately 10% per year. That would be satisfying returns from a low-risk, blue-chip stock.

Magna International yields 4%

The last dividend stock idea is for long-term investors with a high risk tolerance.

Magna International (TSX:MG) is an auto parts company that is in the consumer cyclical sector. Indeed, its profits and cash flows have gone on a roller-coaster ride through the economic cycle.

It’s a rarity to find the consumer discretionary stock offering a 4% dividend yield, which is at the high end of its historical yield range. It means the stock is on sale. However, interested investors should note that it doesn’t mean it can’t get cheaper.

Under extreme operating conditions, the stock had experienced extreme selloffs. For example, over the last two decades, there were two occasions (the global financial crisis and the 2020 pandemic) in which it offered a dividend yield of about 5%. It is anyone’s guess whether, this time around, it would hit that 5% yield or not. The potential of this happening means there could be another downside of roughly 20% in the cyclical stock.

That said, from the current levels of $64.63 per share, a reversion to the mean coupled with an economic expansion could drive total returns of over 20% per year over the next five years. Consider this as the best-case scenario.

The post 3 Dividend Stocks With Attractive Yields for Sale Now appeared first on The Motley Fool Canada.

Should you invest $1,000 in Bank of Nova Scotia right now?

Before you buy stock in Bank of Nova Scotia, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bank of Nova Scotia wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $18,271.97!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 32 percentage points since 2013*.

See the 10 stocks * Returns as of 5/21/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Kay Ng has positions in Bank Of Nova Scotia and Fortis. The Motley Fool recommends Bank Of Nova Scotia, Fortis, and Magna International. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance