Yelp Inc (YELP) Q1 2024 Earnings: Solid Revenue and Net Income Growth

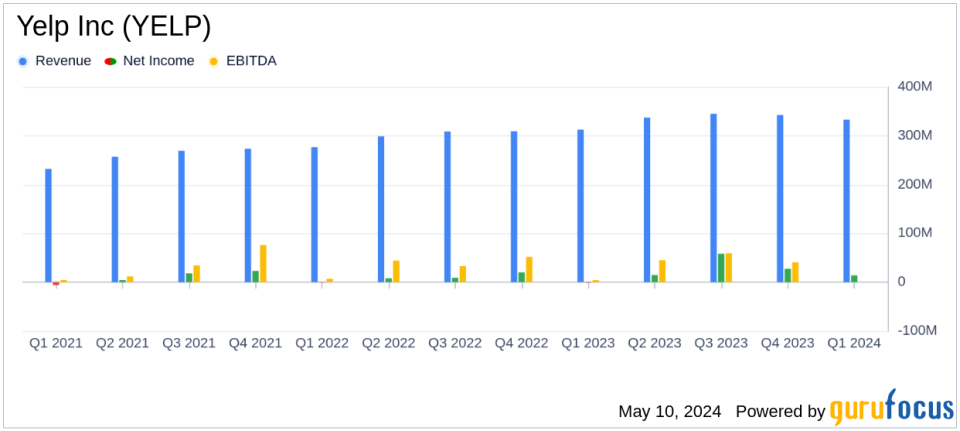

Revenue: $333 million, up 7% year-over-year, slightly below estimates of $333.44 million.

Net Income: $14 million, significantly above estimates of $3.97 million.

Earnings Per Share (EPS): Basic EPS of $0.21 and Diluted EPS of $0.20, surpassing the estimated EPS of $0.06.

Adjusted EBITDA: Grew 19% year-over-year to $64 million, indicating strong operational efficiency and profitability.

Free Cash Flow: Reported at $65.87 million, demonstrating strong cash generation capabilities.

Investments: Continued strategic investments in product development and marketing, supporting sustained growth in key service categories.

Market Outlook: Positive outlook supported by robust product enhancements and effective growth strategies in service sectors.

On May 9, 2024, Yelp Inc (NYSE:YELP) disclosed its first quarter financial results for the year, showcasing a robust performance with significant improvements in revenue and net income. The details were released in an 8-K filing, highlighting the company's strategic focus on services which propelled the positive outcomes.

Yelp Inc, a leading online content market player based in the United States, operates a platform that connects consumers with local businesses. The platform facilitates consumer decisions through reviews, tips, and direct interactions, primarily generating revenue through advertising and business services.

Financial Highlights

For Q1 2024, Yelp reported a net revenue of $333 million, marking a 7% increase year-over-year and surpassing the estimated $333.44 million projected by analysts. Net income saw a substantial rise to $14 million compared to a loss in the previous year, reflecting a 4% margin and demonstrating a significant turnaround in profitability. Adjusted EBITDA also grew impressively by 19% year-over-year to $64 million, indicating efficient operational management and cost control.

Operational and Strategic Developments

Yelp's co-founder and CEO, Jeremy Stoppelman, attributed the quarter's success to the strength in the services sector, particularly home services, which helped counterbalance challenges in other categories like restaurants and retail. The introduction of Yelp Assistant, a conversational AI feature, was highlighted as a key innovation, enhancing user engagement and service quality. CFO David Schwarzbach expressed confidence in the company's strategic investments and disciplined growth approach, which are expected to sustain positive momentum through the year.

Analysis of Financial Statements

The balance sheet remains solid with total assets amounting to $993,477 thousand as of March 31, 2024. The slight decrease from $1,014,723 thousand at the end of 2023 reflects normal business operations and investment activities. The income statement reveals that the improved net income was supported by a controlled increase in costs and expenses, aligning with the revenue growth.

Yelp's cash flow statements also depict a healthy financial posture, with net cash provided by operating activities recorded at $72,855 thousand for the quarter. Despite a net cash used in investing and financing activities, the company maintains a strong liquidity position to support ongoing and future operational needs.

Market and Future Outlook

Despite facing macroeconomic uncertainties and competitive pressures, Yelp's focus on expanding its services offerings and enhancing platform capabilities positions it well for sustainable growth. The company's performance is indicative of its resilience and adaptability in a dynamic market environment.

Investors and stakeholders are likely to keep a close watch on Yelp's ability to maintain its growth trajectory in the upcoming quarters, especially in light of its strategic initiatives and the broader economic factors influencing consumer and business behaviors.

For detailed financial figures and future projections, interested parties are encouraged to view the full earnings report and tune into the quarterly conference calls hosted by Yelp, accessible through their Investor Relations website.

Conclusion

Yelp Inc's first quarter results for 2024 reflect a company that is effectively navigating through market challenges with strategic precision. The positive outcomes not only enhance shareholder value but also strengthen Yelp's position as a key player in the online content and local business sector. Moving forward, the company's continued investment in technology and user experience will be pivotal in driving further growth and profitability.

Explore the complete 8-K earnings release (here) from Yelp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance