Wolfspeed Inc (WOLF) Q3 Fiscal 2024 Earnings: Aligns with Revenue Projections Amid Operational ...

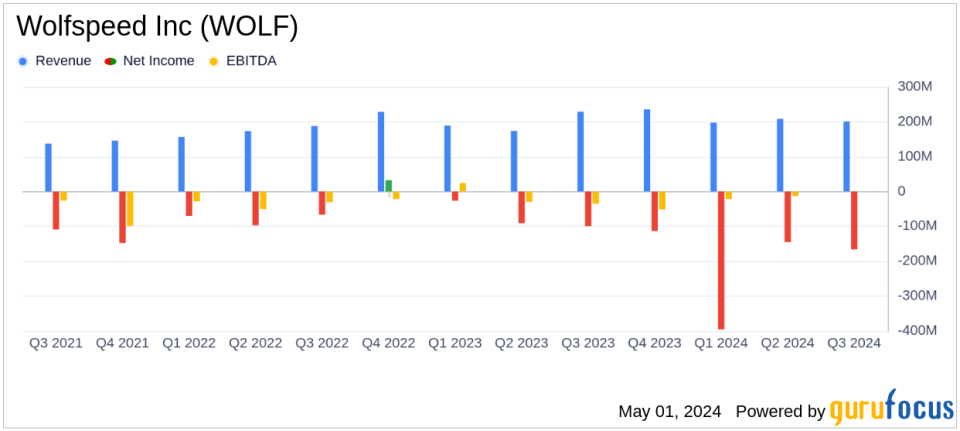

Revenue: Reported at $200.7 million for the third quarter, slightly below the estimated $201.11 million.

Net Loss: Posted a net loss of $148.9 million, significantly below the estimated loss of $81.17 million.

Earnings Per Share (EPS): Recorded a loss of $1.18 per share, underperforming against the estimated loss of $0.64 per share.

Gross Margin: GAAP gross margin fell to 11%, a substantial decrease from 31% in the same quarter last year, reflecting higher underutilization costs.

Operational Highlights: Mohawk Valley Fab's revenue more than doubled sequentially, indicating strong operational progress and growth in production capabilities.

Future Outlook: Expects fourth-quarter revenue to range between $185 million and $215 million, with projected GAAP net losses between $166 million and $189 million.

Strategic Developments: Continued expansion with significant factory start-up costs, aiming for increased long-term production capacity and market reach.

On May 1, 2024, Wolfspeed Inc (NYSE:WOLF) disclosed its financial outcomes for the third quarter of fiscal year 2024 through its 8-K filing. The company, a leader in the manufacture of wide bandgap semiconductors, reported a consolidated revenue of approximately $201 million, closely aligning with analyst estimates of $201.11 million. This performance marks a slight increase from the $193 million recorded in the same quarter the previous year, driven by significant contributions from its Mohawk Valley Fab.

Company Overview

Wolfspeed Inc specializes in silicon carbide and gallium nitride materials and devices, pivotal for power and radio-frequency (RF) applications. The company's products find extensive use in sectors such as transportation, power supplies, and wireless systems. With a primary market in Europe, Wolfspeed also maintains a significant presence in the United States, China, Japan, South Korea, and other regions.

Financial and Operational Highlights

The quarter saw the Mohawk Valley Fab's revenue more than double sequentially, contributing approximately $28 million. This significant increase is a testament to the facility's growing operational efficiency, achieving over 16% wafer start utilization in April. CEO Gregg Lowe highlighted the progress at Mohawk Valley and the ongoing construction at the JP, a 200mm materials factory in North Carolina, as critical drivers for the company's future growth.

Despite these advancements, Wolfspeed faced challenges, including a substantial drop in gross margins to 11% from 31% in the prior year, primarily due to $30 million in underutilization costs. This decline underscores the financial impact of scaling operations amidst fluctuating market demands, particularly noted in the electric vehicle (EV) sector, where despite a general demand slowdown, Wolfspeed continues to see robust design-win activity.

Financial Performance Analysis

Wolfspeed's net loss widened significantly, with a reported GAAP net loss from continuing operations of $148.9 million for the quarter, compared to a net loss of $83.1 million in the same period last year. This increase in loss can be attributed to higher operating expenses and underutilization costs associated with the ramp-up of new production facilities. The company also incurred $14.4 million in factory start-up costs during the quarter.

Looking ahead, Wolfspeed anticipates revenues between $185 million and $215 million for the fourth quarter of fiscal 2024. The projected GAAP net loss is expected to range from $166 million to $189 million, reflecting ongoing investments in capacity expansion and operational scaling.

Strategic Outlook and Market Position

Wolfspeed's strategic initiatives, particularly in enhancing production capabilities and expanding its market reach in the semiconductor industry, are set to position the company favorably in the long term. The focus on vertical integration and operational efficiency, especially in high-growth areas like EVs and renewable energy, aligns with industry trends towards electrification and sustainable energy solutions.

Overall, while short-term financial metrics may reflect the costs associated with expansion and market variability, Wolfspeed's strategic investments in technology and production capacity are foundational for its future growth and market leadership in the semiconductor industry.

Explore the complete 8-K earnings release (here) from Wolfspeed Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance