Posthaste: The Bank of Canada should watch this 'hurdle' to rate cuts like a hawk

The Bank of Canada‘s June 5 interest rate call is looming ever closer, presenting the tantalizing possibility of a first interest rate cut in just over four years. But there are still hurdles to clear before the central bank can pull the trigger, one Big Six bank economist is arguing.

After blockbuster April jobs numbers left markets second-guessing the wisdom of calls for a June rate trim, many Bay Street number crunchers turned their attention to Canada’s May 21 consumer price index (CPI) report, describing it as key to the next rate decision.

Bank of Montreal’s chief economist Douglas Porter called the back-pedalling on a June cut “kneejerk,” in a note last Friday, though he did acknowledge the surprise addition of 90,000 new jobs “will give the bank some pause.”

However, he said he is wary of placing too much importance on one “lone” CPI report, and argues that U.S. inflation lurks as a “hurdle” for the Bank of Canada and rate cuts.

U.S. inflation has recently accelerated, causing markets to erase almost all Federal Reserve interest rate cuts for 2024, except for possibly one in December.

Prices outside the volatile food and energy categories rose 0.4 per cent from February to March, the same accelerated pace as in the previous month. Measured from a year earlier, those core prices were up 3.8 per cent, unchanged from the year-over-year rise in February. The Fed closely tracks core prices because they tend to provide a good read of where inflation is headed.

“Another sour result there may well sink rate cut prospects overall, as it would reinforce the message that inflation truly is stuck at just above three per cent,” Porter said in his note.

Three per cent is the top end of the Bank of Canada’s target range for inflation. The bottom is one per cent.

The U.S. Labor Department reports inflation for April this morning.

Bank of Montreal expects overall inflation to come in at 0.4 per cent month over month, matching last month’s results and that core inflation, which excludes food and energy, will rise 0.3 per cent in April from March.

Economist Claire Fan at Royal Bank of Canada expects to see some slowing in U.S. inflation calling for year-over-year core price growth to decelerate to 3.6 per cent from 3.8 per cent in March.

“Some signs of slower price growth (if materialized) would be welcomed by Fed officials, but the details of earlier price increases have been concerning,” Fan said. “It will take more than one softer price report to calm inflation fears.”

Looking at U.S. inflation through a wider lens, Derek Holt, an economist at Bank of Nova Scotia, said in a note that core, month-over-month U.S. inflation is running at a “too hot” four per cent annualized.

Even if U.S. inflation comes in cooler, the die might already be cast. In the 15 years up to 2021, the U.S. monthly core measure has never come in above 0.3 per cent — it was 0.4 per cent in March — Porter said.

“We have seemingly become inured to higher readings,” the Toronto-based economist said. “Suffice it to say that in such an environment of still-meaty U.S. inflation, BoC hesitancy is perfectly understandable.”

If, however, the Bank of Canada does decide to cut rates, Porter said it can possibly take comfort in the company of other central banks seemingly on the verge of taking the plunge.

The Bank of England (BoE) held rates last week, but nonetheless opened the door to a cut in June, the economist said, noting two members of the BoE’s monetary policy committee voted to cut next month.

“The ECB has been loudly hinting at a June cut as well, and we’re on board with that call,” Porter said.

If the Bank of Canada does decide to make a first cut in June, “at least (it) won’t be on its own,” he said.

Sign up here to get Posthaste delivered straight to your inbox.

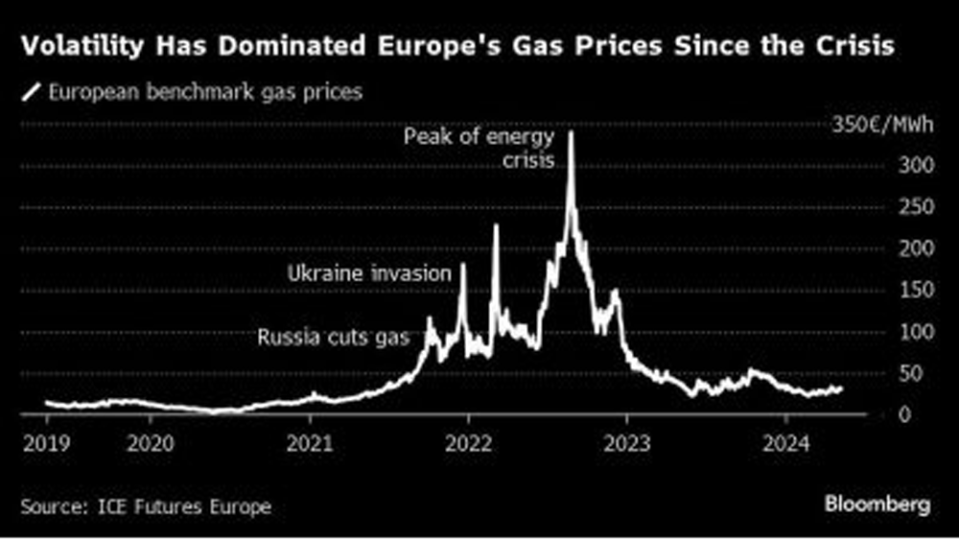

In the more than two years since Russia invaded Ukraine, sending energy prices soaring, Norwegian oil and gas giant Equinor ASA has quietly picked up the crown that once belonged to Russia’s Gazprom PJSC. Norway now supplies 30 per cent of the bloc’s gas; Gazprom provided about 35 per cent of all Europe’s gas before the war. And of the more than 109 billion cubic meters of natural gas Norway exported to Europe last year — enough to power Germany until 2026 — roughly two-thirds was marketed and sold by Equinor. — Bloomberg

Greater Vancouver Board of Trade will hold an event on building B.C.’s energy future. B.C. Hydro chief executive Chris O’Riley will speak on the steps the utility is taking to increase electricity generation and the significant investments to expand the provincial grid, including the recently announced $36-billion 10-year capital plan.

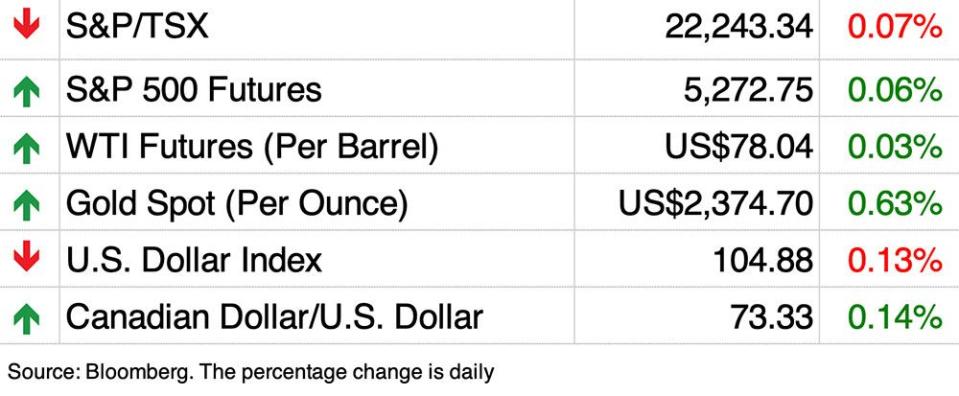

Today’s Data: Canada housing starts and existing homes sales for April, manufacturing sales for March; U.S. inflation and retail sales numbers for April

Earnings: Lightspeed Commerce Inc., Aimia Inc., Birchcliff Energy Ltd., Northland Power Inc., Extendicare Inc.

Bank of Canada risks recession if it waits to cut interest rates: Rosenberg Research

Wealthy Canadians sour on state of economy in wake of capital gains tax changes, poll finds

Canada home to 5 of the world’s 10 most attractive mining jurisdictions

The change to capital gains tax rates, proposed in the federal budget, has angered so many people that discussion about the topic remains alive and lively almost a month after the federal Liberals unveiled the plan. Kim Moody argues the controversial proposal should be delayed, if not scrapped altogether, as there remain many unanswered questions about the changes, leaving Canadians ‘planning in the dark’ with a June 25 deadline for the switchover looming. Read Moody here.

FP Answers

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at aholloway@postmedia.com with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance