Wingstop Inc (WING) Earnings Exceed Expectations with Strong Q1 2024 Performance

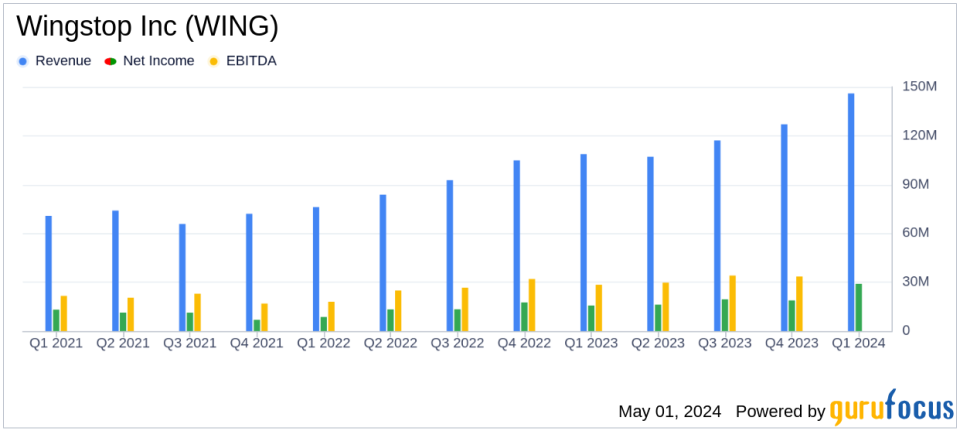

Revenue: $145.8 million, a 34.1% increase year-over-year, surpassing estimates of $135.60 million.

Net Income: $28.7 million, an 83.5% increase from the previous year, exceeding estimates of $22.44 million.

Earnings Per Share (EPS): Reported at $0.98, significantly above the estimated $0.76.

Domestic Same-Store Sales Growth: Rose by 21.6%, indicating robust brand momentum and market penetration.

System-Wide Sales: Increased by 36.8% to $1.1 billion, reflecting strong operational performance and expansion.

New Store Openings: Added 65 net new locations in the quarter, contributing to a total of 2,279 system-wide restaurants.

Digital Sales: Comprised 68.3% of total system-wide sales, underscoring significant digital engagement.

On May 1, 2024, Wingstop Inc (NASDAQ:WING) disclosed its financial outcomes for the first quarter of the fiscal year 2024, revealing a robust performance that surpassed analyst expectations. The company's detailed financial results can be accessed through its 8-K filing.

Founded in 1994 in Garland, Texas, Wingstop has evolved into a major player in the restaurant industry, specializing in a variety of chicken dishes. With over 2,200 locations globally, the company operates a predominantly franchised model, deriving significant revenue from franchise royalties and advertising fees.

Financial Highlights

For Q1 2024, Wingstop reported a 34.1% increase in total revenue, reaching $145.8 million, which comfortably exceeded the estimated $135.60 million. Net income saw an impressive rise of 83.5%, amounting to $28.7 million, or $0.98 per diluted share, surpassing the anticipated $22.44 million and $0.76 EPS. These figures reflect a significant acceleration in the company's profitability and operational efficiency.

Operational Success and Expansion

Wingstop's operational metrics were equally strong, with domestic same-store sales growing by 21.6% and the average unit volume (AUV) for domestic restaurants increasing to $1.9 million. The company also expanded its global footprint, adding 65 new restaurants during the quarter, bringing the total to 2,279 locations worldwide.

Strategic Financial Management

The company's cost of sales rose to $21.3 million, representing 74.5% of company-owned restaurant sales, mainly due to higher costs of chicken wings. Despite this, the adjusted EBITDA increased by 45.3% to $50.3 million, indicating effective management and operational leverage.

Future Outlook and Dividend Announcement

Wingstop provided an optimistic outlook for 2024, expecting low double-digit domestic same-store sales growth and the addition of 275 to 295 global net new units. The company also announced a quarterly dividend of $0.22 per share, underscoring its strong cash flow and commitment to returning value to shareholders.

Conclusion

Wingstop's Q1 2024 results demonstrate the company's continued market strength and operational excellence. With significant increases in revenue and net income, along with robust store expansion, Wingstop is well-positioned for sustained growth. This performance not only highlights the effectiveness of its strategic initiatives but also reinforces its potential for long-term success in the competitive restaurant industry.

For detailed financial analysis and future updates on Wingstop Inc (NASDAQ:WING), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Wingstop Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance