What's in Store for ADMA Biologics (ADMA) in Q1 Earnings?

We expect investors to focus on the sales performance of ADMA Biologics, Inc.’s ADMA portfolio of its three marketed commercial products and other pipeline updates when it reports first-quarter 2024 results.

Let’s see how things have shaped up for the quarter to be reported.

Factors at Play

ADMA Biologics markets plasma-derived biologics for the treatment of immune deficiencies and the prevention of certain infectious diseases. The company’s top line currently comprises sales of three FDA-approved products, namely – Bivigam (to treat primary humoral immunodeficiency), Asceniv (to treat primary immunodeficiency) and Nabi-HB (to treat and provide enhanced immunity against the hepatitis B virus).

Revenues in the last reported quarter jumped around 48% year over year owing to strong sales of its immunoglobulin products, a trend mostly likely to have continued in the to-be-reported quarter.

The company’s commercial specialty biologics product portfolio has been witnessing exponential growth and the momentum is likely to have continued in the to-be-reported quarter.

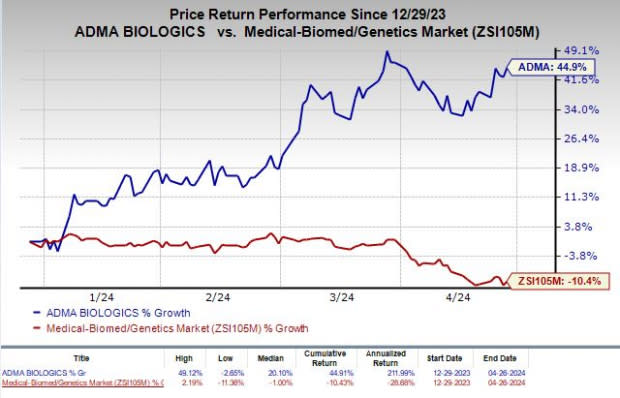

Shares of ADMA have rallied 44.9% so far this year against the industry’s decline of 10.4%.

Image Source: Zacks Investment Research

The FDA approved ADMA Biologics’ supplemental biologics license applications (BLAs) for both Asceniv and Bivigam in March 2024. The approval from the regulatory body extended the approved 4-week room temperature (25°C) storage conditions during the first 24 months of shelf life to allow for a 4-week room temperature storage at any point during the entire 36-month approved shelf life for Asceniv and Bivigam.

The FDA nod for the extension of room temperature storage conditions for Asceniv and Bivigam is expected to have increased sales of these immunoglobulin products in the first quarter of 2024 to some extent.

Owing to the strong sales performance of its commercial products in 2023, ADMA Biologics increased its revenue guidance for 2024 and 2025. Investors will be keen to get an update on whether the company increased the guidance further or not on the upcoming earnings call.

ADMA Biologics is also looking to advance the pre-clinical work for its S. pneumonia hyperimmune globulin pipeline program later in 2024. S. pneumonia is the main cause of community-acquired pneumonia in the United States. We expect management to provide an update on this during the upcoming conference call.

The activities related to pipeline development are most likely to have escalated ADMA Biologics’ operating expenses in the first quarter.

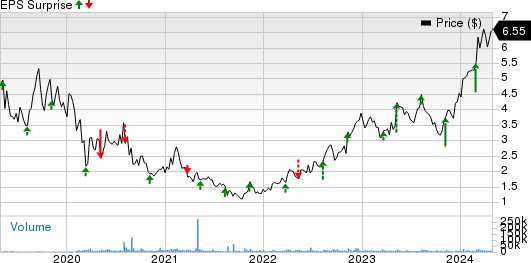

Earnings Surprise History

ADMA Biologics has an encouraging record of earnings surprise history so far. The company’s earnings beat estimates in three of the trailing four quarters and met the same on the remaining occasion. ADMA delivered a four-quarter average earnings surprise of 85.00%. In the last reported quarter, ADMA Biologics’ earnings beat estimates by 100.00%.

ADMA Biologics Inc Price and EPS Surprise

ADMA Biologics Inc price-eps-surprise | ADMA Biologics Inc Quote

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for ADMA Biologics this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: ADMA Biologics has an Earnings ESP of 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 5 cents per share.

Zacks Rank: ADMA Biologics currently carries a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are a few stocks worth considering from the healthcare space, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Atara Biotherapeutics, Inc. ATRA has an Earnings ESP of +33.04% and a Zacks Rank #2.

Shares of Atara Biotherapeutics have gained 34.6% in the year-to-date period. Earnings of Atara Biotherapeutics beat estimates in one of the last four quarters and missed the same on the remaining three occasions. On average, ATRA delivered a negative earnings surprise of 20.30% in the last four quarters.

Sarepta Therapeutics SRPT has an Earnings ESP of +108.99% and a Zacks Rank #3.

Shares of Sarepta have gained 33.5% in the year-to-date period. Earnings of Sarepta beat estimates in each of the last four quarters, delivering an average surprise of 464.56%. SRPT will report first-quarter earnings on May 1.

argenx SE ARGX has an Earnings ESP of +10.00% and a Zacks Rank #3.

argenx stock has declined 2% year to date. argenx beat earnings estimates in two of the last four quarters, met the same once and missed the mark on the other occasion. ARGX delivered an average earnings surprise of 14.18% in the last four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Atara Biotherapeutics, Inc. (ATRA) : Free Stock Analysis Report

argenex SE (ARGX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance