What's in the Cards for Expedia Group (EXPE) in Q1 Earnings?

Expedia Group, Inc. EXPE is scheduled to report its first-quarter 2024 results on May 2.

For the to-be-reported quarter, the Zacks Consensus Estimate for revenues is pegged at $2.80 billion, suggesting growth of 5.2% from the year-ago quarter’s reported figure.

Further, the consensus mark for loss is pegged at 37 cents per share, suggesting a decline of 85% from the figure reported in the year-ago quarter.

Let’s see how things have shaped up for the upcoming announcement.

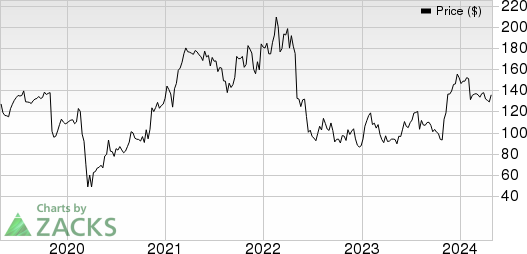

Expedia Group, Inc. Price and EPS Surprise

Expedia Group, Inc. price-eps-surprise | Expedia Group, Inc. Quote

Key Factors to Note

Expedia’s first-quarter 2024 results are likely to have benefited from solid momentum across gross bookings, driven by increasing ‘booked room nights’ and accelerating lodging revenues.

The Zacks Consensus Estimate for gross bookings is pinned at $30.57 billion, suggesting growth of 4% year over year.

The company’s growing initiatives to infuse generative AI technology into its services are expected to have driven customer momentum by delivering an enhanced user experience during the to-be-reported quarter.

Strong momentum across the APAC region and growing investments for B2B-specific innovations are expected to have contributed well to the B2B segment’s performance in the quarter under review.

The consensus mark for B2B revenues stands at $752.52 million, indicating growth of 12.7% from the year-ago reported figure.

Increasing travel demand is likely to have positively impacted B2C revenues during the first quarter.

However, sluggishness in the Trivago segment is expected to have negatively impacted the company’s top line in the first quarter.

The Zacks Consensus Estimate for trivago revenues is pegged at $76.11 million, indicating a decline of 36% year over year.

Weakness across the car business, owing to continued pressure on car rental rates, is expected to have hurt EXPE’s profitability in the quarter under review.

Macroeconomic uncertainties and intensifying online travel competition are likely to have been headwinds for the company.

What Our Model Says

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Expedia has an Earnings ESP of -55.10% and a Zacks Rank #4 (Sell) at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are some stocks worth considering, as our model shows that they have the right combination of elements to beat on earnings this season.

APi Group APG has an Earnings ESP of +2.06% and a Zacks Rank #1 at present. You can see the complete list of today's Zacks #1 Rank stocks here.

APi Group is scheduled to release first-quarter 2024 results on May 2. The Zacks Consensus Estimate for APG’s earnings is pegged at 32 cents per share, indicating growth of 28% from the year-ago quarter’s reported figure.

Arista Networks ANET has an Earnings ESP of +2.49% and a Zacks Rank #1 at present.

ANET is set to report its first-quarter 2024 results on May 7. The Zacks Consensus Estimate for ANET’s earnings is pegged at $1.74 per share, indicating growth of 21.7% from the year-ago quarter’s reported figure.

Booking Holdings Inc. BKNG has an Earnings ESP of +4.13% and a Zacks Rank #1 at present.

BKNG is scheduled to release first-quarter 2024 results on May 2. The Zacks Consensus Estimate for BKNG’s earnings is pegged at $14.03 per share, indicating growth of 21% from the year-ago quarter’s reported figure.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Expedia Group, Inc. (EXPE) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

APi Group Corporation (APG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance