Visa (V) Revolutionizes Payments Landscape With New Products

Visa Inc. V, in its recently held annual Visa Payments Forum, unveiled a range of new products and services which is aimed at transforming the way people pay and receive money, keeping in mind the future requirements of merchants, customers, businesses etc. This move bodes well for the constantly evolving landscape of the payments industry, and Visa’s efforts to keep upgrading itself are expected to strengthen its foothold.

Visa Flexible Credential will permit customers to switch through multiple payment methods through a single card. Per a Visa study, more than 50% of users would want the power of choice to access multiple accounts with a single card. Customers can now easily choose debit, credit, buy now pay later or even rewards points to pay. Visa also launched Tap to Everything, introducing Tap to Pay, Tap to Confirm, Tap to Add Card and Tap to P2P. This move highlights the growing footprint of Visa’s tap to pay coupled with improving customer experience with this product.

Visa Payment Passkey Services is aimed at combating online fraud, which is seven times higher than in-person fraud. This new product will be integrated with Visa’s click-to-pay, enabling a seamless and secure experience at checkout with security checks like face or fingerprint scans. Pay by Bank product will ensure the security of non-card payments, which are lagging in terms of the digital revolution. Visa’s acquisition of Tink is helping it expand in Europe and enabling seamless payment experiences for customers.

Visa is also launching Visa Protect for A2A Payments to secure Real-Time Payments networks with its decade worth of experience in identifying and mitigating fraud. This product has already been launched in Latin America and is in the pilot stage in the U.K. Data Tokens is also aimed at enhancing security by tokenization of sensitive cardholder information. Customers will be able to approve or revoke sharing their data with merchants from their banking app.

Moves like these should help V drive its transaction volumes and improve its retention. It expects fiscal 2024 net revenues to grow in low double digits on an adjusted constant-dollar basis.

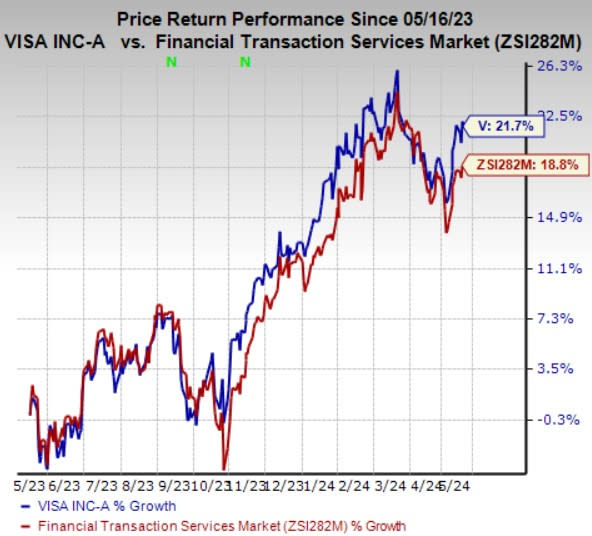

Price Performance

Shares of Visa have gained 21.7% in the past year compared with the industry’s 18.8% rise.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Visa currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Business Services space are SPX Technologies, Inc. SPXC, Barrett Business Services, Inc. BBSI and Global Payments Inc. GPN. While SPX Technologies sports a Zacks Rank #1 (Strong Buy), Barrett Business Services and Global Payments carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of SPX Technologies outpaced estimates in three of the last four quarters and matched the mark once, the average surprise being 13.92%. The Zacks Consensus Estimate for SPXC’s 2024 earnings suggests an improvement of 21.6% from the year-ago reported figure. The consensus mark for revenues suggests growth of 14.8% from the year-ago reported number. The consensus mark for SPXC’s 2024 earnings has moved 4.2% north in the past 30 days.

Barrett Business Services’ earnings outpaced estimates in each of the trailing four quarters, the average surprise being 38.56%. The Zacks Consensus Estimate for BBSI’s 2024 earnings suggests an improvement of 7.6% from the year-ago reported figure. The consensus mark for revenues suggests growth of 7% from the prior-year reading. The consensus mark for BBSI’s 2024 earnings has moved 2.2% north in the past 30 days.

The bottom line of Global Payments outpaced estimates in each of the last four quarters, the average surprise being 1.14%. The Zacks Consensus Estimate for GPN’s 2024 earnings suggests an improvement of 11.6% from the year-ago reported figure. The consensus mark for revenues suggests growth of 6.5% from the year-ago reported number. The stock has witnessed six upward estimate revisions for 2024 earnings compared to two downward revisions over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Visa Inc. (V) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

SPX Technologies, Inc. (SPXC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance