Market bets on Bank of Canada rate cut shoot to 80% after latest Canadian and U.S. data

The economic deities on Friday answered the prayers of those banking on lower rates.

Canadian gross domestic product (GDP) slid well below expectations and core personal consumption expenditures (PCE) inflation in the United States met expectations, which in this inflation-sensitive bond market is an accomplishment.

Consequently, North American rates are on the downswing and Bank of Canada rate-cut expectations are on the upswing.

As this is being written, derivatives markets imply an 80 per cent chance of a 25-basis-point Bank of Canada rate cut on Wednesday, according to Refinitiv Eikon. This would take the benchmark prime rate down to 6.95 per cent, marking its first dip since the pandemic-induced freefall.

While the Bank of Canada could always choose to defer easing until July 24, to eye the two inflation reports before that meeting, the writing’s on the wall: lower variable rates are coming.

Once the central bank pulls the trigger, the floating-rate fan club will start gaining new members. For those variable-mortgage devotees, one key to remember is that there are two flavours to choose from:

Fixed-payment variable-rate mortgages: Where your payment doesn’t move when prime drops, you instead pay more principal and less interest.

Adjustable-rate mortgages: Where your payment drops as your lender’s prime rate drops.

New borrowers anxious for payment relief will increasingly choose the latter, hoping to free up cash flow as they ride the rate slide.

Robert McLister is a mortgage strategist, interest rate analyst and editor of MortgageLogic.news. You can follow him on X at @RobMcLister.

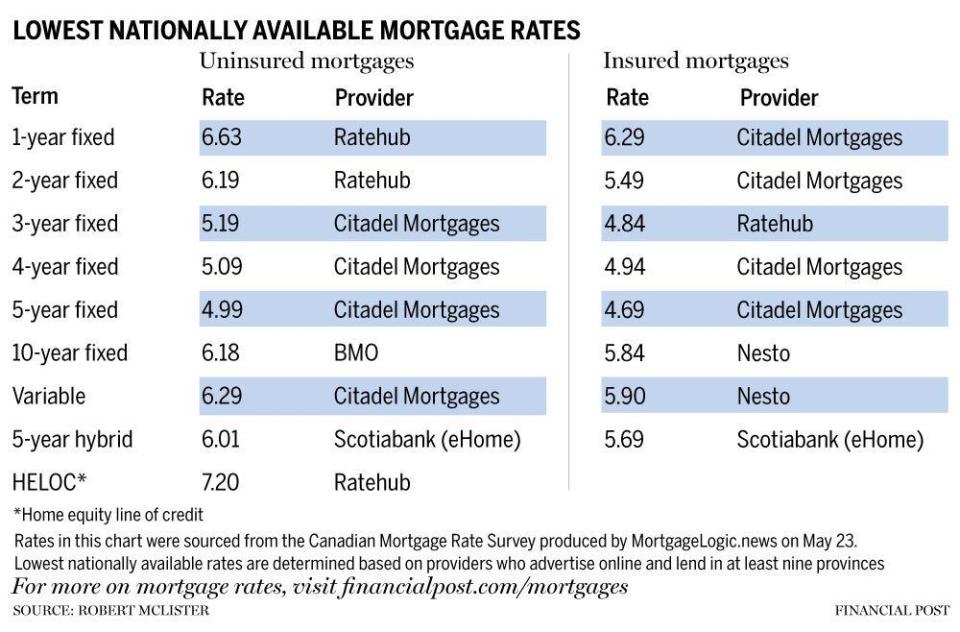

Click here for the lowest national mortgage rates in Canada right now

Yahoo Finance

Yahoo Finance