Vipshop (VIPS) to Report Q1 Earnings: What's in the Cards?

Vipshop Holdings Limited VIPS is set to report first-quarter 2024 results on May 22.

VIPS expects first-quarter total net revenues between RMB 27.5 billion and RMB 28.9 billion, indicating growth of 0-5% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for revenues is pegged at $3.87 billion, suggesting a decline of 3.4% from the year-ago reported figure.

The consensus mark for earnings per share is pegged at 59 cents per share, indicating growth of 15.7% from the prior-year reported figure.

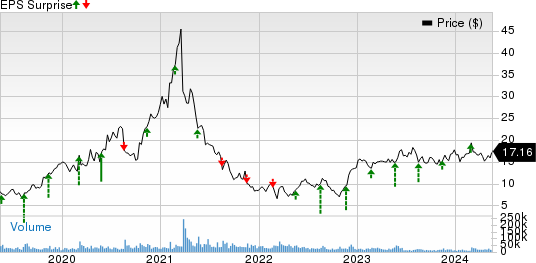

Vipshop’s earnings surpassed the Zacks Consensus Estimate in the trailing four quarters, the average earnings surprise being 21.21%.

Vipshop Holdings Limited Price and EPS Surprise

Vipshop Holdings Limited price-eps-surprise | Vipshop Holdings Limited Quote

Key Factors at Play

VIPS’ growing efforts to strengthen product offerings and improve product procurement are expected to have benefited its first-quarter performance.

The solid execution of Vipshop’s merchandising strategy is likely to have bolstered its total active customer base in the to-be-reported quarter.

Additionally, strength in discount retailing is expected to have continued driving the momentum across repeated customers and helped attract new ones.

The company’s deepening focus on high-margin apparel-related businesses, especially the discount apparel business, is likely to have contributed well to top-line growth.

Apart from this, VIPS’ deep discount channels are expected to have bolstered its online GMV in the to-be-reported quarter.

Improvement in the consumer spending pattern in discretionary categories is expected to have been a tailwind for Vipshop in the quarter under review.

However, intensifying competition in online shopping is likely to have been concerning for the company’s market position.

Also, increasing fulfillment expenses is expected to have hurt the margin expansion of the company in the first quarter.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Vipshop this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here, as you see below.

Vipshop has a Zacks Rank #3 and an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Stocks to Consider

Here are some stocks worth considering, as our model shows that they have the right combination of elements to beat on earnings this season.

NVIDIA NVDA has an Earnings ESP of +2.90% and a Zacks Rank #1 at present. You can see the complete list of today's Zacks #1 Rank stocks here.

NVIDIA is scheduled to release first-quarter fiscal 2025 results on May 22. The Zacks Consensus Estimate for NVDA’s earnings is pegged at $5.49 per share, suggesting a significant jump from the prior-year quarter’s reported figure of $1.09.

Abercrombie & Fitch ANF has an Earnings ESP of +5.10% and a Zacks Rank #2 at present.

Abercrombie & Fitch is set to report first-quarter 2024 results on May 29. The Zacks Consensus Estimate for ANF’s earnings is pegged at $1.54 per share, indicating a significant jump from the year-ago quarter’s reported figure of 39 cents.

Agilent Technologies A has an Earnings ESP of +0.42% and a Zacks Rank #3 at present.

Agilent Technologies is set to report its second-quarter fiscal 2024 results on May 29. The Zacks Consensus Estimate for A’s earnings is pegged at $1.19 per share.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Vipshop Holdings Limited (VIPS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance