Vertical Software Stocks Q1 Earnings: Toast (NYSE:TOST) Best of the Bunch

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers in the vertical software industry, including Toast (NYSE:TOST) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 14 vertical software stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 0.7%. while next quarter's revenue guidance was 2.8% below consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and vertical software stocks have held roughly steady amidst all this, with share prices up 3.1% on average since the previous earnings results.

Best Q1: Toast (NYSE:TOST)

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point-of-sale (POS) hardware, software, and payments solutions for restaurants.

Toast reported revenues of $1.08 billion, up 31.3% year on year, topping analysts' expectations by 3.3%. It was a very strong quarter for the company, with a significant improvement in its gross margin and a solid beat of analysts' billings estimates.

“Toast is off to a strong start in 2024. Our first quarter results demonstrate strong topline growth and margin expansion that we will continue to build on throughout the year. We executed well against our priorities: scaling restaurant locations; driving ARR by delivering products customers love; continuing to expand our addressable market; and building operating leverage as we scale,” said Toast CEO and Co-Founder Aman Narang.

Toast pulled off the fastest revenue growth of the whole group. The stock is up 7.8% since the results and currently trades at $25.6.

Is now the time to buy Toast? Access our full analysis of the earnings results here, it's free.

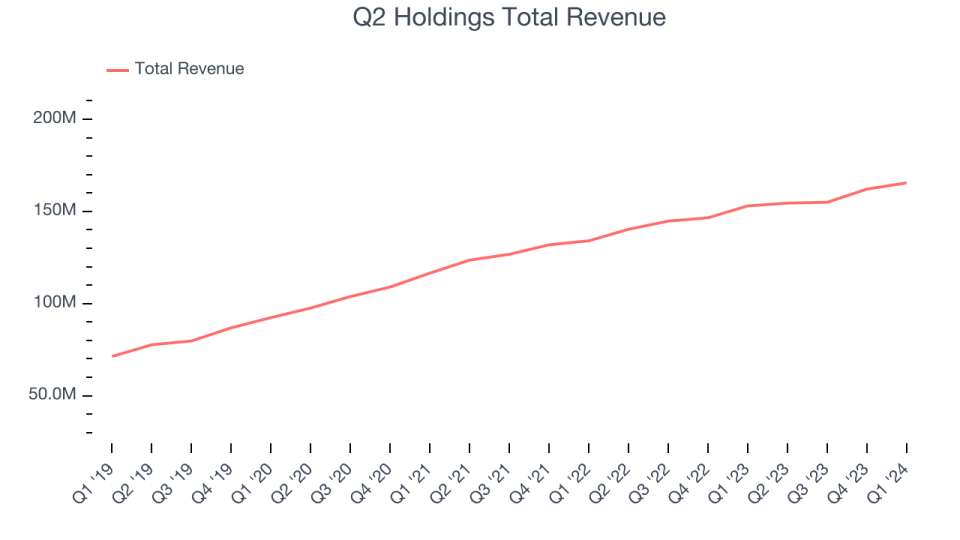

Q2 Holdings (NYSE:QTWO)

Founded in 2004 by Hank Seale, Q2 (NYSE:QTWO) offers software-as-a-service that enables small banks to provide online banking and consumer lending services to their clients.

Q2 Holdings reported revenues of $165.5 million, up 8.2% year on year, outperforming analysts' expectations by 1.3%. It was a very strong quarter for the company, with an impressive beat of analysts' billings estimates.

The stock is up 20.5% since the results and currently trades at $62.34.

Is now the time to buy Q2 Holdings? Access our full analysis of the earnings results here, it's free.

Weakest Q1: ANSYS (NASDAQ:ANSS)

Used to help design the Mars Rover, Ansys (NASDAQ:ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

ANSYS reported revenues of $466.6 million, down 8.4% year on year, falling short of analysts' expectations by 15.9%. It was a weak quarter for the company, with a miss of analysts' revenue estimates and a decline in its gross margin.

ANSYS had the weakest performance against analyst estimates in the group. The stock is up 3.2% since the results and currently trades at $331.5.

Read our full analysis of ANSYS's results here.

Adobe (NASDAQ:ADBE)

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

Adobe reported revenues of $5.18 billion, up 11.3% year on year, in line with analysts' expectations. It was a slower quarter for the company, with and underwhelming revenue guidance for the next quarter.

The stock is down 16.7% since the results and currently trades at $476.13.

Read our full, actionable report on Adobe here, it's free.

Procore Technologies (NYSE:PCOR)

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore Technologies (NYSE:PCOR) offers a software-as-service project, finance and quality management platform for the construction industry.

Procore Technologies reported revenues of $269.4 million, up 26.2% year on year, surpassing analysts' expectations by 2.5%. It was a mixed quarter for the company, with a miss of analysts' billings estimates and decelerating customer growth.

The company added 231 customers to reach a total of 16,598. The stock is up 0.7% since the results and currently trades at $68.75.

Read our full, actionable report on Procore Technologies here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance