Valmont Industries Inc (VMI) Q1 Earnings: Surpasses EPS Estimates, Raises 2024 Guidance

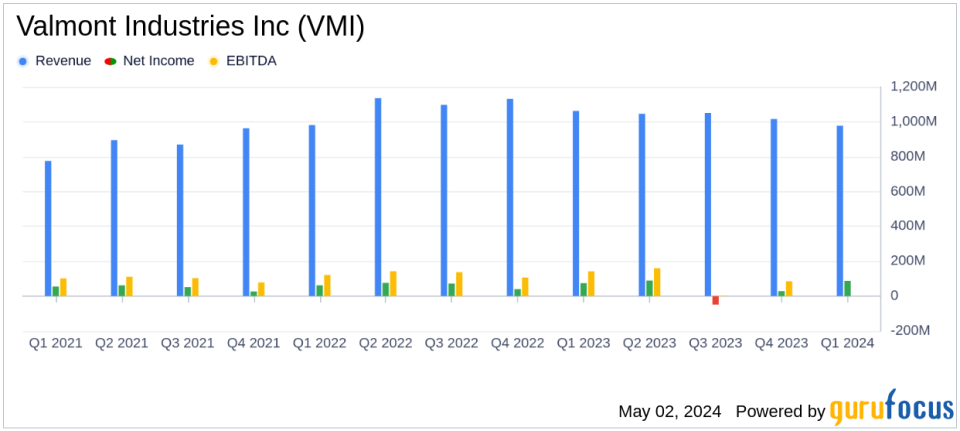

Revenue: Reported at $977.83 million, down 8.0% year-over-year, falling short of estimates of $986.98 million.

Net Income: Reached $87.82 million, up 17.8% from the previous year, surpassing estimates of $68.55 million.

Earnings Per Share (EPS): Achieved $4.32, a 24.5% increase year-over-year, surpassing the estimated $3.31.

Gross Margin: Improved to 31.3% of net sales from 29.0% in the prior year, reflecting enhanced operational efficiencies.

Operating Income: Increased by 11.0% to $131.55 million, with operating margin expanding to 13.5% from 11.1% last year.

Infrastructure Segment: Sales decreased by 1.7% to $723.6 million, with operating income improving significantly due to effective pricing strategies and cost management.

Agriculture Segment: Sales dropped 22.1% to $258.7 million, with operating income declining slightly due to lower volumes, partially offset by improved gross profit margins.

On May 1, 2024, Valmont Industries Inc (NYSE:VMI) released its 8-K filing, detailing a robust financial performance for the first quarter ended March 30, 2024. The company reported a diluted earnings per share (EPS) of $4.32, significantly surpassing the analyst estimate of $3.31. However, net sales saw a decline, totaling $977.83 million compared to the estimated $986.98 million, reflecting an 8.0% decrease from the previous year's $1,062.48 million.

Company Overview

Founded in 1946, Valmont Industries Inc has evolved into a global leader in designing and manufacturing highly engineered products that support infrastructure development and agricultural productivity. Operating in over 100 countries with 85 manufacturing facilities, Valmont's business is split into two main segments: Agriculture and Infrastructure.

Financial Highlights and Segment Performance

The quarter witnessed a notable 17.8% increase in net earnings attributable to Valmont Industries, Inc., amounting to $87.82 million. Gross profit margin improved to 31.3% from 29.0% in the prior year, despite the sales dip. Operating income rose by 11.0% to $131.55 million, representing 13.5% of net sales, up from 11.1% last year.

The Infrastructure segment, which constitutes 73.7% of net sales, slightly decreased by 1.7% to $723.6 million. However, operating income in this segment improved significantly, driven by strong utility market demand and effective pricing strategies. The Agriculture segment faced a sharper sales decline of 22.1% to $258.7 million, primarily due to normalized backlog levels in North America and Brazil and softer commodity prices.

Strategic Developments and Market Outlook

During the quarter, Valmont completed a $120.0 million Accelerated Share Repurchase program and reaffirmed its BBB-/Stable credit rating by Fitch Ratings, Inc. Looking ahead, the company has raised its full-year 2024 guidance, now expecting a net sales change of -2.0% to 0.5% and a diluted EPS in the range of $15.40 to $16.40, reflecting continued confidence in its operational strategies and market demand.

"We are raising our 2024 net sales and diluted earnings per share expectations as we remain focused on execution, commercial excellence, and operational efficiencies to drive margin expansion," stated Avner M. Applbaum, President and CEO of Valmont.

Financial Stability and Investments

The company's balance sheet remains robust with $169.2 million in cash and cash equivalents. Valmont's commitment to strategic growth initiatives is evident in its planned capital expenditures, now expected to be between $110.0 million and $125.0 million for the year.

Conclusion

Valmont Industries Inc's first-quarter performance, characterized by strong earnings growth and strategic capital management, positions the company well for sustained growth. The raised guidance and ongoing market demand across its core segments underscore the company's resilience and strategic foresight in navigating market cycles and leveraging opportunities in infrastructure and agriculture sectors.

For detailed financial figures and future updates, stakeholders and interested investors are encouraged to follow the upcoming earnings conference call and access further information on Valmont's investor relations page.

Explore the complete 8-K earnings release (here) from Valmont Industries Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance