US Foods Holding Corp (USFD) Reports First Quarter Fiscal 2024 Earnings: A Close Look at ...

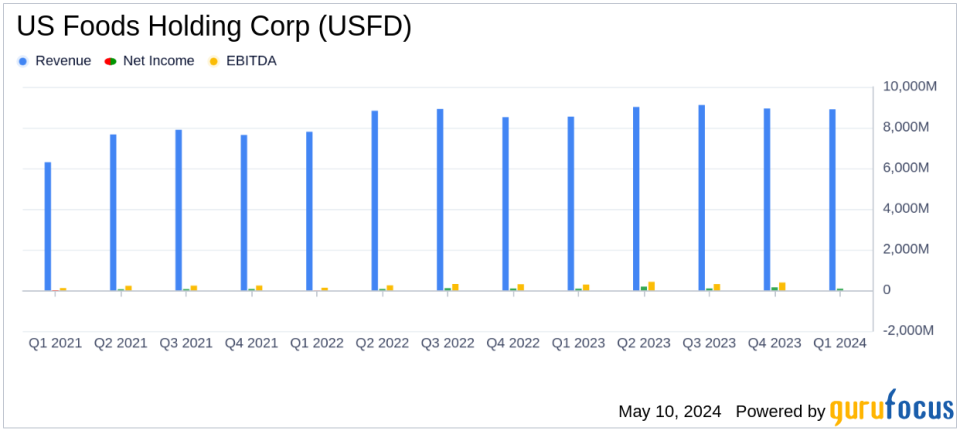

Revenue: $8.9 billion, up 4.8% year-over-year, slightly below estimates of $9.12 billion.

Net Income: $82 million, falling short of estimates of $131.29 million.

Earnings Per Share (EPS): Adjusted Diluted EPS of $0.54, exceeded the estimated EPS of $0.53.

Gross Profit: Increased by 4.9% to $1.5 billion, driven by organic case volume growth and pricing optimization.

Adjusted EBITDA: Grew 5.6% to $356 million, with an Adjusted EBITDA margin increase of 3 basis points year-over-year.

Cash Flow: Operating cash flow decreased to $139 million from $279 million in the prior year, reflecting a reduced working capital benefit.

Acquisitions: Closed the acquisition of IWC Food Service, expanding presence in the central Tennessee market.

On May 9, 2024, US Foods Holding Corp (NYSE:USFD), a leading U.S. food service distributor, released its 8-K filing, announcing the financial results for the first quarter of fiscal year 2024. The company reported a 4.8% increase in net sales, reaching $8.9 billion, and a net income of $82 million, demonstrating resilience and strategic growth in a challenging market environment.

Company Overview

US Foods Holding Corp, headquartered in Rosemont, Illinois, is one of the largest foodservice distributors in the United States. The company distributes food and non-food products to various industries including healthcare, hospitality, and education, as well as to independent and chain restaurants and grocers. US Foods operates through a vast network of distribution facilities and cash-and-carry stores under the Chef'Store banner, primarily generating revenue from meats and seafood products.

Financial Performance and Market Challenges

The first quarter results were in line with expectations, reflecting the company's robust business model and effective market strategies. US Foods achieved a gross profit of $1.5 billion, up 4.9% from the previous year, driven by organic case volume growth and effective cost management. Adjusted EBITDA also saw an increase of 5.6%, amounting to $356 million. Despite facing internal and external challenges, including labor disruptions and food cost inflation, the company's focus on productivity and operational efficiency contributed to these positive outcomes.

Strategic Initiatives and Acquisition

US Foods' strategic initiatives have been pivotal in driving profitability. The acquisition of IWC Food Service, completed in April 2024, is expected to strengthen the company's presence in the central Tennessee market, particularly in the rapidly growing Nashville area. This move aligns with US Foods' strategy to expand its market share and enhance service capabilities in key growth regions.

Financial Statements Insight

The detailed financial statements reveal a disciplined approach to capital management and investment. Operating expenses for the quarter were $1.3 billion, marking a 7.4% increase due to higher distribution costs and the impact of recent acquisitions. The company's net debt stood at $4.4 billion at the end of the quarter, maintaining a stable net leverage ratio of 2.8x. The management reaffirmed its fiscal year 2024 guidance, projecting net sales between $37.5 billion and $38.5 billion, and adjusted EBITDA between $1.69 billion and $1.74 billion.

Investor and Analyst Perspectives

During the earnings call, CEO Dave Flitman highlighted the company's commitment to driving shareholder value and operational excellence. CFO Dirk Locascio emphasized the strategic financial maneuvers that have positioned the company for sustained growth. Analysts are likely to focus on the company's ability to maintain its guidance and manage operational costs effectively in the upcoming quarters.

In conclusion, US Foods Holding Corp's first quarter fiscal 2024 results demonstrate a solid start to the year, underpinned by strategic growth initiatives and robust financial management. As the company continues to navigate market challenges and capitalize on strategic opportunities, it remains a key player in the U.S. food distribution industry.

Looking Ahead

US Foods is poised for continued growth with a clear strategic direction and strong market positioning. The company's focus on expanding its customer base, enhancing operational efficiencies, and strategic acquisitions are expected to drive long-term growth and shareholder value. Investors and stakeholders will be watching closely as US Foods moves forward with its initiatives and updates its long-range plans in the upcoming investor day on June 5, 2024.

Explore the complete 8-K earnings release (here) from US Foods Holding Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance