Upcoming Game May Not Be Enough to Sustain Take-Two Interactive's Valuation

With high expectations for "Grand Theft Auto VI," shares of Take-Two Interactive Software Inc. (NASDAQ:TTWO) have been quite volatile. Since the premiere of the game's trailer at the beginning of December, the shares have fallen by just over 9%. Among the factors justifying this fall is the fact shares had already risen before the trailer in anticipation of the game announcement and that the release date of 2025 was a bit of a disappointment.

From my standpoint, these mixed feelings about Take-Two are well-founded. The GTA franchise represents one of the most profitable entertainment products of all time, and after years of development and waiting, the new game will certainly be a milestone for the company and consequently its investors.

On the other hand, the company's fundamentals are not the best and the stock is trading at rich multiples. Even with the release of GTA VI, it is still unclear whether the stock will be able to generate attractive shareholder value since there are several ways to do this besides the success of the game, such as maintaining growth and operating leverage.

A quick overview of Take-Two Interactive

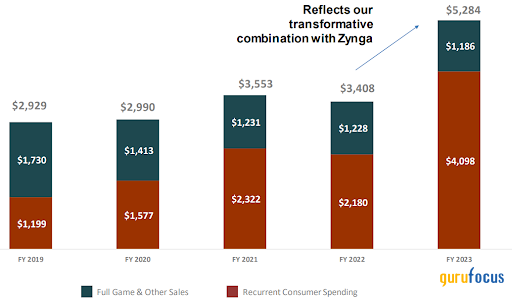

Take-Two Interactive is the holding company of 2K, Private Division, Zynga (mobile division) and, in particular, Rockstar. With these companies, Take-Two controls a number of successful franchises, but the ones with the highest sales and the most recent games and, consequently, the ones that carry the value drivers are: Rockstar Games' Grand Theft Auto, Red Dead Redemption and 2K's NBA 2K. Turning to the revenue breakdown, in recent years the company has made progress in increasing the relevance of recurrent consumer spending, which now accounts for 77% of overall revenue.

Source: Take-Two's Investor Presentation - February 2024

As will be mentioned later, this strategy of strengthening recurring revenue comes from better monetizing its productions, but it was also boosted by the acquisition of Zynga, which brought Mobile revenue to 47%.

Despite the significant increase in this segment (which was the initial intention of the deal), the acquisition made in 2023 did not bring any major achievements. In the last quarter, although net bookings were within guidance, RCS fell by 7%, worse than expected by the company, due to weakness in mobile advertising and NBA 2K.

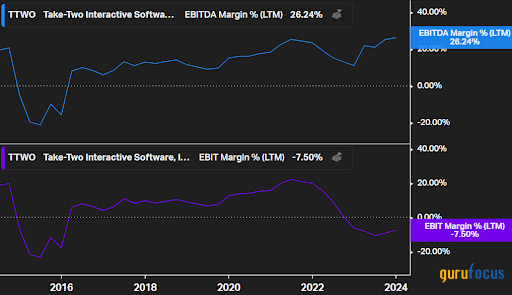

In addition, no significant progress was seen in terms of margins. Zynga's Ebitda margin, as a separately listed company, was weaker than Take-Two's at around 11.60% in the first quarter of 2022 for Zynga against 19% for Take-Two in the same period.

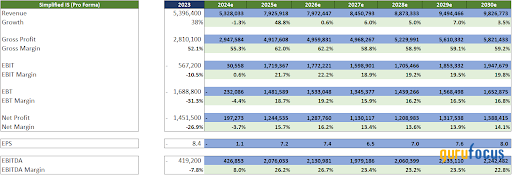

In the chart below, you can see the drastic drop in the group's Ebit margin, which reached -7.50%, but was negatively impacted by the amortization of intangibles. In terms of Ebitda, the margin is above 20%, a level that is not only normalized, but which I consider to be positive given the company still has cost reduction programs in place. These initiatives, coupled with the incremental revenue power of a game like GTA VI, could generate great operating leverage next year.

Source: Koyfin

GTA game is set to be huge

There is no doubt that GTA VI will be a milestone in the history of the company and gaming as a whole. Several metrics point to this, including it is one of the most anticipated games of the generation (perhaps ever), it has generated gigantic hype on social networks, it has had a huge investment and the comparative history is exceptional.

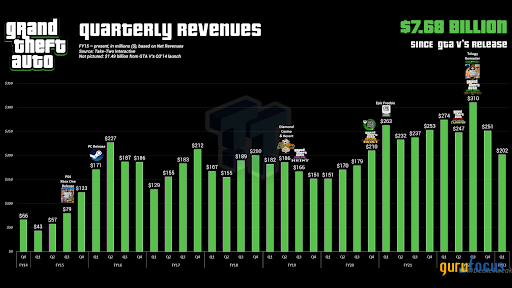

According to data from TweakTown, in its first fiscal year, predecessor game "Grand Theft Auto V" sold more than 30 million copies, with at least another 10 million every year since its release. Not only that, but the game has also been able to bring in a high level of revenue quarter by quarter, driven by releases on other consoles, as well as online DLC, as illustrated in the graph below.

Source: TweakTown

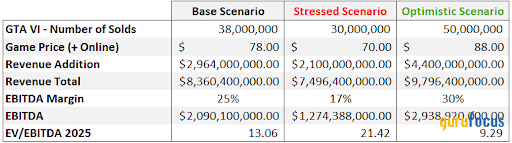

Exercising how much GTA VI can contribute to Take-Two's success, I have drawn up three different scenarios, with assumptions that include the number of titles sold in 2025 (or 2026, if postponed), the game price (since it will probably have different versions, plus the expense online) and the Ebitda margin (i.e., operating leverage).

As the name implies, the base scenario, which can also be considered conservative in terms of margin, includes more reasonable assumptions, such as a number of sales slightly above GTA V and a price slightly higher than the base price, as well as a normalized Ebitda margin. With these assumptions, we find an enterprise value/Ebitda ratio close to 13 for the stock, which is an OK level.

It may be possible for GTA VI to fail in terms of sales, but I certainly do not think it is likely, even in a stressed scenario. I, therefore, believe that the key to the equation will be operating leverage, or how much the company can dilute costs and expenses in order to expand its margins and generate more income. The optimistic scenario illustrates this, where Take-Two would achieve an Ebitda margin of 30% and, therefore, an EV/Ebitda ratio of around 9, which seems more attractive to me.

GTA VI as a live service and terminal growth

Even more important than estimating how much revenue GTA VI can bring in initially is estimating how much this can extend into the long term. GTA V Online can already be considered a success as a live service, but it's not guaranteed that GTA VI will be too, especially considering what a disaster "Red Dead Redemption 2" online was.

However, Take-Two's Rockstar should be experienced enough considering the successes and failures of the last few years to be able to replicate this for the new game. And given the cost of development, the company certainly hopes to exploit the game through recurring revenue. It is difficult to know exactly how much GTA VI will cost in total to develop, but it is estimated to be close to $2 billion.

This move to make recurring revenue is also a trend in the gaming sector: increase the monetization of their games through microtransactions, live services and the like. The trend, in addition to having the corporate bias of seeking more profit, also stems from a more current factor: producing games is expensive. As illustrated in a recent interview with Shawn Layden, a former PlayStation executive, there is a problem of price elasticity in the industry. He also cited that in 1998 the development price of a crash-type game was much lower than today's games and sold for a price of $49.99.

However, creating a live service experience is not trivial, as evidenced by the fact that 70% of developers say they are concerned about the sustainability of live service games and the failure of games that were supposed to be big, such as Warner Bros. Games' "Suicide Squad: Kill the Justice League". At the same time, the top 10 games by average monthly user in 2023 were mostly online games (and old ones), with GTA V coming in second on PlayStation, third on Xbox and ninth on PC.

Source: Newzoo, Kotak

All in all, I think it will be challenging to maintain a high level of recurring revenue growth, but Take-Two's quality and track record show that it is possible. On the other hand, given that a large part of its revenue is tied to GTA V online and Zynga, I am still skeptical about a high compound annual growth rate in consolidated revenue (after 2025-26) or a high terminal growth rate for a discounted cash flow analysis.

DCF analysis

Putting assumptions in the middle of a DCF, the result is not interesting for shareholders. The DCF projections are close to the base scenario mentioned earlier (more specifically, revenue slightly down and Ebitda margin slightly up), with revenue of $7.90 billion in 2025 and advancing at an irregular pace, to reflect the shorter launch periodicity, greater cloudiness and strong base.

In addition, after a margin gain (operating leverage) in 2025-26, I also considered margins returning to a more normalized level, such as an Ebit margin of 20%, to reinforce a "base" scenario, since this margin characterizes an advance in profitability initiatives, but is also a very reasonable level for the company. Here are the highlights of the projections:

Other assumptions include:

Capital expenditures of -3.50% of revenue, declining to 3% after 2030, reflecting fewer acquisitions and greater maturity, but at a constant level of investment for infrastructure (such as artificial intelligence).

Terminal growth at 4%, the result of good but inconsistent launches, amid more timid growth in recurring revenues.

Weighted average cost of capital at 9.73%, considering the rise in the 10-Year Treasury, 5% ERP and KD.

All this information together results in a fair price of $134 for Take-Two, a downside of 6%.

This DCF model is only intended to illustrate a base scenario for estimating something close to the company's intrinsic value and to ensure a margin of safety. Among the "upside risks" (or opportunities), we can mention the gain in scale and greater maturity, leading to a Take-Two that delivers titles faster and cheaper, while maintaining quality, which may be possible through AI, as mentioned by Unity's (NYSE:U) CEO, exploiting intellectual property more efficiently, with new media, new titles and the like, and resuming growth in recurring revenue.

In short, we can see that the market is already considering considerable growth for the company, given the increase in revenue (and possibly margins) with the new game launch. And this is priced into Take-Two's shares.

Given this too low margin of safety and other nebulous aspects of the company, such as Zynga's growth and achieving high margins, my view for Take-Two's stock is neutral (or at least not bullish for now, due the currently stock price) even though I am optimistic about how much of a game changer GTA VI can be.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance