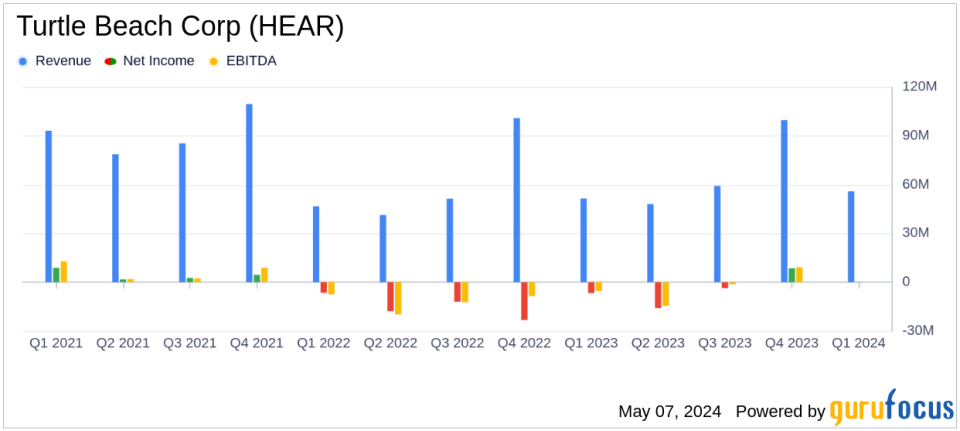

Turtle Beach Corp (HEAR) Q1 2024 Earnings: A Turnaround with Positive Net Income and Revenue Growth

Revenue: Reported at $55.8 million, marking an 8.6% increase year-over-year and surpassing the estimated $53.22 million.

Net Income: Achieved $0.2 million, a significant improvement from a net loss of $6.7 million in the previous year, surpassing the estimated net loss of $3.65 million.

Earnings Per Share (EPS): Recorded at $0.01 per diluted share, a substantial recovery from a loss of $0.40 per diluted share year-over-year, surpassing the estimated EPS of -$0.23.

Gross Margin: Expanded by 430 basis points primarily due to lower freight costs and focused reductions in product costs.

Operating Expenses: Increased to $23.5 million from $20.6 million year-over-year, including $5.0 million related to acquisition costs.

Adjusted EBITDA: Improved to $1.4 million from a loss of $2.8 million in the prior year, signaling effective cost management and operational efficiency.

Cash Flow: Generated $27.3 million from operations, slightly below the $29.0 million from the same period last year.

Turtle Beach Corp (NASDAQ:HEAR) released its 8-K filing on May 7, 2024, detailing a significant turnaround in its financial performance for the first quarter of 2024. The company, a renowned innovator in gaming accessories, reported a net revenue of $55.8 million, marking an 8.6% increase year-over-year and surpassing the estimated $53.22 million. This growth was primarily driven by the acquisition of PDP and increased demand for controller and simulation products.

Overview of Financial Performance

Net income stood at $0.2 million, or $0.01 per diluted share, a stark improvement from a net loss of $6.7 million, or $0.40 per diluted share, in the year-ago quarter. This performance significantly contrasts with the estimated earnings per share of -$0.23, showcasing a return to profitability. Adjusted EBITDA also saw a positive shift to $1.4 million from a loss of $2.8 million in the prior year, attributed to gross margin expansion and operating expense reductions.

Operating expenses for the quarter were $23.5 million, up from $20.6 million a year ago, inclusive of $5.0 million in acquisition-related costs. Despite these increased costs, Turtle Beach's proactive expense management led to a roughly 6% decline in cash-based recurring operating expenses year-over-year.

Strategic Moves and Market Positioning

Cris Keirn, CEO of Turtle Beach, expressed satisfaction with the quarter's results, which aligned with the company's full-year plans for 2024. Keirn highlighted the integration of the PDP team and the anticipation surrounding new product launches as key drivers for the company's sustained growth. The company's strategic focus on portfolio optimization and SKU rationalization has begun to yield fruit, evident from the improved quarterly results.

Turtle Beach's balance sheet remains robust with $17.8 million in cash and no outstanding borrowings on its revolver as of March 31, 2024. The company also secured a $50 million term loan for the PDP acquisition, positioning it well for future investments and growth.

Future Outlook and Analyst Expectations

Looking ahead, Turtle Beach maintains its 2024 revenue outlook in the range of $370 million to $380 million, driven by the PDP acquisition and expected market outperformance in specific gaming categories. The company also anticipates an Adjusted EBITDA between $51 million and $54 million, incorporating about nine months of operations from PDP.

The company's forward-looking strategy focuses on achieving a 10%+ revenue CAGR and improving gross margin percentages to the mid-30s, alongside aiming for mid-teens percentage Adjusted EBITDA margins. These targets underscore Turtle Beach's commitment to sustained profitability and market leadership in the gaming accessories sector.

In conclusion, Turtle Beach's first quarter of 2024 marks a pivotal moment of recovery and growth, with financials exceeding analyst expectations and strategic acquisitions fostering significant market opportunities. Investors and market watchers will likely keep a close eye on the company's ability to maintain this momentum through the year.

Explore the complete 8-K earnings release (here) from Turtle Beach Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance