3 Stocks Set for Dividend Increases This Year

Written by Kay Ng at The Motley Fool Canada

Wouldn’t it be reassuring to hold a group of stocks that tend to increase their dividends every year? Receiving dividends and increasing income is certainly something to look forward to. Here are three TSX stocks that are set to increase their dividends later this year, with one raising its dividend as soon as next month!

Empire

You might have shopped at Empire’s (TSX:EMP.A) grocery stores this week. Its list of banners includes, but is not limited to, Safeway, Sobeys, Thrifty Foods, IGA, Longo’s, Farm Boy, Lawtons Drugs, etc. Although the dividend stock’s yield is below 2.2%, at $33.74 per share at writing, it is a top dividend-growth stock on the TSX with 29 consecutive years of dividend increases.

For your reference, its 20-year dividend-growth rate is 9.1%, while its last dividend hike was 10.3%. According to its usual dividend increase schedule, investors can look forward to its upcoming dividend hike within a month! The hike should be around 7-10%. At the recent quotation, Empire stock trades at a reasonable price-to-earnings (P/E) ratio of about 12.3.

Fortis

Fortis (TSX:FTS) is a blue-chip stock to buy on meaningful dips for passive investors. It has increased its dividend for half a century, and it’s about to increase its dividend again later this year. The dividend declaration will come sometime in September, according to its usual dividend-hike schedule.

Because of higher interest rates since 2022, the cost of capital has increased, growth is lower, and the valuation of Fortis stock has come down to the current P/E of about 17.4 at $54.43 per share at writing. Normally, it could trade at about 19.4 times. So, one could say it is fairly valued in today’s higher interest rate environment.

At the recent quotation, the utility stock offers a dividend yield of 4.3%. Although growth has slowed, management still expects to increase the dividend by 4-6% per year over the next few years. So, assuming a 4% dividend hike in September, the forward yield is about 4.5%, which is not bad.

Alimentation Couche-Tard

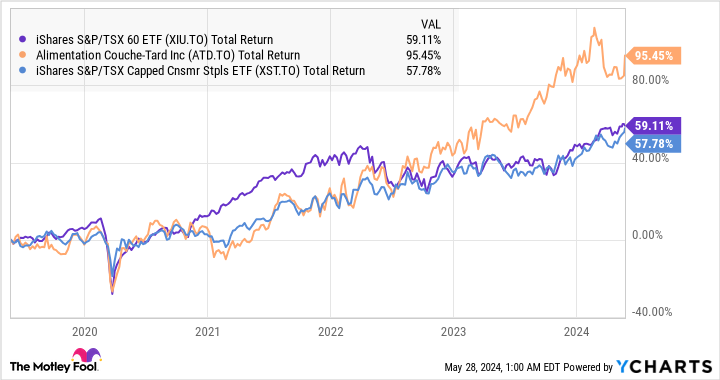

Alimentation Couche-Tard (TSX:ATD) stock has done a wonderful job by making long-term investors richer. For example, in the last five years, it almost doubled investors’ money, delivering higher returns than the Canadian stock market (using iShares S&P/TSX 60 Index ETF as a proxy) and the Canadian consumer staples sector (using iShares S&P/TSX Capped Consumer Staples Index ETF as a proxy), as shown in the YCharts below.

XIU, XST, and ATD Total Return Level data by YCharts

Although Couche-Tard offers a small dividend yield of about 0.9%, the global convenience store consolidator has been a diligent dividend grower. Its 15-year dividend-growth rate is about 24%, while its last dividend hike was 25%. Investors can look forward to another dividend increase in late November based on its usual dividend-hike schedule.

At $80.55 per share at writing, the consumer staples stock appears to be fairly valued. Notably, Couche-Tard will be reporting its fiscal fourth-quarter and full-year results on June 25. Interested investors could wait for the latest results and outlook to come out before buying shares.

The post 3 Stocks Set for Dividend Increases This Year appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Alimentation Couche-Tard?

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 28 percentage points.*

They just revealed what they believe are the 10 best Starter Stocks for investors to buy right now… and Alimentation Couche-Tard made the list -- but there are 9 other stocks you may be overlooking.

Get Our 10 Starter Stocks Today * Returns as of 5/21/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Kay Ng has positions in Alimentation Couche-Tard and Fortis. The Motley Fool has positions in and recommends Alimentation Couche-Tard. The Motley Fool recommends Fortis. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance