TriplePoint Venture Growth BDC Corp. Q1 2024 Earnings: A Close Look at Performance Against ...

Net Investment Income: Reported at $15.5 million or $0.41 per share, below the estimated earnings per share of $0.44.

Total Investment Income: Reached $29.3 million, with a notable portfolio yield on debt investments of 15.4%.

Net Asset Value: Ended the quarter at $341.3 million, or $9.02 per share, reflecting a slight decrease from the previous quarter.

Portfolio Activity: Included $13.5 million in funded debt investments and $30.8 million in loan principal prepayments.

Liquidity and Capital Resources: Reported total liquidity of $311.8 million, with a gross leverage ratio of 1.27x.

Quarterly Distribution: Declared a second quarter distribution of $0.40 per share, payable on June 28, 2024.

Credit Quality: Weighted average investment ranking of the debt portfolio slightly deteriorated to 2.21 from 2.14 in the previous quarter.

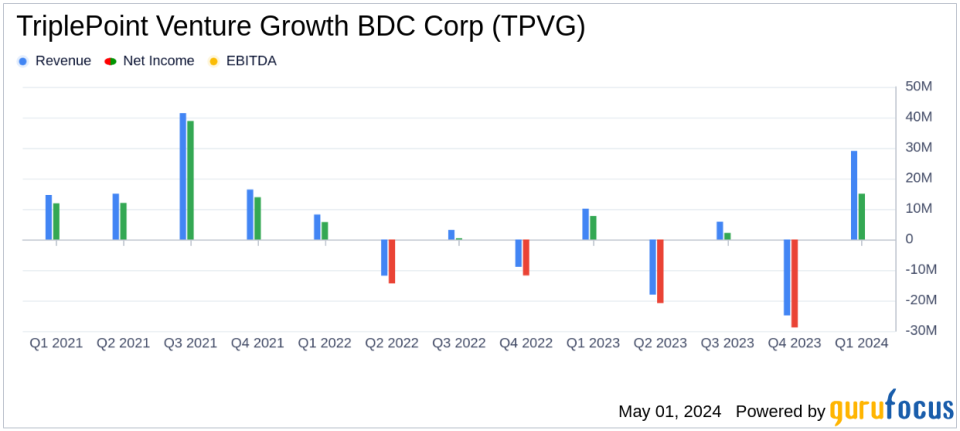

On May 1, 2024, TriplePoint Venture Growth BDC Corp (NYSE:TPVG) disclosed its first-quarter financial results through its 8-K filing. The company, a prominent financing provider to venture growth stage companies in technology and other high-growth sectors, reported a net investment income of $0.41 per share, closely aligning with analyst estimates of $0.44 per share. The reported net income stood at $15.5 million, slightly below the forecast of $16.34 million. Total revenue for the quarter was $29.3 million, which was under the anticipated $31.25 million.

About TriplePoint Venture Growth BDC Corp

TriplePoint Venture Growth BDC Corp operates as a closed-end, non-diversified management investment company in the United States. The firm's investment objective is to maximize total return to stockholders with an emphasis on income generation. TPVG primarily invests in venture growth stage companies across various sectors including technology, e-commerce, and healthcare services, providing customized debt financing solutions.

Quarterly Performance Insights

The first quarter saw TPVG sign $130.5 million of term sheets and close $10 million in new debt commitments, demonstrating robust deal activity despite market challenges. The company funded $13.5 million in debt investments with a weighted average annualized yield of 14.3% at origination. Notably, the portfolio's weighted average annualized yield on debt investments was 15.4%, reflecting strong income generation capabilities.

TPVG's strategic maneuvers have been underpinned by a solid base of operations, with a net asset value of $341.3 million, or $9.02 per share as of March 31, 2024. The total liquidity stood at $311.8 million, ensuring sufficient capital to fund future investments and operational needs. Furthermore, the company declared a second-quarter distribution of $0.40 per share, underscoring its commitment to delivering shareholder value.

Challenges and Market Positioning

Despite the positive income figures, TPVG faced some headwinds with a slight decrease in net investment income year-over-year, primarily due to a lower weighted average principal amount outstanding on its income-bearing debt investment portfolio. Moreover, the company recognized net realized losses on investments of $8.8 million, mainly from the write-off of investments in two portfolio companies.

However, the management remains optimistic about the future, citing increased equity fundraising activity by portfolio companies as a positive indicator for the long-term health of the investment portfolio. The company's ability to navigate through current market conditions and position itself for improving circumstances speaks to the resilience and strategic foresight of its management team.

Investor Considerations

For investors, TPVG's consistent performance in line with analyst expectations, combined with its strategic positioning in high-growth industries, makes it a noteworthy consideration. The company's focus on maintaining a robust pipeline of investments and managing a diversified portfolio mitigates risk and supports steady returns. However, potential investors should also consider the inherent risks associated with the venture debt sector, including the volatility of start-up success and market fluctuations.

In conclusion, TriplePoint Venture Growth BDC Corp's Q1 2024 results reflect a balanced approach to growth and income generation, aligning closely with market expectations and demonstrating a strategic resilience that may appeal to value-focused investors.

Explore the complete 8-K earnings release (here) from TriplePoint Venture Growth BDC Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance