Trex Co Inc (TREX) Surpasses Analyst Revenue Forecasts with Strong Q1 2024 Performance

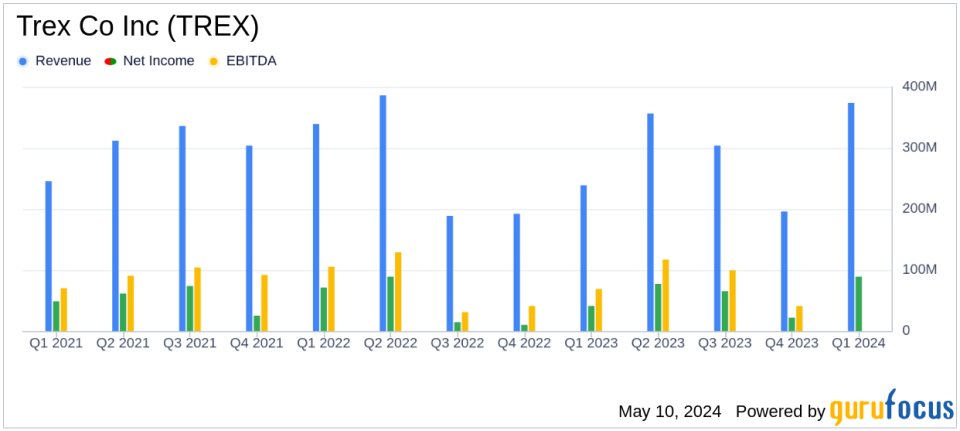

Revenue: Reported $374 million, up 57% year-over-year, surpassing the estimate of $366.73 million.

Net Income: Achieved $89 million, significantly exceeding the estimated $77.75 million.

Earnings Per Share (EPS): Delivered $0.82 per diluted share, outperforming the estimate of $0.72.

Gross Margin: Increased to 45.4%, up from 39.6% in the prior-year quarter, reflecting higher utilization and cost efficiencies.

EBITDA: Rose to $133 million, with an EBITDA margin of 35.6%, compared to $69 million and a margin of 28.8% last year.

Guidance: Forecasts Q2 revenues between $380 million and $390 million; reaffirms full-year revenue guidance of $1.215 billion to $1.235 billion.

Product Expansion: Launched Trex-branded deck fasteners, enhancing the product portfolio and installation efficiency.

Trex Co Inc (NYSE:TREX), a leading manufacturer of wood-alternative decking products, released its 8-K filing on May 9, 2024, disclosing a significant uptick in its financial performance for the first quarter of 2024. The company reported a substantial increase in net sales and net income, driven by strong demand for its premium products and strategic market expansions.

Company Overview

Trex Co Inc is renowned for its high-quality, eco-friendly composite decking and railing products. Operating under the Trex brand, the company's offerings include a variety of outdoor living products across multiple categories such as decking, railing, and outdoor lighting. Trex products are primarily distributed through wholesale distributors and retail lumber dealers, targeting professional contractors, remodelers, and homebuilders.

Financial Highlights

The first quarter of 2024 saw Trex achieving net sales of $374 million, a remarkable 57% increase from $239 million in the prior-year quarter. This growth was significantly bolstered by the shift of the Early Buy season, which contributed approximately $75 million in incremental sales. The company's gross profit soared to $170 million with a gross margin of 45.4%, reflecting an 80% increase in profit and a 580 basis points improvement in margin year-over-year.

Operational Efficiency and Market Expansion

According to Bryan Fairbanks, President and CEO of Trex, the quarter's success was fueled by double-digit sell-through rates for premium products and effective inventory management by channel partners. The company also launched Trex-branded deck fasteners, broadening its product portfolio and reinforcing its position as a comprehensive supplier for decking projects.

Strategic Financial Management

Despite a rise in selling, general, and administrative expenses to $51 million due to increased marketing and product development costs, the company's net income nearly doubled to $89 million, or $0.82 per diluted share. EBITDA also showed a robust increase to $133 million, resulting in an EBITDA margin of 35.6%.

Outlook and Future Growth

Looking ahead, Trex anticipates Q2 sales to be between $380 million and $390 million and reaffirms its full-year guidance for 2024 with expected revenues ranging from $1.215 billion to $1.235 billion. The company remains optimistic about the ongoing shift from wood to composite materials, estimating an average conversion rate of approximately 200 basis points per year.

Investor and Analyst Perspectives

The impressive Q1 results not only surpassed analyst expectations but also positioned Trex as a leader in the outdoor living industry. The company's strategic initiatives and operational efficiencies are expected to continue driving growth and profitability, making it a potentially attractive option for investors looking for sustainable investment opportunities in the construction sector.

Trex's commitment to innovation and market expansion is evident in its continuous product development and strategic marketing efforts. As the company gears up for the upcoming quarters, it remains focused on enhancing shareholder value and sustaining its market leadership in eco-friendly outdoor living solutions.

Conclusion

Trex Co Inc's first quarter of 2024 sets a robust precedent for the year, with significant sales growth and strategic expansions pointing towards a promising future. Investors and market watchers will undoubtedly keep a close eye on the company's progress in the dynamic outdoor living market.

For detailed financial figures and future updates, stakeholders are encouraged to refer to the official Trex filings and upcoming financial disclosures.

Explore the complete 8-K earnings release (here) from Trex Co Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance