Tredegar Corp (TG) Reports Improved First Quarter 2024 Results Amidst Industry Challenges

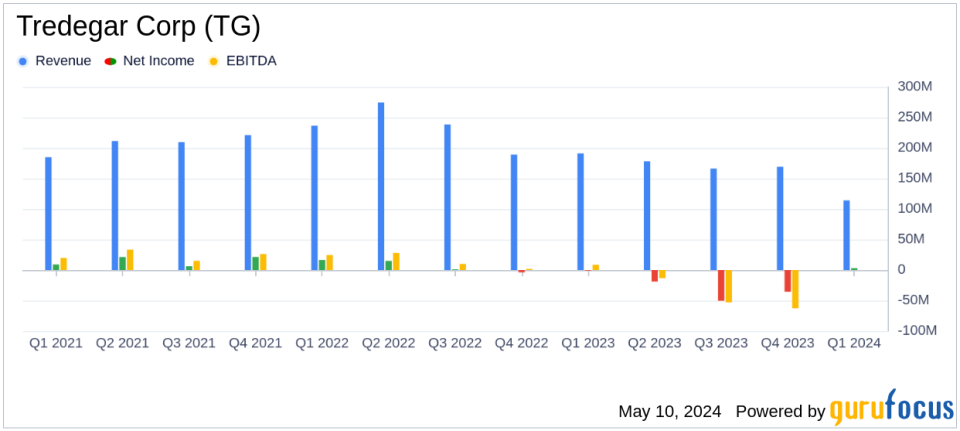

Net Income: $3.3M in Q1 2024, a significant improvement from a net loss of $1.0M in Q1 2023.

Earnings Per Share: Increased to $0.10 per diluted share in Q1 2024 from a loss of $0.03 per diluted share in Q1 2023.

EBITDA from Aluminum Extrusions: Decreased to $12.5M in Q1 2024 from $14.6M in Q1 2023.

EBITDA from PE Films: Rose significantly to $6.9M in Q1 2024, up from $1.8M in Q1 2023.

EBITDA from Flexible Packaging Films: Improved to $2.0M in Q1 2024 from $1.4M in Q1 2023.

Sales Volume: Aluminum Extrusions sales volume decreased to 33.8 million pounds in Q1 2024 from 37.6 million pounds in Q1 2023.

Total Revenue: Decreased to $175.7M in Q1 2024 from $191.1M in Q1 2023.

On May 9, 2024, Tredegar Corp (NYSE:TG) released its first quarter financial results for the period ended March 31, 2024, showcasing a notable improvement in net income and strategic advancements. The company reported a net income of $3.3 million, a significant recovery from a net loss of $1.0 million in the same period last year. Detailed insights are available in the company's 8-K filing.

Tredegar Corp, through its subsidiaries, is engaged in the manufacture of Polyethylene Plastic films, Polyester Films, and Aluminum Extrusions. The Aluminum Extrusions segment, which generates the majority of the company's revenue, produces high-quality, soft-alloy, and medium-strength aluminum used across various industries including building and construction, automotive, and consumer durables.

Performance Highlights and Challenges

The first quarter of 2024 saw Tredegar's earnings before interest, taxes, depreciation, and amortization (EBITDA) from ongoing operations for Aluminum Extrusions at $12.5 million, a decrease from $14.6 million in the previous year. This decline was primarily due to a 9.9% drop in sales volume and a 14.4% decrease in net sales, reflecting lower metal costs and reduced market demand. However, net new orders increased by 61% compared to the first quarter of 2023, indicating a potential recovery in market conditions.

The PE Films segment performed exceptionally well, with EBITDA soaring to $6.9 million from $1.8 million in the first quarter of 2023, driven by a 36.2% increase in sales volume. This segment benefited significantly from operational efficiencies and cost management strategies.

Flexible Packaging Films (Terphane) reported a modest increase in EBITDA to $2.0 million, up from $1.4 million in the previous year, despite a slight decline in net sales due to competitive pressures and excess global capacity.

Strategic and Financial Developments

John Steitz, President and CEO of Tredegar, highlighted the ongoing recovery across business units, which has positively impacted overall operating results and financial outlook. The company is in the process of selling its Terphane segment, with the transaction expected to close following regulatory approvals. This sale is anticipated to enhance Tredegar's financial flexibility and focus on core business areas.

Furthermore, Tredegar is actively managing its cost structure and capital spending to navigate through the current market challenges effectively. The company reported a net debt of $143.5 million as of March 31, 2024, with adequate liquidity maintained under its new asset-based lending facility.

Outlook and Forward Movements

Despite the challenging environment, Tredegar is optimistic about its strategic initiatives and operational adjustments paving the way for sustained growth. The company remains committed to delivering value through innovative product offerings and stringent cost control measures.

Investors and stakeholders are encouraged to review the detailed financial statements and management's discussion in Tredegar's quarterly report on Form 10-Q for the period ended March 31, 2024, to gain further insights into the company's performance and strategic direction.

Tredegar's first quarter results reflect a resilient performance amidst industry headwinds, with strategic dispositions set to bolster the company's future growth trajectory. As the company continues to adapt to market dynamics and optimize operations, it remains a noteworthy entity in the industrial manufacturing sector.

Explore the complete 8-K earnings release (here) from Tredegar Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance