Traders bet on faster interest rate cuts as US inflation falls

Wall Street stock markets hit record highs as traders increased bets on faster interest rate cuts in the US after data showed inflation and retail sales fell in April.

Money markets indicate there is a more than 55pc chance of the Federal Reserve announcing a first rate cut in September, with a first move priced in by the following meeting in November.

Traders are also pricing in two interest rate cuts by the Fed by the end of this year, compared to only one on Tuesday.

It comes after US consumer inflation eased slightly last month, according to US Labor Department, marking its first annual slowdown since January.

The annual consumer price index (CPI) came in at 3.4pc in April, down from 3.5pc in March, which was in line with economist expectations.

Separate figures showed US retail sales were unexpectedly flat in April, indicating that consumer spending was losing momentum.

Paul Ashworth, chief North America economist at consultancy Capital Economics, said: “All things considered, this is consistent with the Fed cutting interest rates in September.”

The S&P 500 and Nasdaq Composite indexes on Wall Street rose to record highs after the data, while the pound gained against the dollar.

George Lagarias, chief economist at Mazars, said: “For markets, a US economy slower enough to facilitate rate cuts by the Fed, but nowhere near a recession, is the best possible news, and that is what they got today.”

Read the latest updates below.

06:26 PM BST

Signing off

Thanks for joining us today. Chris Price will be back in the morning but I’ll leave you with Christopher Jasper’s report that summer holiday flights could be cut back:

Passengers are braced for a wave of flight cancellations this summer as the safety crisis at Boeing has left airlines scrambling to secure enough planes.

The warning has been made by Avia Solutions, the world’s largest aircraft leasing company, which has said European airlines are likely to slim down their schedules in the coming months.

Anticipated cancellations stem from a slowdown in deliveries across the airline sector in the wake of Boeing’s mid-air blowout, as safety concerns spark manufacturing delays at a time of soaring demand post-Covid.

05:45 PM BST

Titanic shipyard at risk of closure as Hunt withholds funds

Harland & Wolff has been plunged into crisis after doubts emerged over a crucial government support package for the Titanic shipyard owner. Matt Oliver and Szu Ping Chan report:

The Belfast-based company’s share price tumbled on Wednesday amid reports the Treasury was poised to block a £200m taxpayer-backed loan guarantee promised in December.

In its latest annual report, Harland & Wolff’s auditors warned the company may not survive without the money.

Whitehall sources confirmed that the guarantee – which critics previously branded a “backdoor” state bailout – was at risk amid legal complications related to state aid rules.

It has thrown into doubt Harland & Wolff’s ability to deliver on a £1.6bn contract to build three Royal Fleet Auxiliary support ships, which will ferry ammunition and food supplies to Britain’s aircraft carriers and warships.

04:55 PM BST

Footsie closes up

The FTSE 100 rose 0.2pc today. The top riser was Experian, up 8.1pc, followed by tobacco business Imperial Brands, up 5.8pc. The biggest faller was Burberry, down 7.3pc, followed by Compass, down 3pc.

Meanwhile, the mid-cap FTSE 250 rose 0.8pc. The biggest riser was geotechnical specialist contractor Keller Group, up 21.1pc, followed by oil and gas industry supplier Hunting, up 18.9pc. The biggest faller was TBC Bank, down 14.2pc, followed by Bank of Georgia, down 13pc.

04:20 PM BST

Bernanke: out of date software is hindering Bank of Enland staff

Tory MP Stephen Hammond asked Ben Bernanke if he was surprised that the Bank of England’s forecasts were being hindered by using out of date software.

Mr Bernake said that the Bank of England is taking some action, including with a database improvement project, but he suggested that the leadership of the Bank had not be totally aware of the issues experienced by staff.

The former US Fed chairman did note that the Federal Reserve was particularly well resourced compared with other central banks.

The Bernanke report said:

Some key software is out of date and lacks important functionality. With the staff fully engaged in the production of the current forecast, particularly during periods of extraordinary volatility, insufficient resources have been devoted to ensuring that the software and models underlying the forecast are adequately maintained (updated, stress tested, and periodically re-estimated),

04:07 PM BST

Bernanke: independence necessary for a credible central bank

Ben Bernanke told the Treasury Select Committee that independence of the Bank of England is necessary for a credible central bank.

He had been asked by Labour MP Dame Angela Eagle about calls from the Right to reverse the decision to let the Bank set interest rates independently.

04:04 PM BST

Bernanke reiterates that the Bank of England should model ‘alternative scenarios’

Ben Bernanke has repeatedly spoken at the Treasury Select Committee today of the need for “alternative scenarios” when the Bank of England does forecasting.

The term was a major topic in the written report into Bank of England forecasts that he led. The report says:

We argue that the current bias toward making incremental changes in successive forecasts, together with the use of human judgements that paper over problems with the models, may slow recognition of important structural changes in the economy ...

Policymaking could be made more systematic and coherent by supplementing the central forecast with additional information and analysis, notably insights drawn from alternative scenarios (including forecasts made based on alternative paths for the standard conditioning assumptions).

Currently, the Bank regularly publishes a scenario that assumes constant interest rates, and in recent years it has occasionally used scenarios to explore the consequences of energy price shocks and other risks.

Expanded use of alternative scenarios would facilitate comparisons of possible policy choices, more accurately quantify the risks to the forecast, and help the Committee learn from past forecast errors.

03:57 PM BST

Bernanke: central bank can’t use ‘vague’ pledges in projections

It would be difficult for the Bank of England to incorporate the Government’s “too vague” pledge to abolish national insurance in its projections, Ben Bernanke has said.

He was being asked at the Treasury Select Committee about how Britain’s central bank should respond to potential tax changes.

The Government has said it wants to abolish national insurance, but has not provided a timeline to deliver the idea. Mr Bernanke indicated that he was wary of of central bankers trying to second guess fiscal policy and suggested that the tax change is being talked about as too far in the future to be relevant to forecasting anyway.

03:42 PM BST

Walmart orders home workers back to the office as it cuts hundreds of jobs

Walmart has ordered staff who are still working from home back into the office as it unveiled plans to cut hundreds of roles. Hannah Boland has the details:

The company, which is the world’s biggest retailer, said the majority of remote workers will be required to start working from its headquarters in Arkansas. Some will be relocated to offices in the San Francisco Bay Area or to Hoboken, New Jersey.

Donna Morris, chief people officer at Walmart, said: “We believe that being together, in person, makes us better and helps us to collaborate, innovate and move even faster.

“We also believe it helps strengthen our culture as well as grow and develop our associates.”

It comes as the retail giant unveiled plans to cut roles in its head offices, although it did not elaborate where the cuts would be. In a memo to workers, Ms Morris said: “Some parts of our business have made changes that will result in a reduction of several hundred campus roles.”

The demand for people to return to offices marks a shift in stance from Walmart which had previously claimed that remote working would be “the new normal, at least for most of the work we lead”.

However, since the end of the pandemic, Walmart has been attempting to bring more workers back into offices.

Walmart said its decision to order most remote workers back in would bring “more of us together more often”.

Remote workers are said to have been given until July 1 to make a decision about whether to relocate or to quit the company.

03:42 PM BST

Bernanke: Bank of England should investigate forecast errors

The Bank of England should regularly review errors in its forecasts, Ben Bernanke has said.

He said that there should be quantiative analysis of past forecasts to discover how they could be improved, with a regular series of review meetings at the Bank including members of the Monetary Policy Committee.

Mr Bernanke is speaking at Treasury Select Committee after conducting a review into forecasting at Bank of England.

03:37 PM BST

Wood Group rejects fresh takeover £1.5bn bid

A North Sea engineering group has rejected a fresh £1.5bn bid from a Dubai-based rival, as low valuations on the London Stock Exchange prompt a wave of foreign takeover attempts.

John Wood Group, the giant British oilfield services and engineering business, has rejected a second offer of 212p per share from the Sidara Group, which was an increase of 3pc on an offer made last week.

It said the bid “fundamentally undervalue Wood and its future prospects”.

Wood shares fell 6pc after the announcement.

03:36 PM BST

Bernanke: Bank of England should place less weight on inflation forecasts

The Bank of England should place less emphasis on inflation forecasts, Ben Bernanke has told the Treasury Select Committee.

He said that the Bank puts more weight on its quantiative forecast that other central banks.

He believes that Bank should take a more qualitative approach.

Mr Bernanke, the former chairman of US Federal Reserve, said that the Bank of England doesn’t need to take the US approach of just being qualitative, but could take a middle way of downplaying the importance of an exact figure because forecasts don’t have the level of precision that people might assume.

03:28 PM BST

Bernanke: Groupthink ‘not necessarily’ cause of runaway inflation

The Bank of England and other central banks had to contend with “a long series of shocks from mid 2021 to the mid 2022” when inflation spiked across the world, according to a former Federal Reserve chairman.

Dr Ben Bernanke told MPs that central banking “is a difficult job” and it is “very difficult to forecast what is going to happen”.

He was speaking after his review into the Bank of England’s inflation forecasting methods.

He said the Bank did not “devote enough time to the maintenance, updating and work on the infrastructure” it used to model inflation.

He said he did not think the Bank had “ignored inflation expectations” before it spiralled to a peak of 11.1pc in October 2022.

He told the Treasury Select Committee that when considering shocks to inflation, “before the event, it is a difficult judgment to make” and it missing a large shock “is not necessarily” a result of groupthink.

With that, I will hand over the the reins to Alex Singleton, who will keep sending live updates here.

03:15 PM BST

UK inflation was ‘inevitable’, says Bernanke

The “significant inflation” experience by the UK over the last three years was “inevitable,” a former chairman of the US Federal Reserve has told MPs.

Dr Ben Bernanke was speaking to the Treasury Select Committee about his review of the Bank of England’s forecasting methods earlier this year.

He admitted he was surprised at how hard hitting some of his recommendations were but said “many aspects of the bank were very positive”.

He said: “I was concerned about some aspects of the modelling and software.”

03:05 PM BST

Union warns future of postal services ‘under threat’ in Royal Mail deal

The Communication Workers Union (CWU) warned that the “future of postal services in the UK is again under threat” with the bid to buy the owner of Royal Mail.

Royal Mail has said it is minded to accept a proposed £3.5bn takeover offer from Czech billionaire Daniel Kretinsky.

CWU general secretary Dave Ward said:

EP Group must immediately demonstrate an up-front and open commitment to working with the union to completely change the culture in workplaces across the UK, rule out any break-up of the company or raid of the pension surplus.

The CWU are calling for a completely new ownership model - one based on innovation, growth and maintaining over 500 years of public service ethos.

Whatever the result of these takeover talks, this is a position we will actively campaign for with the owners of Royal Mail, the Government and Labour.

It cannot be right that a key part of national infrastructure is allowed to be owned by individuals or companies who have no vision for the future and no clear plan to put the workforce at the heart of turning Royal Mail around.

02:59 PM BST

Netflix ‘poised show live NFL games on Christmas Day’

Netflix is reportedly finalising a deal to buy exclusive rights to stream two NFL games on Christmas Day, doubling down on efforts to add more live programming on its streaming services.

A potential deal will be the first time that Netflix has licensed the rights to one of the world’s biggest sports leagues and also the first time it would show live American football.

The NFL plans to announce its 2024-25 schedule later today.

Netflix will pay less than $150m per game under the deal, Bloomberg News reported.

02:54 PM BST

Return to the office boosts caterer Compass

Catering giant Compass Group has revealed a jump in revenues and profit led in part by workers returning to the office on Mondays.

The company - which provides food service for offices, universities and sports venues - said pre-tax profits grew by 21pc to $1.2bn (£1bn) in the six months to March 31.

Its statutory half-year revenues reached $20.7bn (£17.8bn) - up 11.2pc - with its office canteen arm and the “continued return to office trend” credited as part of the factors driving the increase.

Chief financial officer Petro Parras hailed the continued trend in office workers returning to work - singling out Monday in particular as driving volume growth.

Compass said there has been a steady recovery in office attendance since Covid, with Monday now back at the same level as Thursdays.

It said the trend of returning to work on Mondays started in the US, but it has also seen increases in the UK and Europe as well.

Friday continues to lag behind the first four days of the week, although office workers who visit the canteen then tend to spend more - treating themselves to a nicer lunch or a few extra snacks.

02:39 PM BST

Wall Street breaks records as US inflation falls

The S&P 500 has risen to a record high after figures showed that US inflation fell to 3.4pc in April, raising hopes for an interest rate cut by September.

The benchmark stock index rose 0.6pc to an intraday high of 5,276.80 shortly after trading began.

The Dow Jones Industrial Average rose 56.99 points, or 0.1pc, at the open to 39,615.10.

The Nasdaq Composite gained 89.96 points, or 0.5pc, to 16,601.14 at the opening bell.

02:35 PM BST

Royal Mail ‘minded to accept’ £3.5bn takeover offer by Czech billionaire

Royal Mail has said it is minded to accept a proposed £3.5bn takeover offer from Czech billionaire Daniel Kretinsky.

Our reporter James Warrington has the details:

In an update to investors today, parent company International Distribution Services (IDS) said it had received a revised possible cash offer from Mr Kretinsky’s EP Group of 370p per share.

The offer marks an increase of almost 16pc on EP Group’s previous rebuffed bid of 320p per share and values the company at £3.5bn.

The board of Royal Mail said it would be minded to recommend the offer to shareholders. EP Group now has until 5pm on May 29 to table a firm bid or walk away.

02:33 PM BST

Royal Mail takeover would include cutbacks to second class letter service

A takeover of Royal Mail by Daniel Křetínský’s EP Group would support plans for second class letters to be delivered just three times a week.

Its parent company IDS said the £3.5bn deal would include “contractual commitments” to its plans to transform the Universal Service Agreement.

It said EP Group would support “key elements” of its proposals for a one-price-goes-anywhere service for the entire UK, as well as the continuance of six-day delivery for first class letters.

It added:

The board will continue to engage with EP Group to seek to reach agreement on the exact scope and duration of such undertakings and contractual commitments which would be made to the UK Government (or, where applicable, to the company and/or other stakeholders directly).

In addition, the Board is seeking assurances from EP Group to maintain an investment grade rating profile of IDS.

02:22 PM BST

Czech billionaire makes £3.5bn bid for Royal Mail

The Czech billionaire circling Royal Mail has increased his offer for the letter deliverer’s parent company, sparking a surge in its share price.

Daniel Křetínský’s company EP Group has increased his offer for International Distribution Services (IDS) to 370p per share, valuing the business at £3.5bn.

Shares rocketed by 21pc to the top of the FTSE 100 after the improvement on his initial bid, which had valued IDS at £3.1bn.

02:08 PM BST

Traders pricing in two US rate cuts this year

The drop in US inflation and retail sales suggests the US economy is “somewhat slowing down,” according to economists, as traders bet that there will be two rate cuts by the Federal Reserve this year.

Money markets indicate the Fed will cut rates by a quarter of a percentage point at least twice by the end of the year, possibly as early as September.

Paul Ashworth, chief North America economist at consultancy Capital Economics, said: “All things considered, this is consistent with the Fed cutting interest rates in September.”

George Lagarias, chief economist at Mazars, said: “For markets, a US economy slower enough to facilitate rate cuts by the Fed, but nowhere near a recession, is the best possible news, and that is what they got today.”

01:54 PM BST

Traders ramp up bets on September rate cut as US inflation falls

Traders are increasing bets on faster interest rate cuts in the US after data showing inflation eased in April.

Money markets indicate there is a 56.8pc chance of the Federal Reserve announcing a first rate cut in September, with a first move priced in by the following meeting in November.

It comes after US consumer inflation eased slightly last month, according to US Labor Department, marking its first annual slowdown since January.

The annual consumer price index (CPI) came in at 3.4pc in April, down 0.1 percentage point from March.

US core #inflation cools for 1st time in 6 mths in relief for Fed and financial markets. April core CPI, which excl food and energy costs, increased 0.3% from March MoM after +0.4% MoM prev month. From a year ago, it advanced 3.6% in Apr after +3.8% YoY in March. Overall… pic.twitter.com/0MzgiswrxF

— Holger Zschaepitz (@Schuldensuehner) May 15, 2024

01:49 PM BST

US retail sales flat amid higher interest rates

Retail sales in April were unchanged from March as inflation continued to sting and elevated interest rates made taking on debt more burdensome.

The number following a revised 0.6pc pace in March, according to Commerce Department data. It rose 0.9pc in February.

It comes after sales fell 1.1pc in January, dragged down in part by inclement weather.

Excluding gas prices and auto sales, retail sales fell 0.1pc.

Online sales were down 1.2pc, while business at electronics stores was up 1.5pc. Sales at home furnishings stores slipped 0.5pc.

The data offers only a partial look at consumer spending because it excludes things like travel and lodging. However at restaurants, the lone service category tracked in the monthly retail sales report, sales rose 0.2% from March.

01:43 PM BST

Imminent US rate cut ‘unlikely’ as inflation falls, says Charles Schwab

The decline in US inflation in April will not encourage the Federal Reserve to cut interest rates earlier this year, according to analysts.

Richard Flynn, managing director at Charles Schwab UK, said:

Today’s figures show that the rate of inflation has fallen, compared to last month.

Although this will offer reassurance to markets after an unwelcome uptick in CPI figures last month, the figures are unlikely to prompt an imminent change in interest rates.

Patience has been the Fed’s core message lately. Officials have been fairly consistent in stating that current interest rates are sufficiently restrictive to bring inflation under control and that the next move will be a cut.

However, it is also clear that they are in no rush to make that move.

Whether we see rates reduced in July, September, or December will depend on how inflation changes in the coming months, how the economy performs, and whether any issues arise in the financial system or jobs market. In the meantime, we watch and wait.

01:40 PM BST

Wall Street gains as US inflation eases

US stock indexes gained in premarket trading after lower-than-expected inflation data kept alive hopes of interest rate cuts from the Federal Reserve this year.

A Labor Department report showed the consumer price index (CPI) rose 0.3pc on a monthly basis in April, compared with the 0.4pc increase expected by economists. Annually, it increased 3.4pc, in line with estimates.

Excluding volatile food and energy components, the core figure rose 0.3pc month-on-month in April, meeting expectations. Annually, it gained 3.6pc versus the estimated 3.6pc increase.

A separate report from the Commerce Department showed US retail sales were flat month-on-month in April, compared with an estimated 0.4pc increase.

In premarket trading, the Dow Jones Industrial Average was up 203 points, or 0.5pc, the S&P 500 rose 32.5 points, or 0.6pc, and Nasdaq 100 futures were up 128.75 points, or 0.7pc.

01:38 PM BST

Pound jumps as US inflation falls

The pound shot higher against the dollar after US inflation fell as expected to 3.4pc over the last year.

Sterling was up 0.5pc to $1.266 as the consumer prices index stood at 0.3pc between March and April, which was slightly lower than forecasts.

The yield on Treasury bonds dropped to 4.37pc.

01:33 PM BST

US inflation falls to 3.4pc

US inflation fell slightly in April, in line with expectations.

The consumer prices index rose by 3.4pc, which was fractionally down from 3.5pc in March, according to the Labor Department.

BREAKING! US headline #inflation totaled 3.4% in April, MATCHING expectations. MoM 0.1% lower, however.

Core #CPI, excluding food and energy, rose by 3.6%, also matching expectations.

Back to rate cuts for 2024? pic.twitter.com/YdVvA8WY84— jeroen blokland (@jsblokland) May 15, 2024

01:23 PM BST

Car manufacturers to miss Government target for electric vehicle sales, MPs told

Car manufacturers will miss a key Government target for electric vehicle (EV) sales, MPs heard.

The share of the new car market held by pure battery electrics is predicted to be just 19.8pc this year, industry body the Society of Motor Manufacturers and Traders (SMMT) told the Commons’ Transport Select Committee.

At least 22pc of new cars and 10pc of new vans sold by each manufacturer in the UK in 2024 is required to be zero-emission - which in most cases means pure electric - under the Government’s Zero Emission Vehicle (ZEV) mandate.

The threshold will rise annually until it reaches 100pc by 2035.

SMMT head of technology and innovation David Wong told the committee the industry will not meet this year’s requirements as “we’re below that trajectory”. He said:

Our members feel that the market will be - in terms of battery electric - cars 19.8pc and vans 8.3pc.

So it’s below the 22pc for cars and 10pc for vans.

01:10 PM BST

Gas prices rise amid doubts over Ukraine route

Natural gas prices have risen amid concerns over a transit route for Russian gas through Ukraine.

Dutch front-month futures, the benchmark contract in Europe, has risen as much as 3pc as the Ukrainian military intelligence chief said Russia’s military is deploying “small groups of forces in the border area” near Sudzha.

The area is an interconnection point where gas flows through to Ukraine and then onto European nations.

The UK’s equivalent contract has risen as much as 2.9pc today.

12:54 PM BST

British Steel wins Turkey high speed rail contract

British Steel has won a multimillion-pound contract to supply rail for a new high-speed electric railway in Turkey.

The manufacturer will deliver tens of thousands of tonnes of track for the project connecting Mersin with the cities of Adana, Osmaniye and Gaziantep in southern Turkey.

It will help create a lower-emission transport link between Turkey’s second-largest container port and inland cities more than 150 miles away, with the project expected to reduce CO2 emissions by more than 150,000 tonnes a year.

British Steel president and chief executive Xijun Cao said:

We’re delighted British Steel has been awarded this contract, and to be involved in such an important project.

Not only will electrification greatly enhance the transport infrastructure in southern Turkey, it will also deliver significant environmental benefits.

We pride ourselves on providing solutions to the challenges our customers face and look forward to supplying this project with the world-leading rail synonymous with the British Steel name.

12:45 PM BST

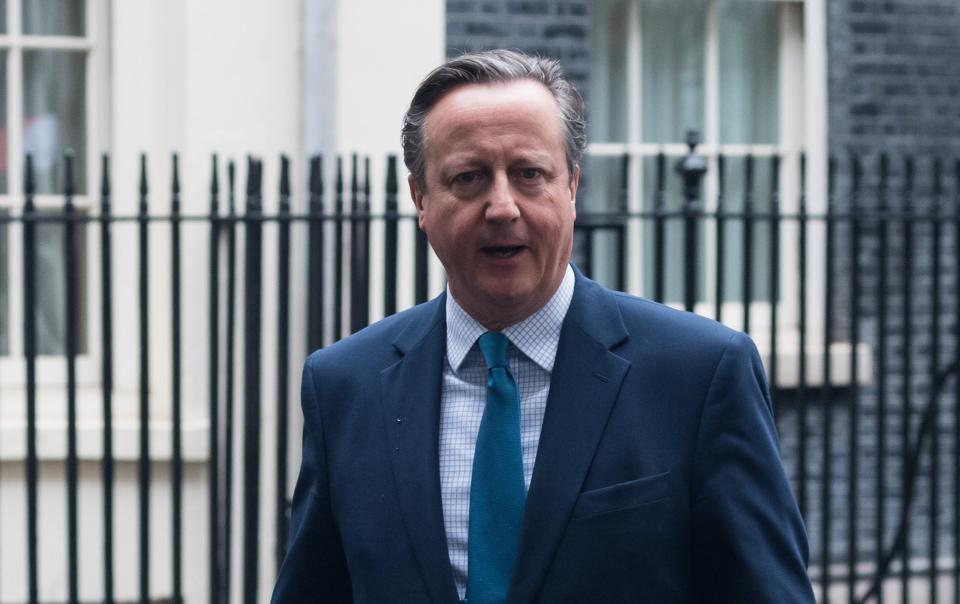

Lord Cameron to hold post-Brexit talks in Brussels

Lord David Cameron is to visit Brussels in a bid to strengthen the UK’s relationship with the EU and progress negotiations over Gibraltar’s post-Brexit trade arrangements.

The Foreign Secretary will chair a meeting of the Trade and Co-operation Agreement partnership council alongside European Commission executive vice president Maros Sefcovic.

Lord Cameron, who as prime minister held the Brexit referendum, is expected to welcome the close relationship the UK now shares with the European Union during the meeting on Thursday.

He will note the importance of the return of the devolved executive and assembly at Stormont earlier this year, following the Government’s Safeguarding the Union agreement.

The UK and EU leaders will also discuss progress on the Windsor Framework, the set of tweaks to post-Brexit checks on goods heading to the Republic of Ireland via Northern Ireland, as well as citizens’ rights and support for Ukraine.

12:08 PM BST

Wall Street subdued ahead of US inflation data

US stock indexes were little changed in premarket trading ahead of the crucial consumer prices data that will test the recent market rally.

The tech-heavy Nasdaq Composite notched a fresh record closing high on Tuesday after Fed chairman Jerome Powell’s assessment of US growth and inflation reassured investors after higher-than-expected producer prices growth in April.

The US Labor Department is expected to report that the consumer price index (CPI) likely gained 3.4pc in the year to April, down slightly from 3.5pc in March.

A stronger-than-expected CPI could amplify concerns about persistent inflation and spark worries that the strong economy will force the Fed to delay its interest rates easing cycle.

Traders see a 50.5pc chance that the Fed will start cutting rates in September, according to the CME FedWatch Tool.

In premarket trading, the Dow Jones Industrial Average was up 0.1pc, the S&P 500 was flat, while the Nasdaq 100 was down 0.1pc.

11:52 AM BST

Electric car sales growth has stalled, says used car dealership

Growth in battery electric vehicle sales has stalled in Britain, a car dealership group has said, putting the industry at risk of missing Government targets.

Vertu reported a recovery in demand for used cars in recent months, but warned that “softness” in the EV market “represents a considerable challenge” in meeting new laws requiring all new cars and vans to be zero emission by 2035.

Vertu maintained its previous warning that Government messaging on electric cars, along with cost-of-living pressures, had hit that portion of the market.

Late last year, Rishi Sunak pushed back the ban on the sale of new petrol and diesel cars in the UK from 2030 to 2035.

Vertu said the Government had caused confusion by announcing soon after delaying the ban that it will still impose stretching targets for car manufacturers to achieve specific zero emissions vehicle (ZEV) sales targets.

More than a fifth (22pc) of new cars sold by manufacturers in the UK next year must be zero emission, under the new rules, rising to 80pc in 2030.

The group saw used car prices drop by 10.3pc between October and December as values tumbled following steep gains in the previous few years.

The AIM-listed company, which was founded in 2007 after buying Bristol Street Motors, posted growing profit and revenue for the year ending February 29.

11:33 AM BST

Hunt: Raspberry Pi listing shows UK open for business

Jeremy Hunt has hailed the decision by computer company Raspberry Pi to list in London.

The Chancellor tweeted:

Excellent news today that Raspberry Pi are planning to list in London. They’re a fantastic British tech company – part of the UK’s trillion-dollar tech sector.

With strong GDP growth and inflation dropping significantly, the UK is open for business and we continue to attract the most promising, global businesses.

11:23 AM BST

Pound rises ahead of US inflation figures

Sterling hit its highest level in almost two weeks versus a weakening dollar ahead of US inflation data.

The pound fell on Tuesday after Bank of England chief economist Huw Pill said policymakers might be able to consider cutting interest rates over the summer.

Market bets on future interest rate cuts remained roughly unchanged, with an around 50pc chance of a first move in June, and if not then by August. Half a percentage point of cuts are expected by the end of the year.

The dollar dipped to a one-month low versus the euro amid lower Treasury yields as traders braced for a key US inflation report later in the day that could dictate the path of Federal Reserve policy.

Sterling rose 0.3pc to $1.262 - its highest level since May 3, and has gained 0.2pc against the euro, which is worth 85p.

10:57 AM BST

Oil faces hit from economic slowdown and mild weather

Global oil demand will grow at a slower pace amid an economic slowdown and mild weather in Europe, according to the International Energy Agency.

The Paris-based adviser said world fuel consumption will increase by 1.1m barrels per day this year, which is about 140,000 barrels less than it expected a month ago.

Trimming its projections for a second consecutive month, the IEA said: “Poor industrial activity and another mild winter have sapped gasoil consumption this year, particularly in Europe where a declining share of diesel cars in the fleet were already undercutting consumption.”

It also predicted that the global supply of oil would increased to record levels this year as non-Opec countries ramp up production at a faster pace than the oil cartel cuts output.

Brent crude oil, the international benchmark, has edged up 0.3pc today to just over $82 a barrel.

Prices having retreated 10pc from this year’s peak as a result of the the fragile economic outlook and abundant US oil supplies.

10:35 AM BST

EU predicts lower eurozone inflation

The EU said that it predicts lower inflation in the eurozone this year than previously forecast and left its growth estimate unchanged despite global uncertainties.

The European Commission said inflation would slow down to 2.5pc this year, down from the February prediction of 2.7pc.

It expected the single currency area to grow by 0.8pc in 2024.

The Bank of England predicted that the UK economy will grow by 0.5pc this year and inflation would rise by 2.5pc in 2024.

But the EU’s economy commissioner, Paolo Gentiloni, said the “forecast remains subject to high uncertainty”, pointing to wars in Ukraine and Gaza.

10:22 AM BST

Eurozone recovery ‘quite muted’, say economists

The second estimate of growth in the eurozone in the first quarter was unchanged from the first estimate and indicates that the economy expanded by 0.3pc compared to the previous three months.

Andrew Kenningham, chief Europe economist at Capital Economics, said the recovery was “quite muted”, adding:

While this is a fairly strong number, it follows two quarters during which the economy contracted.

Moreover, the increase in Q1 was partly due to a weather-related rebound in construction activity which is unlikely to be repeated.

He added that the fact that growth was slightly stronger than expected in the first quarter “is not likely to put the ECB off its plan” to cut interest rates by a quarter of a percentage point in June from its record high of 4pc.

He added: “But if activity continues to surprise on the upside the Bank may cut rates by less than the 125bp that we have pencilled in for the year as a whole.”

10:13 AM BST

Eurozone economy grows half as fast as UK

The eurozone economy grew half as fast as the UK in the first three months of the year as Britain bounced back stronger from recession.

The single currency’s gross domestic product (GDP) expanded by 0.3pc during the period, exiting a recession at the end of last year.

Britain’s GDP grew by 0.6pc in the first quarter of the year, prompting official statisticians to suggest the economy was “going gangbusters” after two consecutive periods of decline in the second half of 2023.

Euro area #GDP +0.3% in Q1 2024, +0.4% compared with Q1 2023: flash estimate from #Eurostat https://t.co/izWea1piZq pic.twitter.com/lJhjbTupnT

— EU_Eurostat (@EU_Eurostat) May 15, 2024

10:03 AM BST

I would work with pro-business Starmer, says JP Morgan boss

The chief executive of JP Morgan has said he would be happy to work with Sir Keir Starmer if Labour win the next general election, as he considered him “pro-business”.

Jamie Dimon met the Labour leader for the first time this week during a visit to the UK, when he also met Rishi Sunak.

Mispronouncing the Prime Minister’s name, he told Sky News:

I have enormous respect for Richie [sic] and I met Keir for the first time, and the same thing.

One of the things I like, is they’re pro business. Growing the economy is a good thing and that should benefit everybody.

In America, I talk about the fraying of the American dream. It is true in a lot of these countries a lot of lower income folks haven’t done as well as they should and we need to do things about that. But if you don’t grow the economy, you damage that.

He said both Conservative and Labour were talking about “growing the economy, technology, research and development, simplifying regulations, making it easier for people to start businesses and grow businesses, making sure the schools educate with the need to have good paying jobs”.

He added: “Those policies work and if you go around the world I can name country after country that it actually worked.

09:50 AM BST

JP Morgan boss: Biden should have consulted allies on green subsidy plan

JP Morgan chief executive Jamie Dimon criticised Joe Biden’s programme of green subsidies, saying it should have been enacted with consultation with America’s allies.

Wall Street’s longest-serving major bank boss was asked about the Inflation Reduction Act, which offers government support to companies investing in the US - a policy which has drawn accusations of protectionism.

Mr Dimon told Sky News that one of the world’s present battlefields is trade and the US should have worked with countries like Britain and France to ensure it worked for everyone.

He said: “We don’t want our allies saying ‘America’s going it’s own way, it’s America first, America only’. There was a bit of that.”

He also said laws on permits to allow major infrastructure development needed to be eased to speed up growth in the US economy, adding “you guys have the same problem here,” referring to Britain.

09:31 AM BST

Hunting tops FTSE 250 after Kuwait deal

The oil services group Hunting has surged to the top of the FTSE 250 after announcing it has secured a record $145m order for piping products from Kuwait Oil Company.

The company’s shares jumped as much as 20pc after it said underlying profits would be at the top end of its guidance thanks to the bumper order.

It said its order book stands at a record high.

09:18 AM BST

Britvic shares fizz after strong results

Pepsi maker Britvic shares rose to their highest level in more than two and a half years after it delivered better than expected results.

The drinks giant jumped as much as 8.4pc to near the top of the FTSE 250 as revenue increased 11.2pc to £880.3m.

Underlying profits at the company, which also makes Fruit Shoot and Lipton, rose by 17.7pc to £100.4m.

It also announced a share buyback of up to £75m over the next 12 months.

08:54 AM BST

Tui revenues hit record amid ‘high demand’ for package holidays

Holiday giant Tui has revealed better than expected results after notching up record revenues as it said travelling remains “very popular” despite rising prices for trips abroad.

The group - which is switching its listing from London to Frankfurt next month - reported pre-tax losses of €403.1m (£346.6m) for the six months to March 31, against €648.8m (£557.9m) a year earlier.

Holiday companies traditionally post losses over the quieter winter months.

Its group loss stood at €330.5m (£284.2m), against losses of €558m (£479.8m) a year earlier.

Tui said it was seeing “high demand” for package holidays in particular.

But the company said its average prices were around 4pc higher for the summer season than a year ago.

The group’s summer programme is 60pc sold, with nine million bookings for the upcoming peak season, up 5pc year-on-year.

08:34 AM BST

FTSE 100 hits record high amid hopes for US interest rate cuts

The FTSE 100 scaled to a new record high as investors await the next US consumer price index data which could indicate when the Federal Reserve can make its first interest rate cut.

The blue-chip FTSE 100 was up 0.5pc after hitting a record high of 8,474.41 points in opening minutes of trade, while the mid-cap FTSE 250 rose 0.4pc.

Credit data company Experian was the top gainer on the FTSE 100 with a 8.3pc jump after it forecast annual organic revenue growth of between 6pc and 8pc for fiscal year 2025.

Burberry was the biggest loser on the UK’s flagship stock index with a 3.8pc drop after the luxury brand reported a 34pc drop in annual operating profit.

Compass Group fell 2.3pc despite the catering firm first-half profit slightly ahead of market view.

Investors will be waiting for the latest US inflation data this afternoon, which markets already moving higher after Fed chairman Jerome Powell reiterated on Tuesday that the US central bank is unlikely to hike rates.

08:28 AM BST

Sony ‘rethink’ of Paramount bid pushes Japan’s markets higher

Tokyo’s Nikkei index closed slightly higher as Sony Group soared after a US media report said it was rethinking its bid for TV and film giant Paramount.

The benchmark Nikkei 225 index gained 0.1pc, or 29.67 points, to end at 38,385.73, while the broader Topix index was flat, losing just 0.07 points to 2,730.88.

During an earnings press conference on Tuesday, Sony Group did not comment on rumours of a joint $26 billion bid for Paramount Global with Apollo Global Management.

But CNBC reported that Sony was “rethinking” its bid for the US owner of CBS, Comedy Central and MTV.

In Tokyo trading, Sony Group jumped 8.2pc to 12,950 yen.

08:05 AM BST

UK markets open higher ahead of US inflation data

The FTSE 100 has opened higher ahead of data expected to show that US inflation eased slightly in April.

The UK’s blue chip index has gained 0.5pc to 8,471.02 while the midcap FTSE 250 has risen 0.2pc to 20,659.18.

08:01 AM BST

Global stocks hit record high amid interest rate cut hopes

Global stock have risen to a record high amid hopes that the US is on track to start cutting interest rates later this year.

The MSCI All Country World Index - a measure of stock prices around the globe - rose 0.1pc after closing at a record on Tuesday.

It has rallied nearly 6pc since April as central banks gear up for interest rate cuts, including the Bank of England and the European Central Bank.

On Tuesday, US Federal Reserve chairman Jerome Powell said he did not expect interest rates to be increased again, ahead of inflation figures which are expected to show prices rose at a slightly slower pace in April, down to 3.4pc from 3.5pc.

07:54 AM BST

Imperial Brands puts up tobacco prices as sales fall

Cigarette maker Imperial Brands said higher prices for its tobacco products offset a decline in the number being sold.

The company revealed a slight fall in operating profit in the first half of its financial year, which slipped below £1.5bn.

It said its next generation products, which include vapes, increased net revenue by 16.8pc.

It is delivering the £1.1bn share buyback this year and increasing its interim dividend by 4pc to 44.9p per share.

Chief executive Stefan Bomhard said:

In tobacco, stronger brands and improved sales execution have enabled us both to consolidate the market share gains in our priority markets achieved in recent years and to deliver a strong price mix of 8.6pc.

07:40 AM BST

Burberry profits slump as high-end customers ‘become pickier’

Burberry has blamed a year-long global slowdown in demand for luxury goods for a sharp dip in profits, as inflation hit wealthy customers.

Pre-tax profit plummeted 40pc at the fashion brand last year to £383m for the year ending March 30, while underlying earnings were 34pc down year-on-year.

The luxury fashion giant warned that the “challenging” environment would continue over the coming months, and that it had picked out cost saving measures to help it combat the impact of inflation.

Yanmei Tang, analyst at Third Bridge, said:

Burberry is among the brands that have been affected by a slowdown observed across the wider luxury industry. High-end customers become pickier about what they buy.

Our experts say Burberry is struggling to clearly define and elevate its brand identity, resulting in confusing messaging and poor sales growth. There is too much reliance on a new creative direction rather than making operational changes.

07:36 AM BST

Raspberry Pi announces plan to list in UK in boost for City

UK computer company Raspberry Pi has confirmed plans to list on the London stock market in a move that could value the firm at a reported £500m.

The Cambridge-based tech outfit - known for credit card-sized computers designed to boost coding skills among children - has said it is considering an initial public offering (IPO) on the London Stock Exchange’s main market.

It has hired advisers ahead of a possible float.

If the IPO goes ahead, it would be a boost to London’s flagging stock market, which has been hit by a swathe of UK-listed firms being bought out or ditching Britain for the US.

Eben Upton, founder and chief executive of Raspberry Pi, said:

Raspberry Pi enthusiasts will see the next phase of our development offer unprecedented opportunities for creativity and innovation.

Our commitment to low-cost computing, a fundamental part of what is special about Raspberry Pi, is unchanged.

In an ever more connected world, the market for Raspberry Pi’s high-performance, low-cost computing platforms continues to expand.

07:30 AM BST

Burberry profits slump as demand from Chinese shoppers wanes

Burberry profits plunged as Chinese consumers turned away from the luxury retail industry at the start of this year.

The British fashion brand warned it expects the first half of its current financial year to “remain challenging” after a drop off in demand.

Sales in its important Asia Pacific region were down 17pc in its financial fourth quarter, while its number of Chinese customers was down 12pc compared to the same period a year earlier.

As many retailers complain about the impact of the tourism tax on the sector - in which overseas shoppers are charged VAT - Burberry added that tourism accounted for almost a quarter of sales from Chinese customers globally.

In the year to the end of March, its operating profit dropped by 36pc to £418m.

Chief executive Jonathan Akeroyd said: “Executing our plan against a backdrop of slowing luxury demand has been challenging.

“While our FY24 financial results underperformed our original expectations, we have made good progress refocusing our brand image, evolving our product and strengthening distribution while delivering operational improvements.

“We are using what we have learned over the past year to finetune our approach, while adapting to the external environment.”

Comparable sales in the Americas dropped by 12pc in the first three months of this year versus the same period a year ago, while in China that figure was down 19pc.

Burberry also warned that it expects wholesale revenue to drop by about a quarter in the first half of this year.

Shares in the company have dropped by about 16pc so far in 2024.

07:19 AM BST

Good morning

Thanks for joining me. Burberry has revealed a sharp drop in profits as shoppers from China turned away from the luxury sector.

In the year to the end of March, its operating profit dropped by 36pc to £418m, as the number of shoppers from China dropped by 12pc in the final three months of last year.

5 things to start your day

1) Vauxhall owner to sell cheap Chinese electric cars in Britain | Stellantis boss criticises Western protectionism as he doubles down on China partnership

2) Colonial diamond empire De Beers to be sold as Anglo American fights off takeover | British mining giant launches shake-up after rejecting £34bn offer from BHP

3) Oil rig workers stranded at sea after helicopter pilots go on strike | Some staff cancel holidays with walkouts expected to disrupt more than 80 flights

4) Former Royal Mail boss seeks to deliver letters by drone | Simon Thompson claims technology could be a gamechanger for £173bn parcel industry

5) Jeremy Warner: Unrepentant Bank of England refuses to learn from its failures | Threadneedle Street’s distinct lack of contrition spells bad news for Britain’s future

What happened overnight

Asian stocks were mostly higher after a rally on Wall Street that took the Nasdaq Composite to a record high.

Traders were reassured by comments from Federal Reserve chairman Jerome Powell said policymakers will not likely raise interest rates to respond to stubborn inflation. US consumer prices data is out later.

In Asian trading, Tokyo’s Nikkei 225 index climbed 0.4pc to 38,491.15 and Australia’s S&P/ASX 200 advanced 0.4pc to 7,760.40.

In China, the Shanghai Composite index slipped 0.4pc to 3,133.47 after the central bank kept a key lending rate unchanged Wednesday, signaling Beijing’s focus on maintaining monetary stability.

Elsewhere, Taiwan’s Taiex gained 1.4pc and in Bangkok the SET was virtually unchanged.

Markets in South Korea and Hong Kong were closed for a holiday.

Stocks rose on Wall Street yesterday, pushing the Nasdaq Composite to another record close and leaving the S&P 500 sitting just shy of its own all-time high.

The Nasdaq Composite, which is heavily influenced by technology stocks, jumped 0.8pc, to 16,511.18, while the S&P 500 index rose 0.5pc, to 5,246.68. It is sitting about 0.1pc below its record high set in late March. The Dow Jones Industrial Average rose 0.3pc to 39,558.11.

The yield on the benchmark 10-year US Treasury bonds slipped to 4.45pc from 4.49pc late Monday.

Yahoo Finance

Yahoo Finance