Top Undervalued Small Caps With Insider Action In United Kingdom July 2024

As the United Kingdom approaches a significant general election, market sentiment remains cautiously optimistic, with key indices like the FTSE 100 closely watched by investors for potential impacts. Amidst this backdrop, identifying undervalued small-cap stocks with insider buying can offer intriguing opportunities for those looking to potentially benefit from market movements influenced by broader economic and political events.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Stelrad Group | 9.3x | 0.5x | 44.63% | ★★★★★★ |

Ultimate Products | 9.9x | 0.8x | 15.99% | ★★★★★☆ |

Norcros | 7.5x | 0.5x | 44.93% | ★★★★★☆ |

THG | NA | 0.4x | 43.42% | ★★★★★☆ |

Bytes Technology Group | 28.2x | 6.4x | 17.33% | ★★★★☆☆ |

CVS Group | 21.1x | 1.2x | 41.95% | ★★★★☆☆ |

Savills | 36.3x | 0.7x | 29.35% | ★★★☆☆☆ |

Robert Walters | 20.7x | 0.3x | 38.31% | ★★★☆☆☆ |

J D Wetherspoon | 21.4x | 0.4x | -58.62% | ★★★☆☆☆ |

Hochschild Mining | NA | 1.6x | 42.39% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

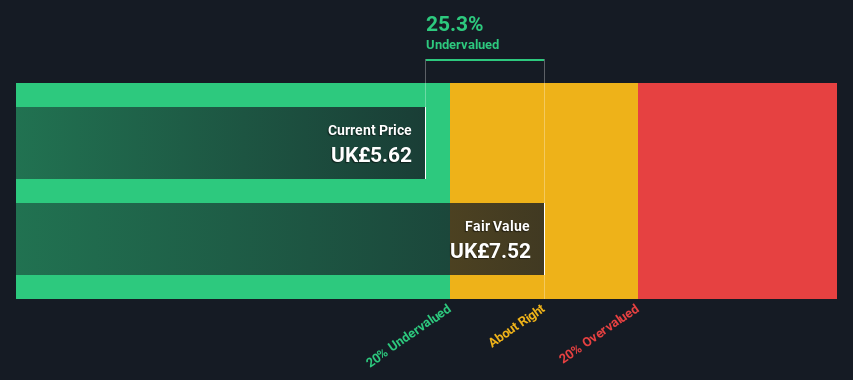

Polar Capital Holdings

Simply Wall St Value Rating: ★★★★★☆

Overview: Polar Capital Holdings is a specialist investment management company with a market capitalization of approximately £0.56 billion.

Operations: The Investment Management Business generated £197.59 million in revenue, with a gross profit margin of 88.53% and a net income margin of 20.65%.

PE: 13.7x

Polar Capital Holdings, demonstrating a solid financial trajectory, recently reported a year-over-year revenue increase to £197.59 million and net income growth to £40.79 million. This uptick reflects an earnings per share rise from £0.368 to £0.423, signaling robust operational efficiency and market confidence. Despite relying solely on external borrowing—a riskier funding strategy—the firm maintains steady dividend payouts at 46 pence per share, underscoring consistent shareholder returns amidst its growth phase. This financial health coupled with insider confidence showcased by recent strategic executive appointments positions Polar Capital as a compelling entity within the UK's undervalued investment landscape.

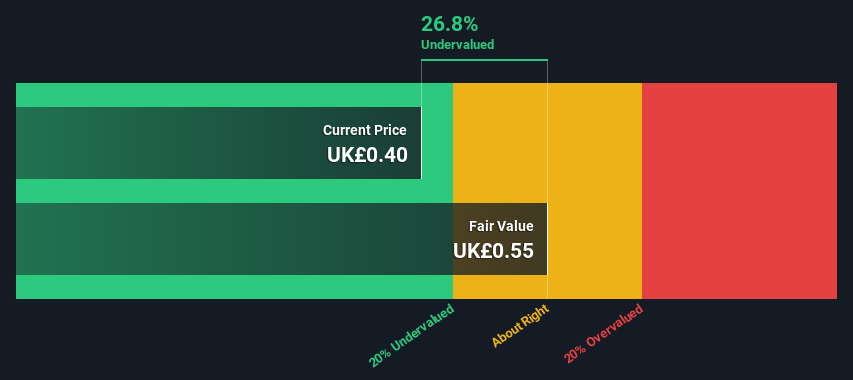

Assura

Simply Wall St Value Rating: ★★★★☆☆

Overview: Assura is a healthcare real estate investment trust (REIT) specializing in the ownership, management, and development of primary care facilities across the UK, with a market capitalization of approximately £1.76 billion.

Operations: The company's gross profit margin has fluctuated slightly but remained around 90.8% in the most recent quarter, with a gross profit of £143.3 million on revenue of £157.8 million. Operating expenses for the same period were £14 million.

PE: -42.3x

Assura's recent financial performance and strategic moves suggest a promising outlook despite some challenges. With a notable improvement in net loss to £28.8 million from last year's £119.2 million, and an increase in sales to £157.8 million, the company is on a recovery path. Insider confidence is evident as they recently purchased shares, signaling belief in long-term value amidst its current market assessment. Additionally, the new £250 million joint venture aimed at enhancing NHS infrastructure underlines Assura’s commitment to growth in healthcare real estate, potentially increasing its appeal to investors looking for exposure in this sector.

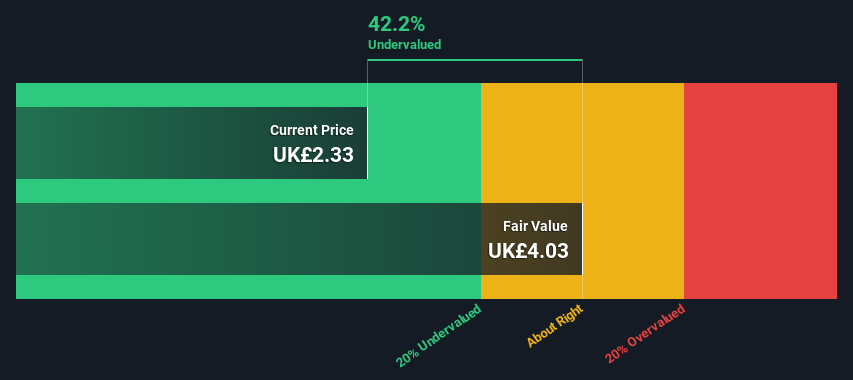

MONY Group

Simply Wall St Value Rating: ★★★★★★

Overview: MONY Group is a diversified financial services company that operates across various segments including money, travel, cashback, insurance, and home services.

Operations: The company generates its highest revenue from the Insurance segment at £220 million, followed by Money and Cashback segments which contribute £100.2 million and £59.8 million respectively. Over recent periods, it has maintained a gross profit margin consistently above 67%, with a notable increase in net income reaching £72.7 million by the end of the latest reported period.

PE: 16.8x

Recently, MONY Group, previously known as Moneysupermarket.com Group PLC, showcased a revenue increase to £114.6 million in Q1 2024 from £106.3 million the previous year, signaling robust market traction. With earnings expected to climb by over 10% annually, financial health appears strong despite reliance on external borrowing—a riskier funding strategy. Insider confidence is evident as they recently purchased shares, underscoring belief in the company's prospects amidst its transition and growth trajectory within the competitive UK market landscape.

Take a closer look at MONY Group's potential here in our valuation report.

Assess MONY Group's past performance with our detailed historical performance reports.

Where To Now?

Take a closer look at our Undervalued Small Caps With Insider Buying list of 36 companies by clicking here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:POLR LSE:AGR and LSE:MONY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance