Top Asia Currency Trade Risks Tripping Up Market If Rupee Swings

(Bloomberg) -- One of Asia’s most lucrative currency trades risks becoming a victim of its own success, according to analysts, with investors blindsided if the market suddenly turns.

Most Read from Bloomberg

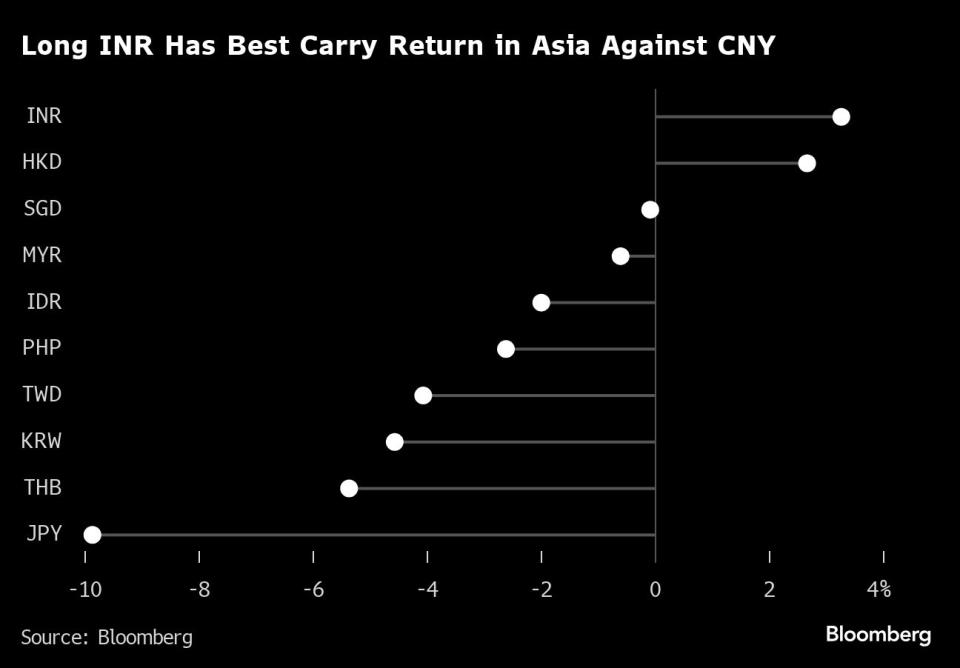

Borrowing China’s yuan and buying rupees with the proceeds is a top regional play this year. The strategy takes advantage of India’s higher interest rates as officials in both countries keep their currencies in a tight range. Citigroup Inc. estimates the strategy offers 350 basis points to 400 basis points of returns based on the interest rate differential, known as carry.

The risk is that too many investors have piled in, exposing them to sudden swings in the exchange rate. This was the case with the peso when Mexico’s election last week left the market stunned.

Citing a drop in India’s foreign currency reserves in April and potentially worsening trade balance, JPMorgan Chase & Co. said in a June 5 note that it had unwound its yuan-rupee short prior to India’s election and would forgo bets on the pair until levels were “better.” Barclays Plc also sees grounds for caution.

“The main risk around this trade is positioning, which is quite heavy,” said Mitul Kotecha, head of FX and EM macro strategy for Asia at Barclays. Even so, “we continue to see value” in shorting the yuan against the rupee.

The trade is getting tailwinds from the diverging economic outlooks for the two countries. India is the fastest-growing major economy, the central bank’s main interest rate is at a six-year high and officials are using its war chest of reserves to keep volatility to a minimum. That stands in contrast to China, where growth momentum is lackluster and the real estate sector is still plagued by defaults.

An economic revival in China that causes the yuan to strengthen might be what catches out traders. So could a reversal in the rupee, which is just shy of a record low against the dollar.

“People want to be long INR for the carry and then you have to look at a funding currency for it,” said Aditya Bagree, head of India and South Asia Markets at Citigroup Inc. “It’s just that CNY right now is a very attractive funding currency compared to others.”

Still, with price pressures in the world’s second-largest economy anemic, the People’s Bank of China may ease policy further. The yuan has already declined roughly 2% against the dollar this year, and any further weakening would play into carry traders’ hands.

Given weak domestic demand, the currencies of north Asian countries, notably China’s, “will likely stay on the weak side compared to the Indian rupee,” said David Hauner, head of global emerging market fixed-income strategy at Bank of America Corp. “We actually see USD/CNY going quite a bit higher toward 7.45 by the end of the year.”

Most Read from Bloomberg Businessweek

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Food Companies Hope You Won’t Notice Shortages Are Raising Prices

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance