Dividend Fortunes: 2 Canadian Stocks Leading the Way to Retirement Wealth

Written by Kay Ng at The Motley Fool Canada

Dividend investing is an excellent way to help anyone retire with the kind of lifestyle they want. Billions of dollars of favourably taxed Canadian dividends are up for grabs for anyone willing to take risks in the stock market. For money, you don’t need for a long time, it makes good sense to consider investing in solid dividend stocks.

Canadians from all walks of life can benefit from investing in high-yield dividend stocks that tend to increase their dividends over time. If you have a long way until retirement, you might complement your dividend portfolio with lower-yielding but higher-growth stocks.

Here are a couple of dividend stocks to help investors get started on retiring wealthy. In fact, if investors have a sufficiently large portfolio, they could churn out enough dividend income to improve their lifestyles today!

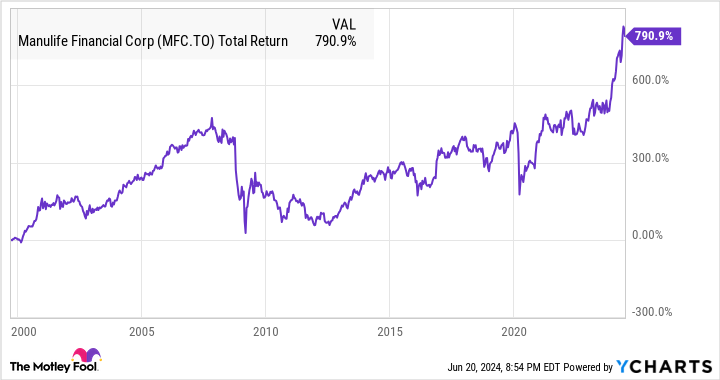

MFC Total Return Level data by YCharts

Manulife

Manulife (TSX:MFC) stock was an underperformer for some time. Finally, the stock price seems to have caught up to its earnings. At $35.22 per share, the dividend stock trades at a reasonable blended price-to-earnings ratio (P/E) of about 9.8 versus its long-term normal valuation of roughly 10.2 times earnings. Over the past decade, the life and health insurance increased its adjusted earnings per share (EPS) at a compound annual growth rate (CAGR) of 10%, which helped drive a 10-year dividend-growth rate of 10.9%.

At the recent quotation, it offers a decent dividend yield of 4.5% and is expected to increase its adjusted EPS by at least 7% per year over the next few years. If so, investors can approximate total returns of north of 11% per year, assuming no valuation expansion. You can also expect dividend growth that more or less aligns with its earnings growth.

Dollarama

Dollarama (TSX:DOL) has been a fabulous growth stock that also increased its dividend at a double-digit rate over the last decade. Its 10-year dividend-growth rate is 11.7%. At the recent quotation, it offers a puny dividend yield of 0.3%. So, investors should focus on its potential for capital gains and dividend growth.

The value retailer attracts shoppers looking for deals, as its well-selected, diversified basket of merchandise is sold at select fixed price points up to $5. Therefore, the business makes quality earnings through good and bad economic periods.

Last week, it reported solid fiscal 2025 first-quarter results with sales growth of 8.6% to $1.4 billion versus a year ago. Comparable store sales grew 5.6%. And the EPS climbed 22%.

In fiscal 2025, it plans to open 60-70 net new stores and targets comparable store sales of 3.5% to 4.5%.

The only thing that might deter investors from the stock today is its valuation, which is at the high end of its historical range. At about $123 per share at the time of writing, it trades at a forward P/E of approximately 30, with anticipated EPS growth of over 11% per year over the next couple of years.

Interested investors could consider accumulating shares in the proven name on meaningful market pullbacks.

The post Dividend Fortunes: 2 Canadian Stocks Leading the Way to Retirement Wealth appeared first on The Motley Fool Canada.

What Stocks Should You Add to Your Retirement Portfolio?

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now. The 10 stocks that made the cut could produce monster returns in the coming years, potentially setting you up for a more prosperous retirement.

Consider when "the eBay of Latin America," MercadoLibre, made this list on January 8, 2014 ... if you invested $1,000 at the time of our recommendation, you’d have $18,111.92.*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 27 percentage points since 2013*.

See the 10 stocks * Returns as of 5/22/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance