Toast's (NYSE:TOST) Q1: Strong Sales, Gross Margin Improves

Restaurant software platform Toast (NYSE:TOST) announced better-than-expected results in Q1 CY2024, with revenue up 31.3% year on year to $1.08 billion. It made a GAAP loss of $0.15 per share, improving from its loss of $0.15 per share in the same quarter last year.

Is now the time to buy Toast? Find out in our full research report.

Toast (TOST) Q1 CY2024 Highlights:

Revenue: $1.08 billion vs analyst estimates of $1.04 billion (3.3% beat)

EPS: -$0.15 vs analyst expectations of -$0.14 (6% miss)

Gross Margin (GAAP): 23.2%, up from 21.4% in the same quarter last year

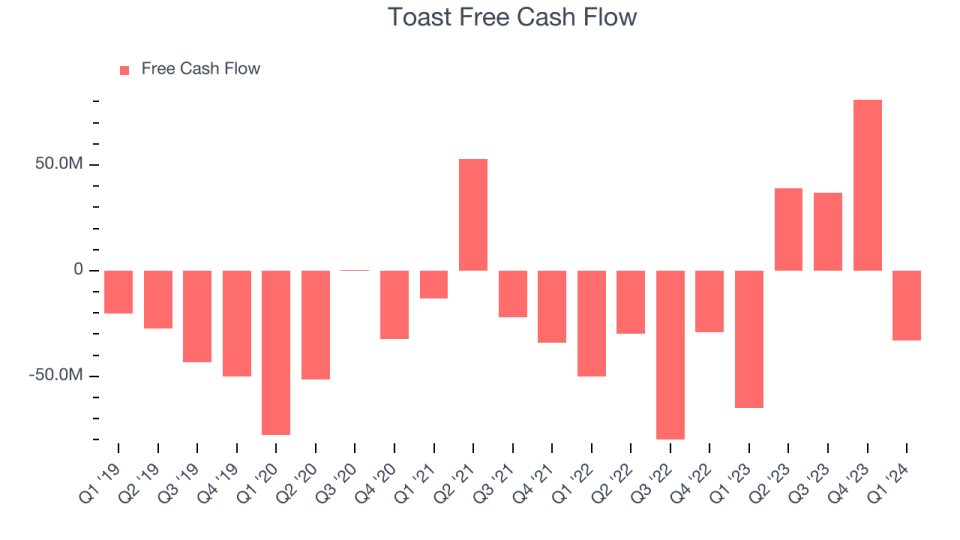

Free Cash Flow was -$33 million, down from $81 million in the previous quarter

Market Capitalization: $13.04 billion

“Toast is off to a strong start in 2024. Our first quarter results demonstrate strong topline growth and margin expansion that we will continue to build on throughout the year. We executed well against our priorities: scaling restaurant locations; driving ARR by delivering products customers love; continuing to expand our addressable market; and building operating leverage as we scale,” said Toast CEO and Co-Founder Aman Narang.

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point-of-sale (POS) hardware, software, and payments solutions for restaurants.

Hospitality & Restaurant Software

Enterprise resource planning (ERP) and customer relationship management (CRM) are two of the largest software categories dominated by the likes of Microsoft, Oracle, and Salesforce.com. Today, the secular trend of mass customization is driving vertical software that customizes ERP and CRM functions for specific industry requirements. Restaurants are a prime example where a set of customized software providers have sprung up in recent years to create unique operating systems that blend tax and accounting software, order management and delivery, along with supply chain management. Hotels and other hospitality providers are another example.

Sales Growth

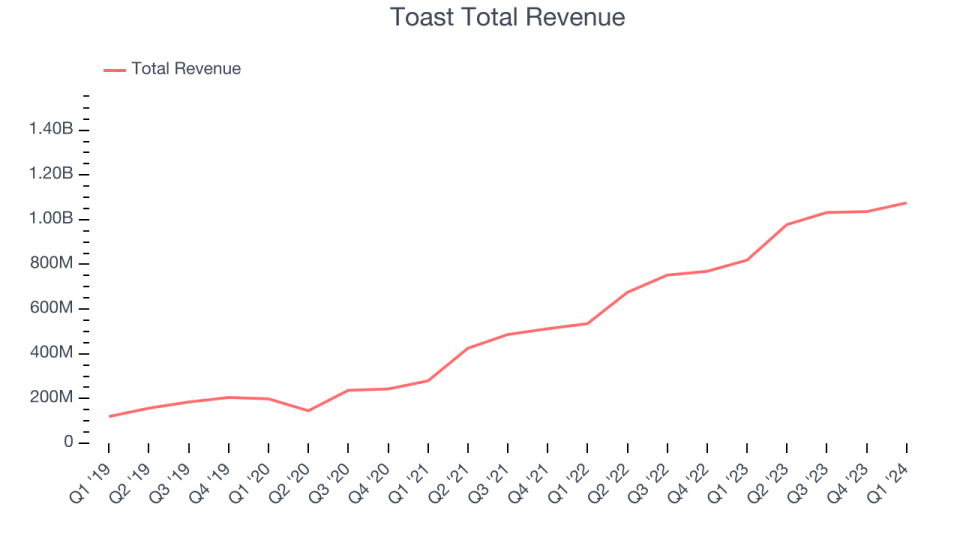

As you can see below, Toast's revenue growth has been incredible over the last three years, growing from $279 million in Q1 2021 to $1.08 billion this quarter.

Unsurprisingly, this was another great quarter for Toast with revenue up 31.3% year on year. On top of that, its revenue increased $39 million quarter on quarter, a very strong improvement from the $4 million increase in Q4 CY2023. This is a sign of acceleration of growth and great to see.

Looking ahead, analysts covering the company were expecting sales to grow 24% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Toast burned through $33 million of cash in Q1 , increasing its cash burn by 49.2% year on year.

Toast has generated $124 million in free cash flow over the last 12 months, or 3% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Toast's Q1 Results

We were impressed by Toast's strong gross margin improvement this quarter. We were also glad its revenue outperformed Wall Street's estimates. Overall, we think this was a good quarter that should please shareholders. The stock is up 3.7% after reporting and currently trades at $24.63 per share.

Toast may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance