Three Swedish Dividend Stocks Offering Up To 5.2% Yield

Amidst a backdrop of fluctuating global markets, Sweden's economy continues to present opportunities for investors seeking stable returns. This article explores three Swedish dividend stocks offering yields up to 5.2%, providing a potential haven in the current uncertain market environment where steady income is highly valued.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 5.98% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 3.85% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.27% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.11% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.01% | ★★★★★☆ |

Duni (OM:DUNI) | 4.62% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.71% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.16% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.16% | ★★★★★☆ |

AB Traction (OM:TRAC B) | 4.02% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

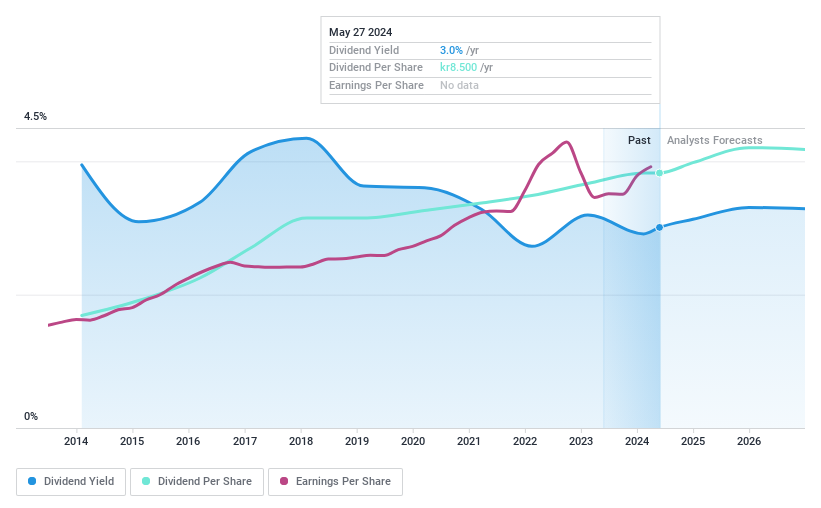

Axfood

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Axfood AB operates primarily in Sweden, focusing on the food retail and wholesale sectors, with a market capitalization of approximately SEK 60.96 billion.

Operations: Axfood AB generates its revenue primarily through several segments: Dagab with SEK 74.94 billion, Willys with SEK 44.54 billion, Snabbgross at SEK 5.35 billion, and Home Purchase contributing SEK 7.57 billion.

Dividend Yield: 3%

Axfood reported a solid first quarter in 2024 with sales increasing to SEK 20.25 billion, up from SEK 19.25 billion the previous year, and net income rising to SEK 561 million from SEK 475 million. The company's dividend of SEK 8.50 per share is supported by earnings, with a payout ratio of 75.1%, and cash flows, evidenced by a cash payout ratio of only 34.8%. However, its dividend yield at 3.01% remains below the top quartile of Swedish dividend payers which offer around 4.15%. Recent executive changes include Simone Margulies becoming CEO in August, suggesting potential strategic continuity and leadership stability.

Eolus Vind

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eolus Vind AB operates in the development, construction, and operation of renewable energy projects across Sweden, Norway, Finland, the United States, Poland, Spain, and the Baltic states with a market capitalization of approximately SEK 1.87 billion.

Operations: Eolus Vind AB generates its revenue through the development, construction, and management of renewable energy projects in various regions including Sweden, Norway, Finland, the USA, Poland, Spain, and the Baltic states.

Dividend Yield: 3%

Eolus Vind, a Swedish wind power developer, recently declared a dividend of SEK 2.25 per share for 2023 despite facing significant earnings challenges with a first-quarter net loss of SEK 32 million and substantial revenue declines from SEK 304 million to SEK 49 million year-over-year. The company's dividends have shown volatility over the past decade but are currently supported by a low payout ratio of 10.1% and a cash payout ratio of 55.5%. However, Eolus Vind's future earnings are projected to decline annually by an average of 24.9% over the next three years, raising concerns about the sustainability of its dividends amidst ongoing executive changes and strategic expansions in new wind projects set for completion in late 2025.

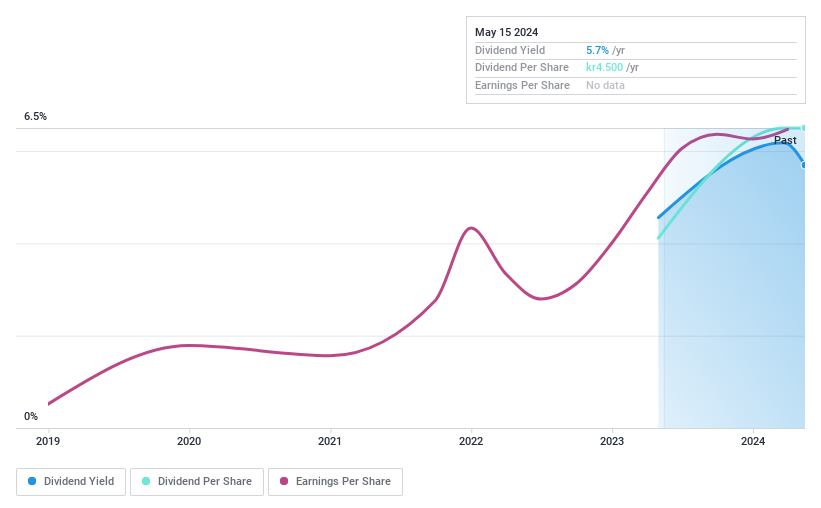

Solid Försäkringsaktiebolag

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag operates as a provider of non-life insurance products for private individuals across Sweden, Denmark, Norway, Finland, and other European countries, with a market capitalization of approximately SEK 1.59 billion.

Operations: Solid Försäkringsaktiebolag generates revenue through three main segments: Product (SEK 328.53 million), Assistance (SEK 339.51 million), and Personal Safety (SEK 423.71 million).

Dividend Yield: 5.2%

Solid Försäkringsaktiebolag, having recently initiated dividend payments, declared a dividend of SEK 4.50 per share at its Annual General Meeting on April 25, 2024. The company's dividends are well-supported with a payout ratio of 50.2% and a cash payout ratio of 86.5%, reflecting coverage by both earnings and cash flows. Despite this strong backing, the firm's short history of dividend payments makes it difficult to assess the stability and future growth of these dividends. Additionally, recent leadership changes could influence its strategic direction and financial policies moving forward.

Summing It All Up

Navigate through the entire inventory of 23 Top Dividend Stocks here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:AXFO OM:EOLU B and OM:SFAB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance