Three Growth Companies With High Insider Ownership And At Least 10% Revenue Growth

Amid fluctuating sentiments in the U.S. market, where recent gains in major indices like the S&P 500 and Dow Jones Industrial Average hint at cautious optimism, investors remain vigilant as Federal Reserve officials signal a potentially firmer stance on interest rates. In such a climate, growth companies with high insider ownership and robust revenue growth can be particularly compelling, as high insider stakes often reflect leadership's confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 28.2% |

Li Auto (NasdaqGS:LI) | 29.3% | 22% |

Duolingo (NasdaqGS:DUOL) | 15% | 54.9% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 37.6% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.7% | 88.9% |

FTC Solar (NasdaqGM:FTCI) | 30.6% | 63.1% |

EHang Holdings (NasdaqGM:EH) | 33% | 98% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 23.6% | 76.5% |

Let's explore several standout options from the results in the screener.

Duolingo

Simply Wall St Growth Rating: ★★★★★★

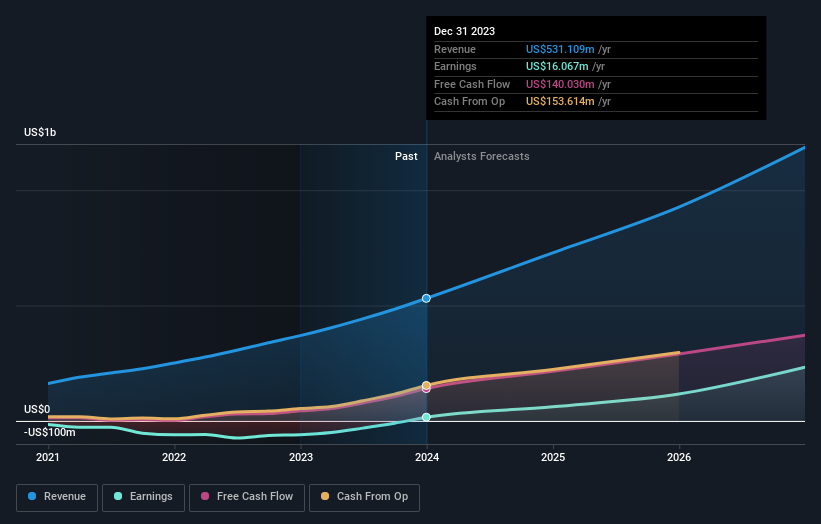

Overview: Duolingo, Inc. is a mobile learning platform that offers language education services across the United States, the United Kingdom, and other international markets, with a market capitalization of approximately $10.72 billion.

Operations: The company generates its revenue primarily from its educational software segment, which amounted to $531.11 million.

Insider Ownership: 15%

Revenue Growth Forecast: 20.5% p.a.

Duolingo, a notable player in the growth sector with significant insider ownership, has demonstrated a robust financial turnaround. In 2023, it reported a net income of US$16.07 million, recovering from a previous loss, with sales jumping to US$531.11 million from US$369.5 million. The company's revenue and earnings are expected to grow significantly above market rates at 20.5% and 54.9% per year respectively. Despite recent shareholder dilution, Duolingo trades at 40.3% below its estimated fair value and has been added to several S&P indices as of April 2024, signaling enhanced investor confidence and market recognition.

Click to explore a detailed breakdown of our findings in Duolingo's earnings growth report.

Our expertly prepared valuation report Duolingo implies its share price may be too high.

Robinhood Markets

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Robinhood Markets, Inc. operates a financial services platform in the United States, with a market capitalization of approximately $15.81 billion.

Operations: The company generates its revenue primarily through its brokerage services, which amounted to $1.87 billion.

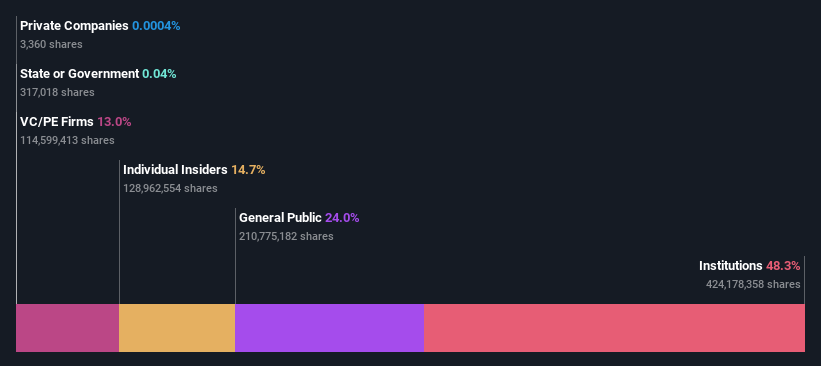

Insider Ownership: 14.7%

Revenue Growth Forecast: 10.2% p.a.

Robinhood Markets, poised for growth with high insider engagement, is expected to turn profitable within three years, a notable shift given its past performance. The company's revenue growth forecast at 10.2% annually outpaces the U.S. market average of 8.3%. Despite a low projected return on equity of 1.5%, recent strategic board changes and substantial insider transactions underscore a committed leadership navigating towards profitability. This strategy is further evidenced by their latest earnings report showing significant improvement from prior losses to a net income of US$30 million in Q4 2023.

Paylocity Holding

Simply Wall St Growth Rating: ★★★★☆☆

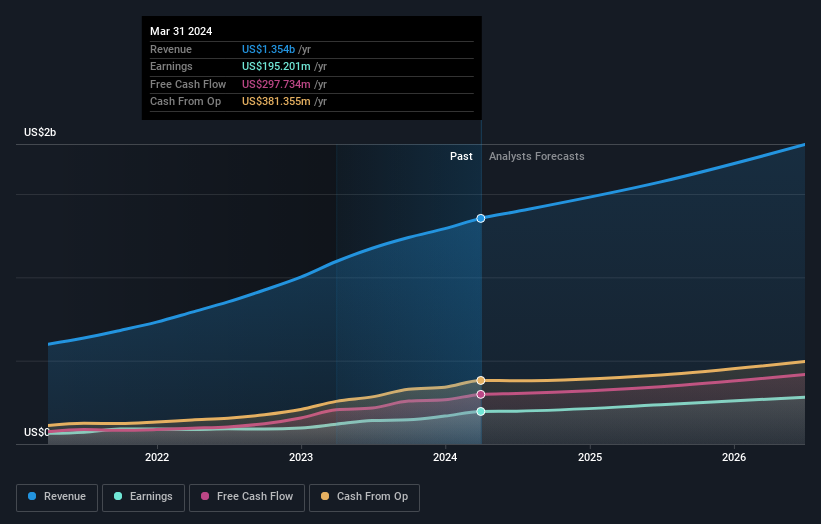

Overview: Paylocity Holding Corporation offers cloud-based human capital management and payroll software solutions in the United States, with a market capitalization of approximately $9.54 billion.

Operations: The company generates its revenue primarily from cloud-based software solutions, totaling approximately $1.35 billion.

Insider Ownership: 21.8%

Revenue Growth Forecast: 11.8% p.a.

Paylocity Holding, a notable player in the growth sector with significant insider ownership, has demonstrated robust financial performance with a recent revenue increase to US$401.28 million and net income of US$85.31 million for Q3 2024. The company forecasts continued growth, projecting revenues up to US$1.397 billion for FY 2024, representing a substantial year-over-year increase. Additionally, Paylocity has initiated a share repurchase program valued at US$500 million, underscoring confidence in its financial health and commitment to shareholder value.

Key Takeaways

Investigate our full lineup of 196 Fast Growing Companies With High Insider Ownership right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:DUOL NasdaqGS:HOOD and NasdaqGS:PCTY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance