Tetra Technologies Inc (TTI) Q1 2024 Earnings: Misses Analyst Revenue and EPS Forecasts

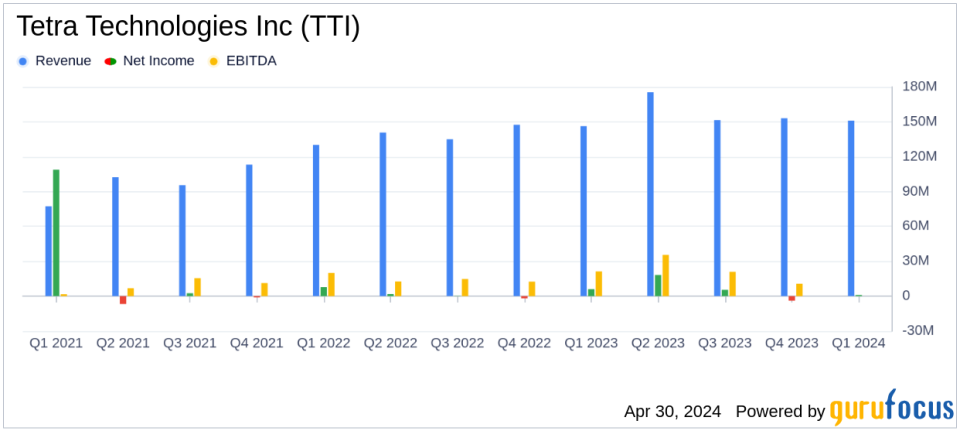

Revenue: $151 million, up 3% year-over-year, slightly below estimates of $153.65 million.

Net Income: $915,000, a significant decrease compared to $6.0 million in the same quarter last year, falling short of estimates of $3.83 million.

Earnings Per Share (EPS): Reported at $0.01, adjusted EPS excluding unusual items was $0.05, exceeding the estimated $0.03.

Adjusted EBITDA: $22.8 million, an increase of 11% year-over-year, indicating improved operational efficiency.

Free Cash Flow: Reported a use of $29.6 million in adjusted free cash flow, a significant increase in cash use compared to the previous year.

Debt Management: Successfully refinanced term loan with a new maturity in 2030, enhancing financial stability.

Strategic Initiatives: Progress in high-value projects and strategic partnerships, including a lithium joint venture with ExxonMobil, promising future growth avenues.

Tetra Technologies Inc (NYSE:TTI) announced its first quarter financial results for 2024 on April 30, revealing figures that fell short of analyst expectations. The company reported a quarterly revenue of $151 million and earnings per share (EPS) of $0.01, which did not meet the anticipated $153.65 million in revenue and $0.03 EPS. For a comprehensive view, readers can access the full details through the company's 8-K filing.

Company Overview

Tetra Technologies Inc is a diversified oil and gas services company. It operates primarily through two segments: Completion Fluids & Products, and Water & Flowback Services. The company specializes in completion fluids, water management, and various associated services, deriving the majority of its revenue from the United States. This strategic focus supports its operations across several challenging yet vital areas of the oil and gas industry.

Financial Performance and Challenges

The first quarter saw a modest year-over-year revenue increase of 3%, yet it marked a slight decline from the previous quarter. The net income stood at $915,000, significantly lower compared to $6.0 million in the same quarter the previous year. This decline can be attributed to non-recurring charges amounting to $5.2 million. Adjusted EBITDA saw an 11% increase, reaching $22.8 million. However, the company faced challenges with its Water & Flowback Services segment, which experienced a decrease in revenue and margins due to lower activity levels and one-off costs.

Strategic Initiatives and Market Position

Despite the financial setbacks, TTI is progressing with several strategic initiatives aimed at enhancing its market position. These include the desalination of produced water, ramp-up of high duration battery electrolyte production, and developments in bromine and lithium projects. The refinancing of their term loan, which now includes a delayed draw feature for the bromine project extending to 2030, is a significant step towards securing necessary capital for future ventures.

Analysis of Financial Statements

The balance sheet shows an increase in working capital, primarily due to a rise in accounts receivable linked to sales timing. The company's liquidity position remains strong with $195.1 million available, including a $75 million delayed draw. However, the net cash used in operating activities was reported at $13.8 million, with adjusted free cash flow also showing a substantial cash use of $29.6 million, reflecting ongoing investments in strategic projects.

Outlook and Commentary

Brady Murphy, President and CEO of TTI, commented on the results, "Our first quarter results were in line with our expectations, with strong performance in our Completion Fluids and Products segment offsetting weaker start in Water & Flowback Services. We are encouraged by the alignment of deepwater projects and strategic initiatives that bolster our outlook for 2024 and beyond."

Looking forward, TTI expects improvements in its Water & Flowback Services by the second quarter, with revenue and EBITDA margins anticipated to return to levels seen before the year-end activity decline. The company remains optimistic about its strategic initiatives, particularly in high-value areas like deepwater operations and industrial chemicals, which are expected to drive growth in the coming periods.

Conclusion

While TTI's Q1 2024 performance has shown areas of concern, particularly with missed revenue and EPS forecasts, its strategic investments and ongoing projects could set the stage for a more robust financial performance in the future. Investors and stakeholders will likely keep a close watch on the company's ability to manage its resources effectively and capitalize on emerging opportunities in the evolving energy sector.

Explore the complete 8-K earnings release (here) from Tetra Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance