Tencent Beats Estimates After WeChat, Video Lift Ad Growth

(Bloomberg) -- Tencent Holdings Ltd.’s revenue and earnings beat estimates after its TikTok-style video platform gained traction against ByteDance Ltd. and drove growth despite a faltering Chinese economic recovery.

Most Read from Bloomberg

US Inflation Data Was Accidentally Released 30 Minutes Early

Putin and Xi Vow to Step Up Fight to Counter US ‘Containment’

With a BlackRock CEO, $9 Trillion Vanguard Braces for Turbulence

Jamie Dimon Sees ‘Lot of Inflationary Forces in Front of Us’

Dow Average Touches 40,000 Before Pulling Back: Markets Wrap

Revenue for the three months ended March rose 6% to 159.5 billion yuan ($22 billion), compared with the 158.8 billion yuan average estimate. Net income also climbed a stronger-than-anticipated 62% after users spent 80% more time on WeChat’s video accounts, a nod to efforts to wrest engagement from rival ByteDance. That helped drive a 26% rise in ad sales.

Stock in major shareholder Prosus NV — a proxy for Tencent’s stock after trading hours — rose 2.9%. China’s most valuable company is increasingly relying on WeChat to rejuvenate its sprawling internet empire at a time of economic difficulties. The country’s go-to everything app has stepped up monetization through advertising, e-commerce sales, and in-game purchases, offsetting weakness across other segments. Such higher-margin revenue could buy Tencent time as it seeks its next big breakthrough in areas like gaming and generative AI.

The world’s second-largest economy has struggled post-pandemic. Chinese consumers remain cautious during a property meltdown and persistent youth unemployment, while the economy is slipping deeper into deflation, reflecting anemic domestic demand. Beijing’s leaders are slated to hold a long-delayed conclave in July, when new policies to stimulate the economy are expected.

But Tencent also has a few internal issues to sort out.

Once its bread and butter, the games division remains in search of its next big hit, after years of regulatory tightening that cut play times and slowed development. Its new mobile release Dream Star hasn’t yet unseated NetEase Inc. as the leader in the fast-growing genre of party royale games — casual titles intended for group play. Tencent fast-tracked the Chinese debut of Dungeon & Fighter Mobile to this month, but the hack-and-slash game will then have to contend with rival titles from ByteDance and Genshin Impact studio Mihoyo.

Beyond China, Tencent’s Supercell will soon launch its first new game in five years. Before that, its biggest revenue driver was an updated version of the aging mainstay Brawl Stars.

Value-added services — a segment that largely comprises gaming revenue — slid in the quarter even as ads and fintech services grew. But the company disclosed gross gaming receipts for the first time in years — a more precise measure of the amount that gamers are spending Tencent said grew in the first quarter of 2024.

Tencent’s studios “might have taken their foot off the pedal when it comes to innovation” after years free from intense scrutiny on revenue and profit, Morningstar analyst Ivan Su wrote in a note before the results. “It seems a wave of change is on the horizon.”

Read More: Tencent, Alibaba Earnings Are Key to Longer China Stock Rally

WeChat sits at the heart of Tencent’s effort to tap its massive user traffic for what it calls high-quality growth. The super-app’s foray into mini-videos and live shopping helps diversify revenue streams beyond gaming and improve margins across the board, after the company let go of non-core businesses in past years.

Tencent’s cloud division is seeking to reach break-even, and its payment arm won a regulatory nod in March to boost its registered capital, potentially unlocking a new stream of lucrative revenue through consumer loans. Both units will likely help Tencent’s earnings outpace sales growth in coming quarters. Gross margin rose to 53%, the highest since 2016.

Longer run, Tencent joins much of the world’s biggest internet conglomerates in exploring the potential of generative AI. Its large language model, Hunyuan, is now integrated with a suite of products including search and online marketing. Like Alibaba Group Holding Ltd., the WeChat operator has also made multiple bets on domestic AI model startups, helping mint new unicorns including Baichuan and Minimax.

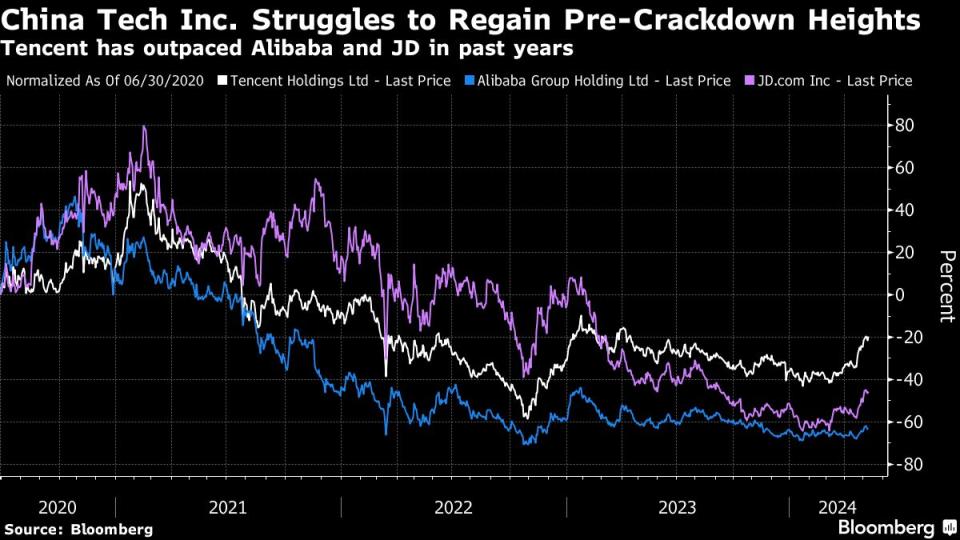

Tencent’s shares have surged roughly 30% so far this year, far outpacing the Hang Seng Tech Index. In March, the company announced a plan to more than double its stock buyback program to at least $12.8 billion this year, another sign of maturity in a Chinese tech sector that once led the nation in growth. The step-up could help ease the selling pressure by Tencent’s biggest shareholder Prosus NV, which is paring its stake in Tencent to fund its own buyback.

--With assistance from Sarah Zheng, Jane Zhang, Sabrina Mao, Debby Wu and Peter Elstrom.

(Updates with shares from the second paragraph)

Most Read from Bloomberg Businessweek

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

Milei Targets Labor Law That’s Set to Hand Banker $10 Million Severance

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance