Swedish Growth Companies With High Insider Ownership In June 2024

As global markets exhibit mixed signals with some regions showing growth and others grappling with economic challenges, Sweden's market remains a focal point for investors interested in stability and potential growth. In such an environment, Swedish growth companies with high insider ownership are particularly compelling as they often signal strong confidence from those who know the companies best.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 35.1% | 50.9% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

InCoax Networks (OM:INCOAX) | 17.9% | 104.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 43.4% |

SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Here we highlight a subset of our preferred stocks from the screener.

Sectra

Simply Wall St Growth Rating: ★★★★☆☆

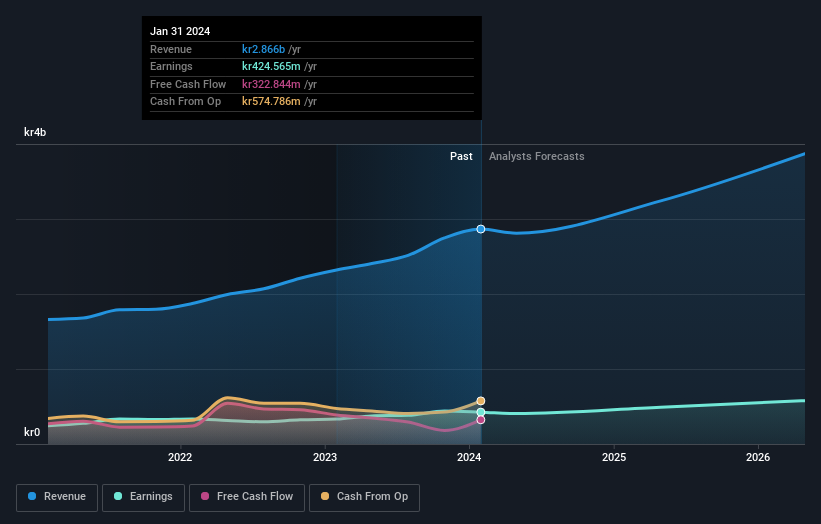

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors primarily in Sweden, the UK, the Netherlands, and other parts of Europe, with a market capitalization of SEK 48.24 billion.

Operations: The company generates revenue primarily through its Imaging IT Solutions and Secure Communications segments, which reported SEK 2.55 billion and SEK 367.40 million respectively, along with a smaller contribution from Business Innovation at SEK 89.90 million.

Insider Ownership: 30.3%

Revenue Growth Forecast: 14.7% p.a.

Sectra, a Swedish company specializing in medical imaging IT and cybersecurity, has shown robust growth with a 14.7% annual increase in revenue and a 19.3% rise in earnings, outpacing the Swedish market averages. Recent innovations include launching a genomic diagnostics module developed with the University of Pennsylvania Health System, enhancing cancer treatment personalization. Additionally, Sectra's recent FDA clearance for digital pathology marks significant progress in standardizing diagnostic processes. High insider ownership aligns management’s interests with shareholders', supporting long-term value creation despite not being the top performer in its category for growth or ownership concentration.

Vimian Group

Simply Wall St Growth Rating: ★★★★☆☆

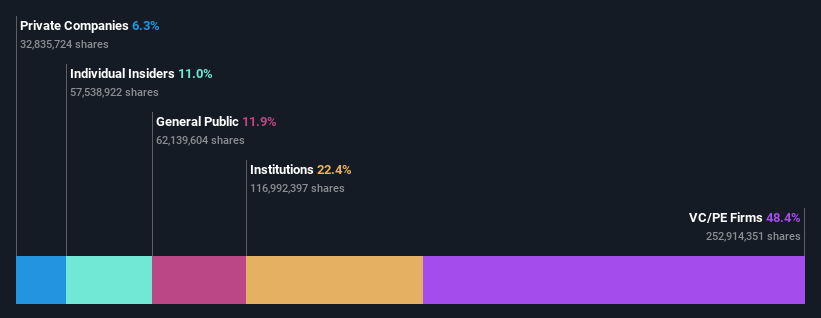

Overview: Vimian Group AB operates globally in the animal health sector and has a market capitalization of approximately SEK 18.16 billion.

Operations: Vimian Group's revenue is divided into several segments, with Specialty Pharma generating €153.26 million, Medtech contributing €109.03 million, Veterinary Services at €51.63 million, and Diagnostics bringing in €21.14 million.

Insider Ownership: 11%

Revenue Growth Forecast: 12.2% p.a.

Vimian Group, while trading at 33% below its estimated fair value, faces challenges with interest coverage and shareholder dilution over the past year. Despite these issues, Vimian's earnings are expected to grow significantly, outpacing the Swedish market with a forecasted annual growth rate of 58.6%. Revenue growth forecasts also exceed local market trends at 12.2% per year. Recent leadership changes include Magnus Welander's election as chairman, following a substantial equity offering in April which raised SEK 1.63 billion.

Yubico

Simply Wall St Growth Rating: ★★★★★★

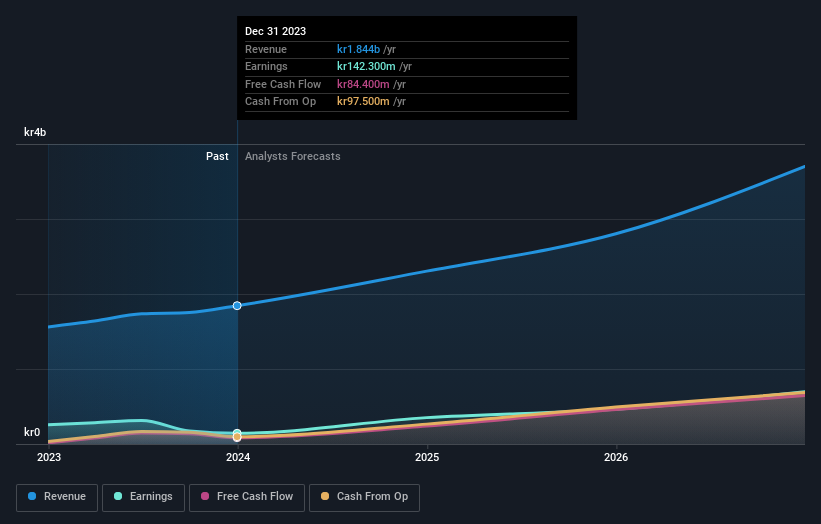

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of approximately SEK 21.14 billion.

Operations: The company generates revenue primarily from its security software and services segment, totaling SEK 1.93 billion.

Insider Ownership: 37.5%

Revenue Growth Forecast: 23.2% p.a.

Yubico, a Swedish growth company with high insider ownership, is trading at 7.9% below its estimated fair value and has experienced substantial insider buying recently. Despite shareholder dilution over the past year, Yubico's earnings are forecast to grow by 43.42% annually, outperforming the local market significantly. Revenue increased by 19.9% last year and is expected to continue growing at 23.2% annually—well above the Swedish market average of 2%. However, profit margins have declined from last year's levels.

Get an in-depth perspective on Yubico's performance by reading our analyst estimates report here.

Our expertly prepared valuation report Yubico implies its share price may be too high.

Summing It All Up

Gain an insight into the universe of 81 Fast Growing Swedish Companies With High Insider Ownership by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:SECT BOM:VIMIAN OM:YUBICO and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance