Swedish Exchange Growth Companies With Insider Ownership As High As 28%

As the Swedish market navigates through a landscape of interest rate adjustments and economic forecasts, investors are keenly observing trends in growth companies with high insider ownership. These firms often signal strong confidence from those closest to the business, potentially aligning well with current market conditions where discerning investment choices are paramount.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Sun4Energy Group (NGM:SUN4) | 12.6% | 49.6% |

BioArctic (OM:BIOA B) | 35.1% | 48.2% |

Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

InCoax Networks (OM:INCOAX) | 14.9% | 104.9% |

Yubico (OM:YUBICO) | 37.5% | 42% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 91.9% |

SaveLend Group (OM:YIELD) | 24.8% | 88.5% |

Let's explore several standout options from the results in the screener.

Fortnox

Simply Wall St Growth Rating: ★★★★★☆

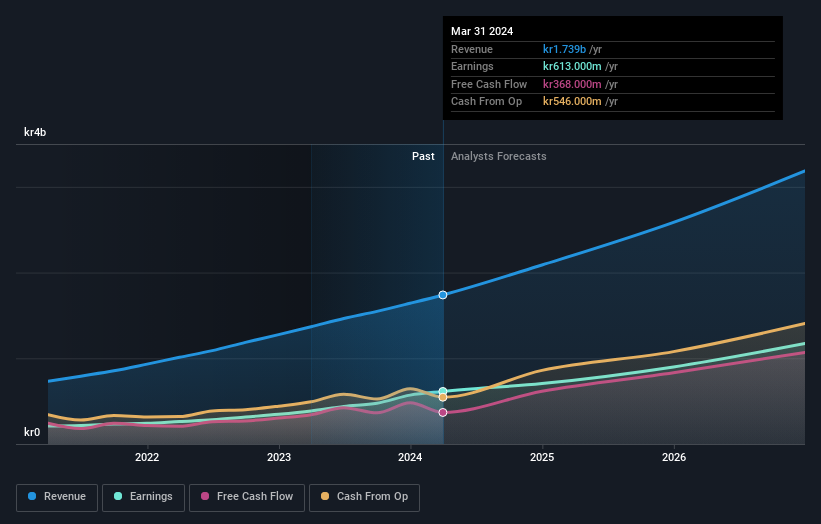

Overview: Fortnox AB operates in providing financial and administration software solutions tailored for small and medium-sized businesses, accounting firms, and organizations, with a market capitalization of approximately SEK 39.97 billion.

Operations: The company generates revenue primarily through Core Products (SEK 698 million), followed by Entrepreneurship (SEK 356 million), The Agency (SEK 327 million), Money (SEK 232 million), and Marketplaces (SEK 150 million).

Insider Ownership: 21%

Fortnox demonstrates robust growth potential with earnings rising by 58.8% over the past year and forecasted to grow at 21.2% annually, outpacing the Swedish market's 13.8%. Despite a highly volatile share price recently, insider activities show more buying than selling, reflecting confidence among those closest to the company. Recent financial results underscore this optimism; Q1 2024 saw revenue reaching SEK 473 million and net income at SEK 149 million, both marking significant increases from the previous year.

Click here to discover the nuances of Fortnox with our detailed analytical future growth report.

The valuation report we've compiled suggests that Fortnox's current price could be inflated.

Nolato

Simply Wall St Growth Rating: ★★★★☆☆

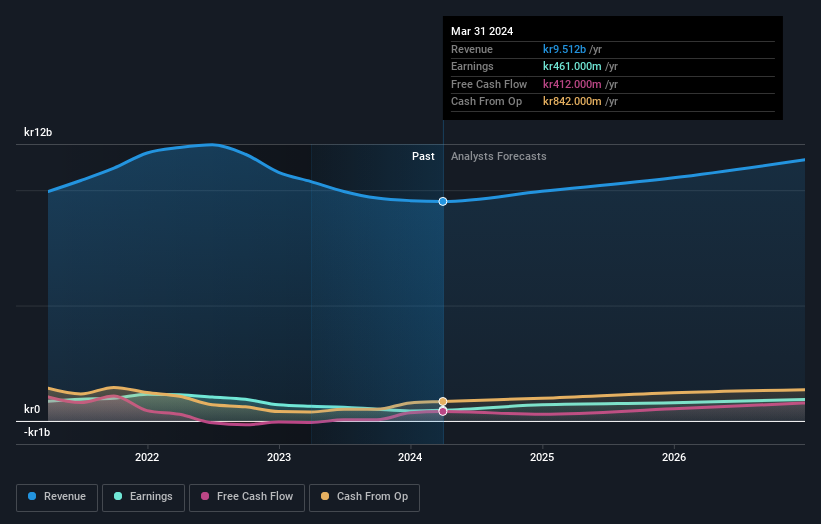

Overview: Nolato AB specializes in developing, manufacturing, and selling products made from plastic, silicone, and thermoplastic elastomer for various sectors including medical technology, pharmaceuticals, and consumer electronics across multiple regions globally. The company has a market capitalization of approximately SEK 16.35 billion.

Operations: The company generates revenue by developing and selling specialized products for sectors such as medical technology, pharmaceuticals, and consumer electronics across various global regions.

Insider Ownership: 28.9%

Nolato exhibits promising growth with earnings expected to outpace the Swedish market, though its revenue growth lags behind more aggressive benchmarks. Insider transactions suggest a balanced view, with recent purchases not being substantial but no significant sales either. The company's strategic investments in manufacturing for medical devices indicate long-term planning, yet the immediate financial impact remains minimal. Recent earnings show improvement, supporting a cautiously optimistic outlook despite a dividend that's poorly covered by cash flows.

Pandox

Simply Wall St Growth Rating: ★★★★☆☆

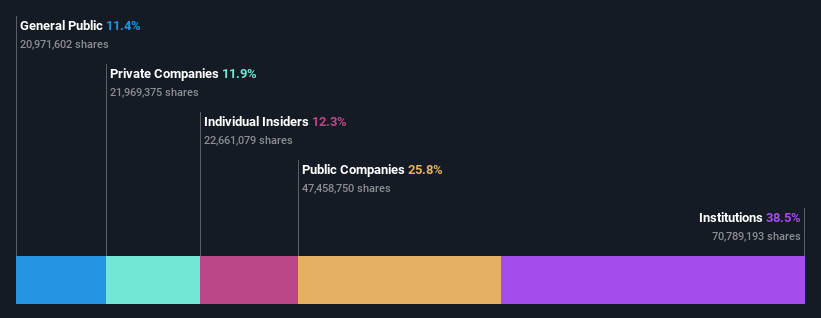

Overview: Pandox AB, a Swedish hotel property company, focuses on owning, operating, and leasing hotel properties with a market capitalization of approximately SEK 32.50 billion.

Operations: The company generates revenue primarily through two segments: own operation, which brought in SEK 3.24 billion, and rental agreements, contributing SEK 3.76 billion.

Insider Ownership: 12.3%

Pandox AB shows potential with expected earnings growth significantly outpacing the Swedish market, though its revenue growth is modest. Recent insider buying activity, although not in large volumes, aligns with positive Q1 earnings results showing a strong turnaround from last year's losses. The company's financial position is challenged by interest coverage and dividend sustainability concerns. Despite these issues, Pandox maintains a competitive valuation relative to its peers.

Click to explore a detailed breakdown of our findings in Pandox's earnings growth report.

Upon reviewing our latest valuation report, Pandox's share price might be too pessimistic.

Where To Now?

Discover the full array of 82 Fast Growing Swedish Companies With High Insider Ownership right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:FNOXOM:NOLA B OM:PNDX B

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance