Steven Cohen's Strategic Acquisition of Rapid7 Inc Shares

Overview of the Recent Transaction

On May 20, 2024, Point72, under the leadership of Steven Cohen (Trades, Portfolio), executed a significant transaction by acquiring 2,023,787 shares of Rapid7 Inc (NASDAQ:RPD), a prominent player in the cybersecurity sector. This addition has increased the firm's total holdings in Rapid7 to 3,103,115 shares, reflecting a substantial commitment to the company. The shares were purchased at a price of $39.56, marking a notable investment move in the technology landscape.

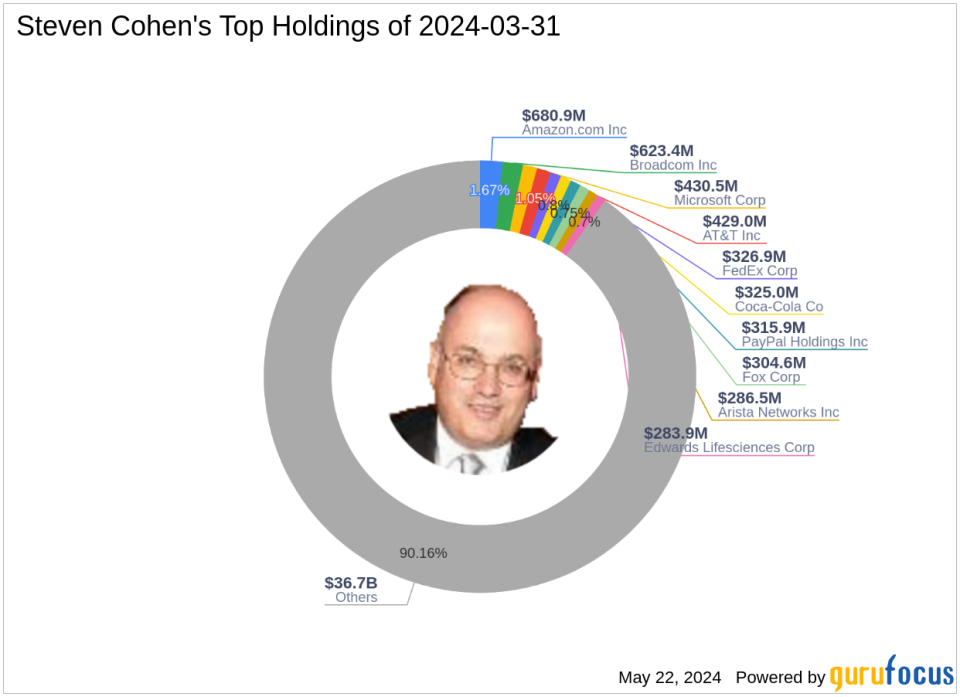

Profile of Steven Cohen (Trades, Portfolio) and Point72

Steven A. Cohen, Chairman and CEO of Point72, a robust investment firm with over 1,650 employees, has a storied history in the financial markets. Founded originally as S.A.C. Capital Advisors in 1992 and later transformed into Point72, the firm focuses on a long/short equity strategy, employing a detailed, bottom-up research approach to drive its investment decisions. Cohen's leadership extends beyond finance into ventures such as Point72 Ventures and Hyperscale, and philanthropy, significantly impacting various sectors.

Introduction to Rapid7 Inc

Rapid7, established in 2000 and publicly listed since 2015, operates extensively within the cybersecurity industry. The company offers a range of services from vulnerability management to advanced threat detection and response solutions. Based in Boston, Rapid7 has expanded its offerings to meet the evolving security needs of global businesses, making it a key player in the technology sector.

Analysis of the Trade's Impact

The recent acquisition by Cohen's Point72 represents a 0.2% impact on its portfolio, with Rapid7 now constituting 0.3% of the total portfolio and 4.97% of the total shares held in Rapid7. This strategic move underscores the firm's confidence in Rapid7's growth potential and its alignment with Point72's investment philosophy.

Market Context and Stock Performance

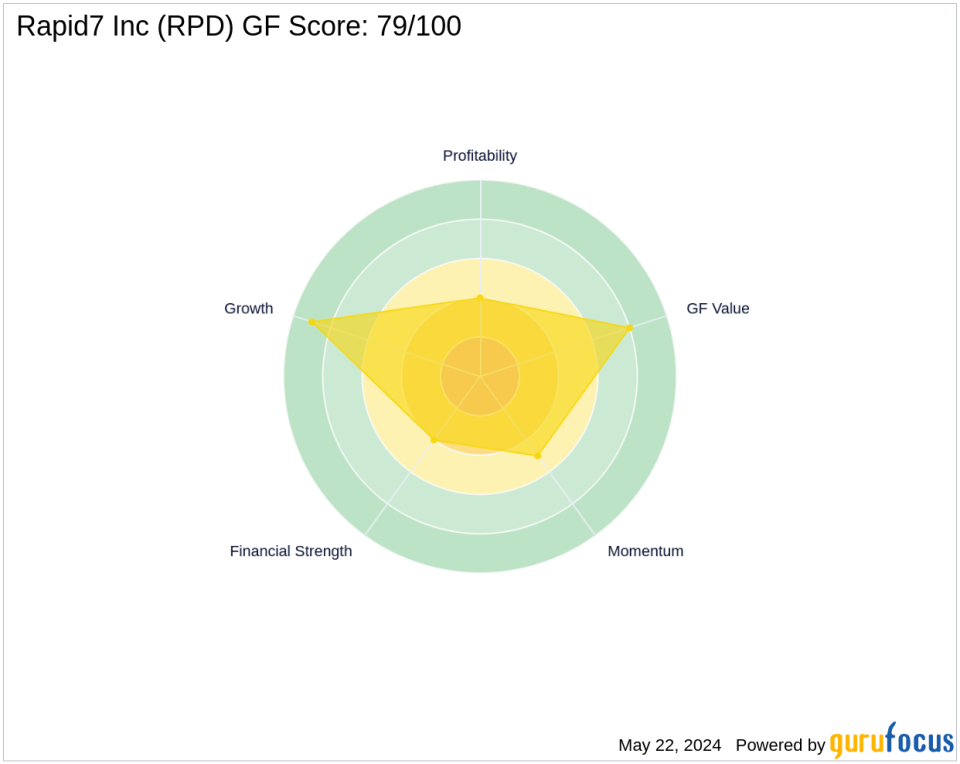

Rapid7's current market capitalization stands at $2.37 billion, with a stock price of $38.10, reflecting a slight decrease post-transaction. The stock's performance, including a year-to-date decline of 30.7%, juxtaposes its potential as indicated by a GF Score of 79/100, suggesting a strong future performance potential.

Sector and Industry Analysis

The technology and cybersecurity sectors are experiencing rapid growth and transformation. Within this competitive landscape, Rapid7 has carved out a niche with its comprehensive security solutions, positioning itself strongly against competitors and aligning with market demands for advanced cybersecurity measures.

Insights from Other Significant Investors

Other notable investors in Rapid7 include firms like Leucadia National and individuals such as Joel Greenblatt (Trades, Portfolio), although their specific stakes vary. Comparatively, Cohen's recent investment significantly increases Point72's influence and stake in the company.

Future Outlook and Analyst Insights

Despite current market challenges, analysts remain cautiously optimistic about Rapid7's trajectory. The firm's consistent innovation in cybersecurity solutions and strategic expansions are expected to drive future growth, potentially enhancing stock value and affirming Cohen's investment decision.

This strategic acquisition by Steven Cohen (Trades, Portfolio) through Point72 not only highlights the firm's adeptness at identifying potential in the tech sector but also positions Rapid7 as a significant player to watch in the evolving cybersecurity landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance