Steering Clear Of CSC Financial For One Better Dividend Stock Option

Dividend-paying stocks often attract investors looking for a reliable source of income. However, the stability of these dividends is crucial, as fluctuations can indicate underlying financial issues. CSC Financial serves as a cautionary example, with its history of inconsistent dividend payments suggesting potential risks that could outweigh the benefits of its yield.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

CITIC Telecom International Holdings (SEHK:1883) | 9.62% | ★★★★★★ |

China Construction Bank (SEHK:939) | 7.34% | ★★★★★☆ |

Chongqing Rural Commercial Bank (SEHK:3618) | 7.83% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.86% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 8.33% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.58% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.17% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.23% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 9.11% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 8.05% | ★★★★★☆ |

Click here to see the full list of 88 stocks from our Top Dividend Stocks screener.

Here's a peek at one of the choices from the screener and one that may be safer to dodge.

Top Pick

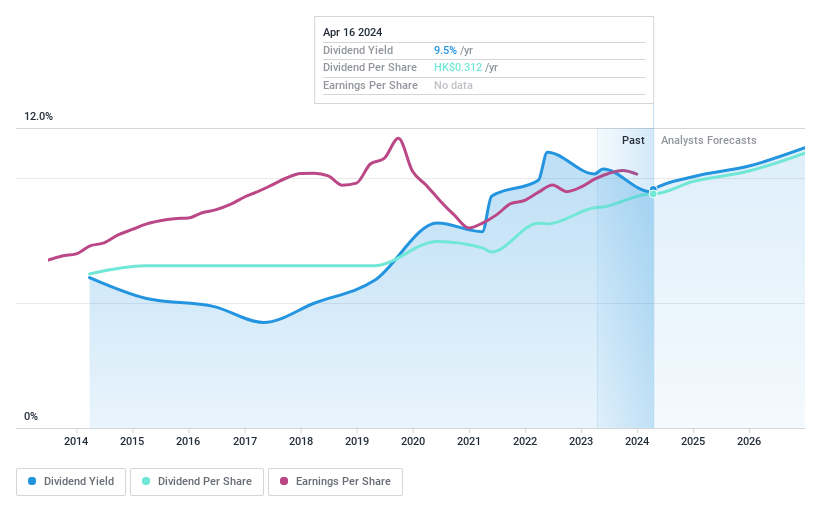

Chongqing Rural Commercial Bank

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chongqing Rural Commercial Bank Co., Ltd. provides banking services in the People's Republic of China and has a market capitalization of approximately HK$59.00 billion.

Operations: The bank's revenue is derived from various banking services provided across China.

Dividend Yield: 7.8%

Chongqing Rural Commercial Bank offers a stable and attractive dividend yield of 7.83%, slightly below the top-tier Hong Kong market dividends but still competitive. With a low payout ratio of 32.1%, its dividends are well-covered by earnings, ensuring reliability over the past decade without reductions. Recent increases in dividend payouts, such as the RMB 3.28 billion declared in May 2024, highlight its commitment to shareholder returns despite modest recent dips in quarterly earnings.

One To Reconsider

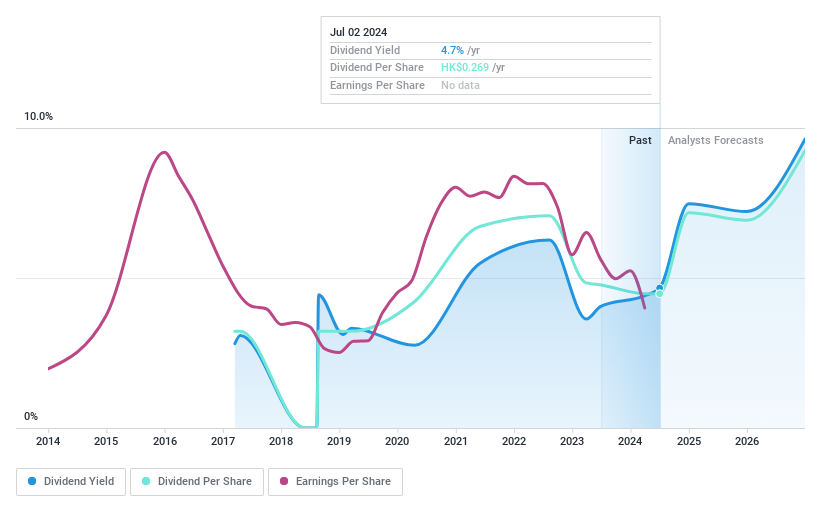

CSC Financial

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: CSC Financial Co., Ltd. operates globally, offering investment banking services through its subsidiaries, with a market capitalization of approximately HK$140 billion.

Operations: The firm generates revenue primarily from investment banking services, both domestically and internationally.

Dividend Yield: 4.7%

CSC Financial's recent dividend cut, from RMB 2.5 per 10 shares, signals instability in its dividend policy, contrasting sharply with the firm's historical volatility in payouts over its short 7-year dividend history. Despite trading at a significant undervaluation and forecasted earnings growth of 27.51%, the dividends are poorly supported by both earnings and free cash flow, indicating potential challenges in maintaining future payouts. This lack of financial coverage raises concerns about the sustainability and reliability of CSC Financial as a dividend stock.

Taking Advantage

Gain an insight into the universe of 88 Top Dividend Stocks by clicking here.

Shareholder in one of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:3618 and SEHK:6066.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance