Starbucks: The Quality Remains

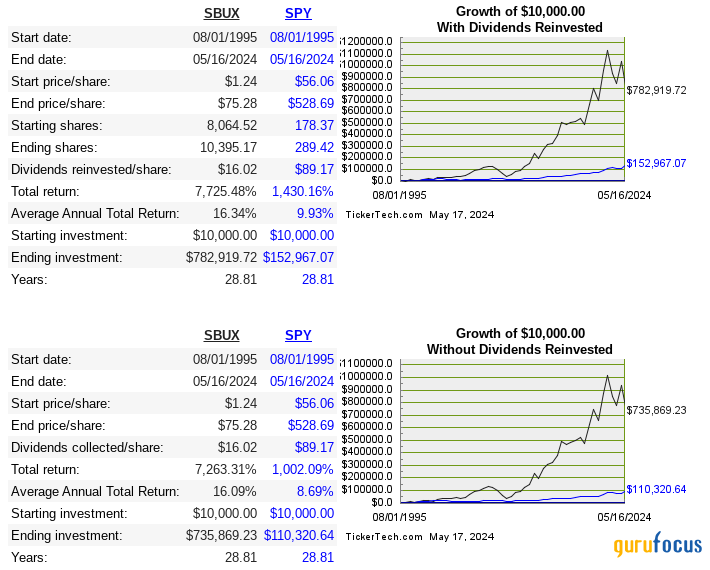

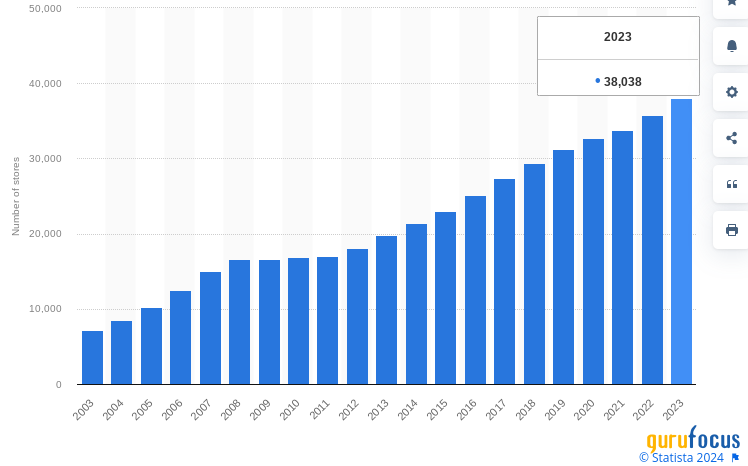

American coffee retailer Starbucks Corp.(NASDAQ:SBUX) is one of the most prominent of all blue-chip stocks and consumer brands. There are over 38,000 locations worldwide, both corporate owned and licensed. The stock has been one of the better performing of its generation.

Further, its store count since 2003 has risn exponentially.

There are not many comparable peers in the strictest sense to Starbucks as far as coffee goes, so I used other fast-food restaurants to compare, including McDonald's (MDC), Restaurant Brands (NYSE:QSR), Yum Brands (NYSE:YUM), Chipotle Mexican Grill (NYSE:CMG) and China's Luckin Coffee (LKNCY).

Company | Revenue 10-Year CAGR | Median 10-Year ROE | Median 10-Year ROIC | EPS 10-Year CAGR | FCF 10-Year CAGR |

SBUX | 9.2% | 14.6% | 31.1% | 80% | 7.6% |

MCD | -1% | -99% | 17.2% | 7.6% | 5.5% |

QSR | 19.9% | 13.6% | 3.5% | n/a | 14.9% |

YUM | -6% | -17.7% | 38.6% | 9% | 1.9% |

CMG | 11.9% | 22.7% | 12.7% | 15.5% | 14% |

LKNCY* | 95% | 10.8% | 7% | n/a | n/a |

Capital allocation

The licensing model has always played a part in why the return on invested capital has been so good. Of course, the majority of the stores are corporate, which still shows how good the returns are. Keep in mind that over half of earnings are regularly paid out as dividends, which shows reinvestment opportunities are increasingly limited. Beyond the business model is another important factor, so lets look at the capital allocation now:

Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

EBIT | 2,793 | 3,351 | 3,854 | 3,897 | 3,807 | 3,916 | 1,518 | 4,657 | 4,430 | 5,503 |

FCF | -553 | 2,445 | 3,258 | 2,732 | 9,961 | 3,240 | 114 | 4,519 | 2,556 | 3,675 |

CAPEX | 1,161 | 1,304 | 1,440 | 1,519 | 1,976 | 1,807 | 1,484 | 1,470 | 1,841 | 2,334 |

Acquisitions | -104 | 275 | -70 | -85 | 703 | -684 | -1,175 | -59 | ||

Dividends | 783 | 929 | 1,178 | 1,450 | 1,743 | 1,761 | 1,923 | 2,119 | 2,263 | 2,432 |

Repurchases | 619 | 1,244 | 1,835 | 1,892 | 6,980 | 9,812 | 1,400 | 3,911 | 817 | |

Debt Repayment | 610 | 400 | 350 | 968 | 1,896 | 1,037 | 1,254 | |||

Long Term Debt | 2,048 | 2,348 | 3,185 | 3,933 | 9,090 | 11,167 | 22,321 | 21,355 | 20,635 | 21,472 |

SBC | 183 | 210 | 218 | 176 | 250 | 308 | 249 | 319 | 272 | 303 |

We can see Starbucks has a fairly strong shareholder yield, but the debt levels have been on the rise. I do not have any serious issue with the way capital has been allocated, but I would prefer to see deleveraging, which can free up increased shareholder yield in the future. Returning capital to shareholders will continue to drive future returns more than ever.

Risk

The word moat is extremely overused in the investment world, but Starbucks is a classic wide-moat company. I would argue its moat stands upon the brand power. To picture a future where this brand gets dismantled takes an extreme imagination. Even to someone who is long-term bearish on the U.S. economy, but specifically the American consumer, they should be able to objectively see the strength of the brand, and the customer's dependency on the product. The power of the brand comes close to that of Apple Inc. (NASDAQ:AAPL) or Nike (NYSE:NKE). All three fall into the discretionary category, yet they survive and thrive no matter the economic environment.

In the long term, it is possible that consumer trends will shift away from coffee, and that could be a real secular risk eventually. While it is possible, I would also say it is not plausible or probable. If this shift really did take place, it would be a long and slow process. The company would have plenty of time to pivot.

The future earnings of Starbucks should be easier to estimate than any of the Magnificent Seven. It may not be growing like the hottest stock of the day, but the top-line growth is not bad at all for a company of its size.

The biggest risk overall is potentially paying too much, which we will cover below. When the stock is high quality like Starbucks is, the biggest risk usually comes in the form of paying too much, not being wrong about the business.

It has $2.70 billion in cash versus $15.50 billion in long-term debt. This is not enough debt to sink the company, but it is not ideal to have this much debt when you are also returning capital to shareholders at the same time.

I do not normally like my view on the current CEO to be a big factor into my thesis on the company, but I need to quickly comment on the C-suite situation. Founder and largest shareholder Howard Schultz stepped down as interim CEO last year, followed by stepping down as chairman of the board. While these actions would indicate he's not interested in running or directing the company anymore, he recently wrote a critical open letter after the earnings miss, advocating for experiences over transactions and optimizing mobile ordering, among other things. While I agree with his recommendations, I do not understand how he expects publishing an op-ed as an outsider will really enact change. He just had the chance to make major changes as the leader; why did not he do more to create the standards he wants to see now? I do not expect Schultz to return, and at this point no one can expect him to keep returning to steer the ship back on course every time the new captain veers off course. All I can say further is that I anticipate the current CEO being replaced within the next year, especially if there are contiually bad earnings beats.

I should also briefly add that Starbucks brings political drama with it, and many Americans feel that choosing to buy or not buy their products is a political statement. I do not take this view, and I try to not pick any stock based on politics. I look at Starbucks as a cash flowing business, not a cultural emblem. My valuation is an attempt to deal with future cash flows, not betting for or against the institution culturally.

Valuation

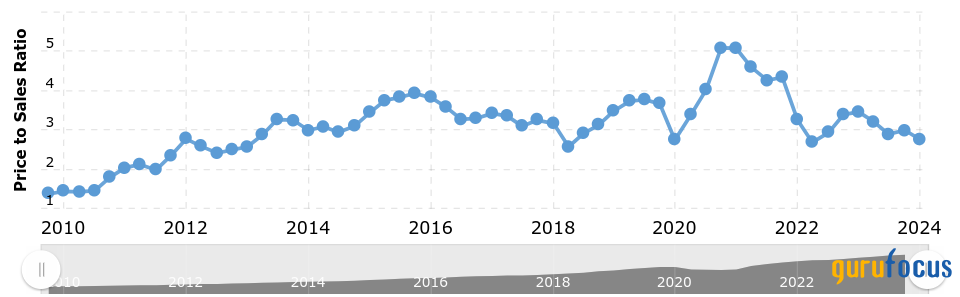

The big news of late is, of course, the terrible earnings miss. Let's zoom out just a little bit though. Shares hit an all-time high in July of 2021 and currently sit almost 40% below that record high.

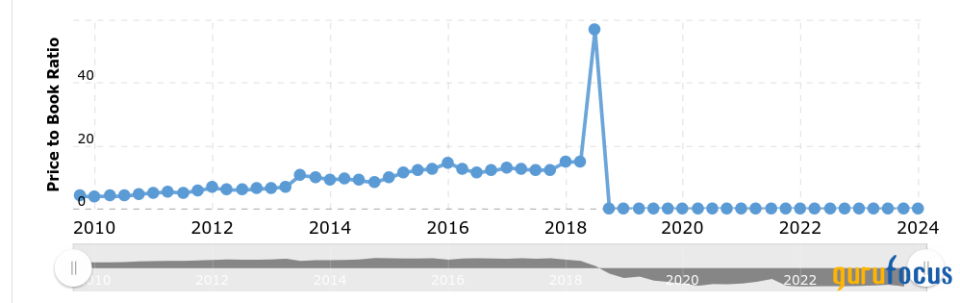

First we will look at some historical multiples, then compare the current with peers:

Company | EV/Sales | EV/EBITDA | EV/FCF | P/B | Div Yield |

SBUX | 2.5 | 12.9 | 21.2 | -9.6 | 3.1% |

MCD | 9 | 16.7 | 31.2 | 7.7 | 2.4% |

QSR | 6.3 | 19.1 | 36.9 | 6.9 | 3.1% |

YUM | 7.1 | 20.5 | 38.4 | -5.1 | 1.8% |

CMG | 8 | 40.4 | 64.6 | 26.2 | n/a |

LKNCY | 1.6 | 7.6 | 265.7 | 5.2 | n/a |

Historically, the multiples do look low, but against competitors there does not appear to be any real discount.

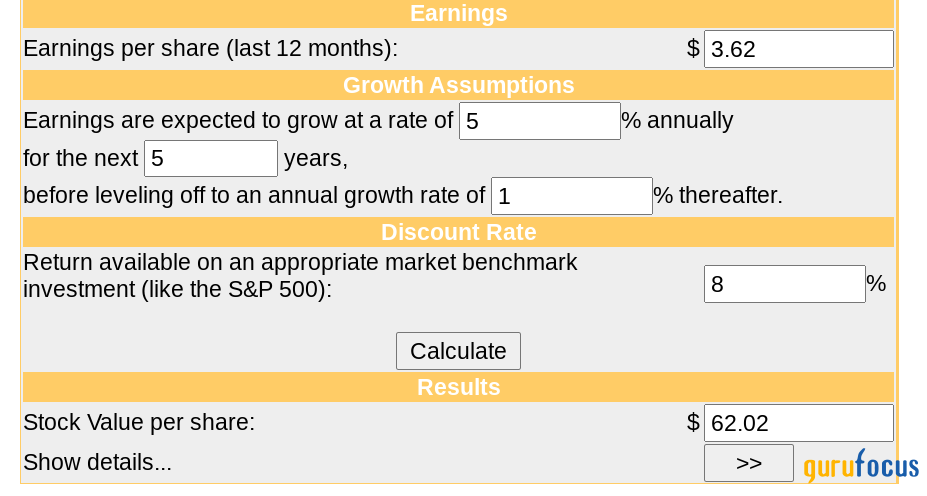

Next is the discounted cash flow model:

My earnings estimates are fairly conservative, but I am definitely bullish on the long-term earnings for the company. I do not see a secular decline, but clearly Starbucks is very mature at this stage.

I contend the quality of this business will endure throughout almost anything. If the gold and silver bugs are right and hyperinflation is inevitable and imminent, then consumers will spend their last hyperinflated dollars on their very last customized latte before then moving into a tiny camper in the woods.

The brand power does allow quite a bit of pricing power, but in an environment of high inflation, it will be hard for Starbucks to price its way out of the inflation rate. The gross margin has declined slightly over the past decade, but the pricing power is still there to an extent. Plenty of people are happy to pay a premium for a Starbucks coffee.

This is a more doomy scenario, though, assuming inflation stays much higher for much longer. I do not like to incorporate macro scenarios in my projections; I just want to focus on the quality of the business and determine when the price gets to a sensible level to buy. It is not hard to see Starbucks is a high-quality business with a legitimately wide moat. The price today is a bit much for me, but the company fits my qualifications of high quality, despite a bad quarter.

Conclusion

Starbucks meets the definition of a high-quality business with a legitimately wide moat. The chance of disruptive risk or market share loss is extremely low, while earnings growth is stable. Most growth will come internationally now, but shareholder yield will continue to be a focus.

The problem with most blue-chip stocks is they often get a premium attached to them when their growth levels are so low that it can barely beat gross domestic product growth. This is bit the case with Starbucks. It still has room to grow and is returning capital to shareholders at the same time. Unfortunately, the recent drop still is not enough for me to invest, even though I am bullish on the business itself in the very long run.

Regardless, do not let this recent bad quarter lead you to thinking the stock is inherently undervalued now. One bad miss does not mean the business should be taken out of the "high-quality" bucket.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance