Standard Motor Products Inc (SMP) Q1 2024 Earnings: Mixed Results Amidst Rising Costs

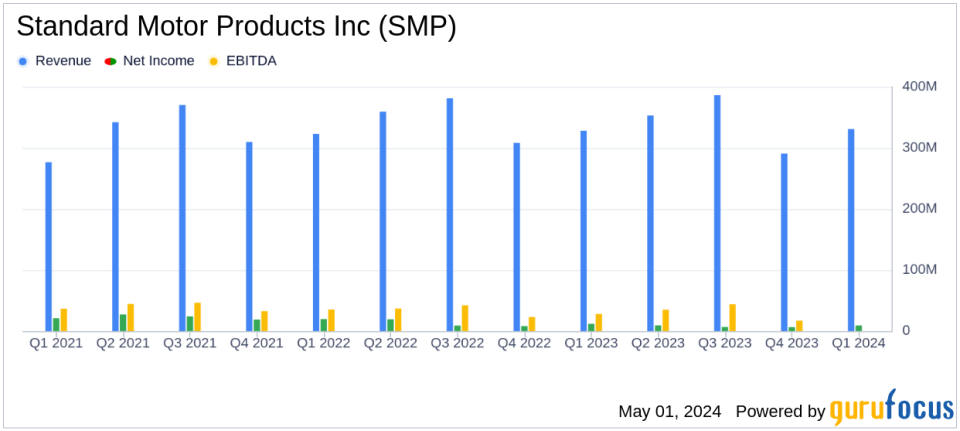

Revenue: Reported at $331.4 million for Q1 2024, up from $328.0 million in Q1 2023, slightly exceeding estimates of $321.84 million.

Earnings Per Share (EPS): Achieved $0.44 per diluted share from continuing operations, surpassing the estimated $0.37.

Net Income: From continuing operations was $9.9 million, exceeding the estimated $8.10 million.

Dividend: Announced a quarterly dividend of $0.29 per share, payable on June 3, 2024, to shareholders of record as of May 15, 2024.

Stock Repurchase: Purchased $2.6 million of common stock under the existing $30 million authorization during the quarter.

Segment Performance: Engineered Solutions sales rose by 4.5%, while Temperature Control sales slightly declined by 1.1% compared to the same quarter last year.

Adjusted EBITDA Margin: Reported at 6.9% for the quarter, down from 8.8% in the previous year, reflecting increased operational costs and inflationary pressures.

On May 1, 2024, Standard Motor Products Inc (NYSE:SMP), a prominent player in the automotive parts industry, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a slight increase in net sales to $331.4 million from $328.0 million in the same quarter the previous year. However, earnings from continuing operations experienced a decline, coming in at $9.9 million, or $0.44 per diluted share, compared to $12.7 million, or $0.57 per diluted share in Q1 2023.

Standard Motor Products Inc operates primarily in the United States, focusing on manufacturing and distributing automotive parts for engine management, ignition, emission, and fuel systems, as well as temperature-control products. The company serves both original equipment and aftermarket sectors, emphasizing high-quality, durable parts essential for vehicle maintenance and repair.

Performance Overview

Despite achieving a record top-line performance with a 1% increase in sales, SMP faced significant challenges due to rising costs across various inputs, which impacted profitability. The company's Adjusted EBITDA margin decreased to 6.9% from 8.8% in the previous year. This was partly due to $1.1 million in start-up costs for a new distribution center and increased factoring costs, alongside general inflation in SG&A expenses.

By segment, the Vehicle Control sales rose modestly by 0.5%, while Temperature Control sales saw a slight decline of 1.1%, attributed to the timing of pre-season orders. The Engineered Solutions segment, however, marked a notable growth of 4.5%, setting a new record for the quarter.

Strategic Developments and Shareholder Returns

Looking forward, SMP remains committed to its strategic initiatives, including the operational ramp-up of its new distribution center in Shawnee, KS, which is expected to enhance capacity and efficiency for future growth. The company also continues its shareholder-friendly activities, declaring a quarterly dividend of $0.29 per share and repurchasing $2.6 million of its common stock under the existing authorization.

Financial Health and Future Outlook

Standard Motor Products reaffirmed its full-year 2024 outlook, expecting flat to low single-digit sales growth and an Adjusted EBITDA margin between 9.0% and 9.5%. The company anticipates approximately $25 million in capital expenditures for the new facility and foresees continued cost pressures, although these are expected to be offset by the long-term benefits of its strategic investments and operational improvements.

CEO Eric Sills expressed optimism about the future, citing favorable market trends in the automotive aftermarket, driven by an aging vehicle population and high costs of new vehicles, which are likely to bolster demand for SMP's products.

Investor Communication

SMP has scheduled a conference call on May 1, 2024, to discuss the quarterly results and provide more insights into its operations and strategies. This will be accessible via webcast on the company's investor relations page.

In conclusion, while Standard Motor Products faces near-term challenges, its strategic initiatives and market positioning underscore a commitment to sustaining growth and shareholder value in the evolving automotive parts landscape.

Explore the complete 8-K earnings release (here) from Standard Motor Products Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance