Spotlight On High Insider Ownership Growth Companies In China May 2024

As of May 2024, China's market landscape shows promising signs of recovery, buoyed by strong holiday spending and positive trade data. This context provides a fertile ground for exploring growth companies with high insider ownership, which often signals confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

YanKer shop FoodLtd (SZSE:002847) | 29.2% | 23.9% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 25.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Anhui Huaheng Biotechnology (SHSE:688639) | 28.3% | 28.5% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.7% | 43.1% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 69.2% |

Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

We'll examine a selection from our screener results.

Fujian Aonong Biological Technology Group Incorporation

Simply Wall St Growth Rating: ★★★★★☆

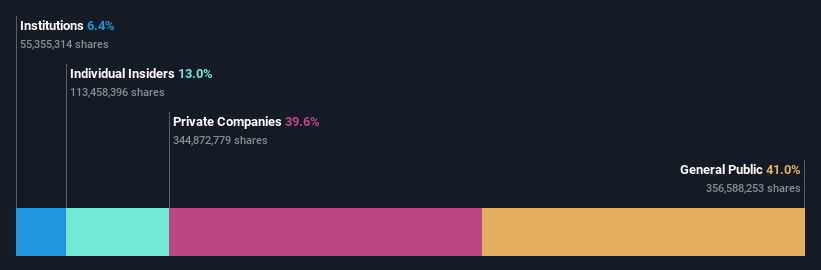

Overview: Fujian Aonong Biological Technology Group Incorporation operates in multiple sectors including feed production, pig raising, food processing, supply chain services, agricultural internet platforms, and bio-pharmaceuticals across China and internationally, with a market capitalization of approximately CN¥3.56 billion.

Operations: The company generates revenue through diverse segments including feed production, pig raising, food processing, supply chain services, agricultural internet platforms, and bio-pharmaceuticals.

Insider Ownership: 13%

Revenue Growth Forecast: 34.4% p.a.

Fujian Aonong Biological Technology Group Incorporation, a growth company with high insider ownership in China, is trading at 90.2% below its estimated fair value, presenting a potentially attractive valuation relative to peers. Despite recent challenges, including being dropped from the S&P Global BMI Index and reporting significant losses for FY 2023 and Q1 2024, the company's revenue growth forecast of 34.4% per year outpaces the Chinese market average. This robust projected revenue increase coupled with an anticipated transition to profitability within three years underscores potential for recovery and growth.

Harbin Jiuzhou GroupLtd

Simply Wall St Growth Rating: ★★★★★☆

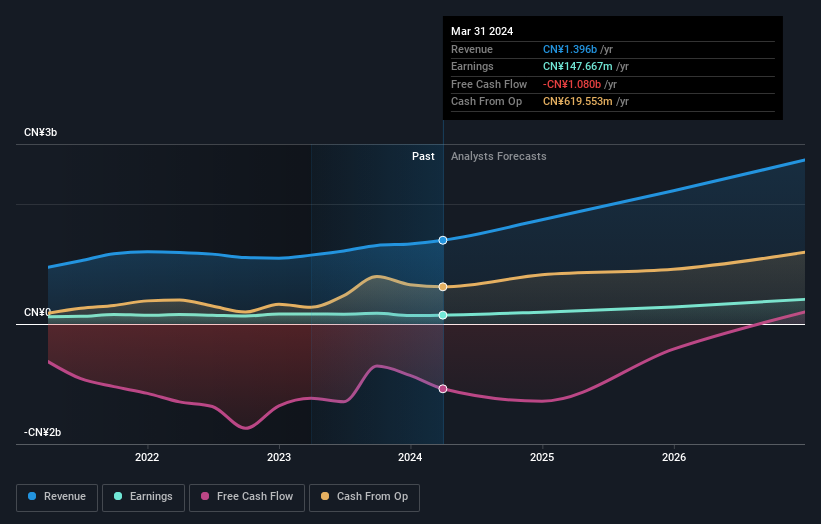

Overview: Harbin Jiuzhou Group Co., Ltd. is a company engaged in manufacturing and supplying electrical equipment and energy efficiency management solutions, both domestically and internationally, with a market capitalization of approximately CN¥3.33 billion.

Operations: The company generates its revenue through the manufacture and supply of electrical equipment and energy efficiency management solutions.

Insider Ownership: 29.0%

Revenue Growth Forecast: 32.5% p.a.

Harbin Jiuzhou Group Ltd., a Chinese growth company with high insider ownership, is experiencing mixed financial performance. Despite a recent decline in net income and earnings per share as reported in its Q1 2024 results, the company is positioned for significant future growth with earnings expected to increase by 63.8% annually. However, it faces challenges such as high debt levels and unstable dividends. Additionally, its revenue growth forecast of 32.5% per year surpasses the market average, indicating potential despite current profitability concerns.

Guangdong Aofei Data Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Aofei Data Technology Co., Ltd. is a company specializing in data technology services with a market capitalization of approximately CN¥11.54 billion.

Operations: The firm operates primarily in the data technology services sector.

Insider Ownership: 10.2%

Revenue Growth Forecast: 20.7% p.a.

Guangdong Aofei Data Technology is poised for robust growth, with earnings and revenue forecasted to outpace the Chinese market significantly. Despite a highly volatile share price and financial results impacted by large one-off items, the company's aggressive growth strategy is evident from its recent earnings report showing substantial year-over-year increases in sales and net income. However, concerns remain about its ability to cover interest payments effectively, reflecting potential risks in financial stability.

Key Takeaways

Discover the full array of 407 Fast Growing Chinese Companies With High Insider Ownership right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603363 SZSE:300040 and SZSE:300738.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance