Société BIC And 2 Other Prominent Dividend Stocks On Euronext Paris

Amidst a backdrop of cautious optimism in European markets, where recent ECB rate cuts have stirred mixed reactions about future economic directions, investors may find stability and potential income through dividend stocks. Given the current climate of fluctuating market signals and interest rates, companies like Société BIC that offer regular dividends could be appealing for those seeking to balance their portfolios with steady returns.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 6.10% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.60% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.32% | ★★★★★★ |

Fleury Michon (ENXTPA:ALFLE) | 5.35% | ★★★★★☆ |

Métropole Télévision (ENXTPA:MMT) | 9.27% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 3.77% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.93% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.17% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.09% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.35% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Euronext Paris Dividend Stocks screener.

We'll examine a selection from our screener results.

Société BIC

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Société BIC SA is a global manufacturer and distributor of stationery, lighters, shavers, and other products, with a market capitalization of approximately €2.91 billion.

Operations: Société BIC SA generates revenue primarily through three segments: Blade Excellence - Razors at €544.80 million, Flame for Life - Lighters at €830.60 million, and Human Expression - Stationery at €842.30 million.

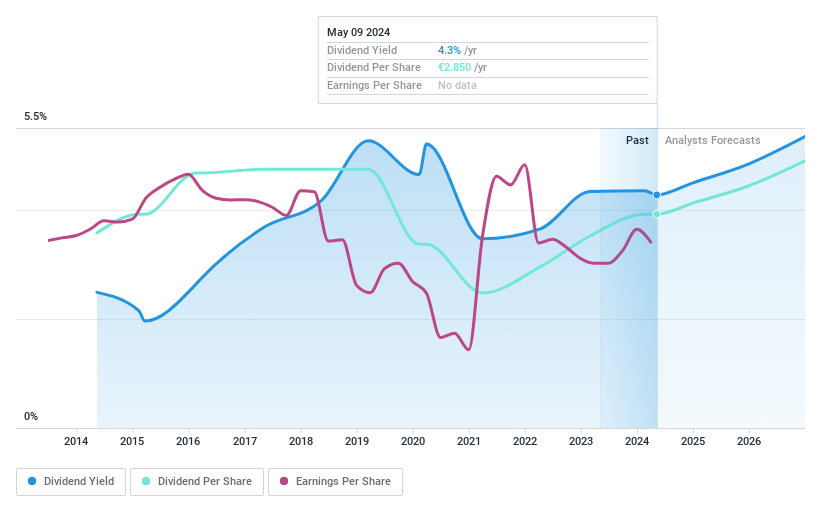

Dividend Yield: 4.3%

Société BIC has demonstrated a mixed performance in terms of dividend reliability, with a history of volatility over the past decade, including annual drops exceeding 20%. However, recent developments indicate a positive shift; at its 2024 Annual General Meeting, BIC increased its ordinary dividend to €2.85 per share, an 11% rise from the previous year and also announced an extraordinary dividend of €1.42 per share. Despite these increases, BIC’s current yield remains below the top quartile for French dividend stocks. The dividends are supported by earnings and cash flows with payout ratios at 57.5% and 47.7%, respectively, suggesting sustainability under current conditions.

Unlock comprehensive insights into our analysis of Société BIC stock in this dividend report.

Our valuation report here indicates Société BIC may be undervalued.

Carrefour

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carrefour SA operates a diverse network of food and non-food retail stores across Europe, Latin America, the Middle East, Africa, and Asia with a market capitalization of €10.07 billion.

Operations: Carrefour SA generates €39.02 billion in revenue from its French operations, €22.54 billion from Latin America, and €24.27 billion from other European countries excluding France.

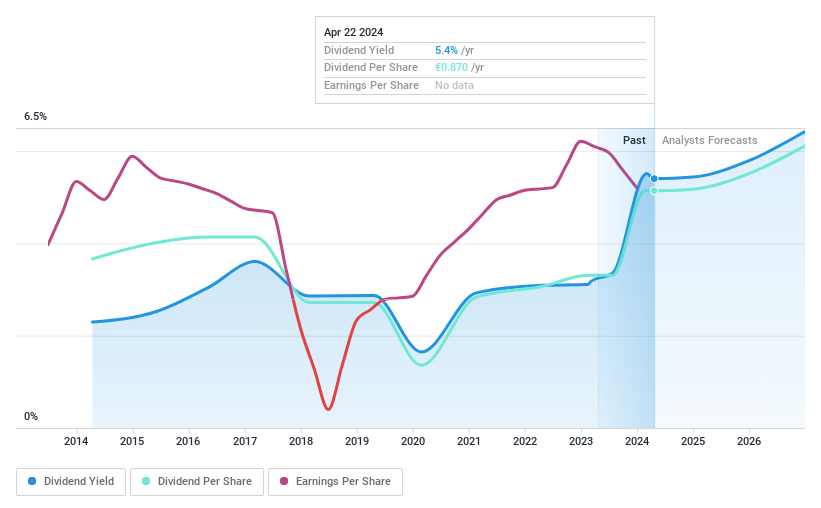

Dividend Yield: 6%

Carrefour SA, while offering a dividend yield of 5.96%, above the French market average of 5.24%, exhibits mixed signals regarding its dividend sustainability and growth. Despite a reasonable payout ratio of 66.8% and cash payout ratio at 21.1%, indicating coverage by earnings and cash flows, the company's dividends have shown volatility over the past decade. Additionally, Carrefour trades at a significant discount to estimated fair value but carries high debt levels and has seen declining net profit margins from last year's 1.7% to this year's 1.1%.

Wendel

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wendel is a private equity firm focused on middle-market and later-stage equity financing through leveraged buyouts and acquisitions, with a market capitalization of approximately €3.83 billion.

Operations: Wendel's revenue is generated through various segments, with Bureau Veritas leading at €5.87 billion, followed by Stahl at €0.91 billion, and smaller contributions from CPI (€0.13 billion), Scalian (€0.13 billion), and ACAMS (€0.09 billion).

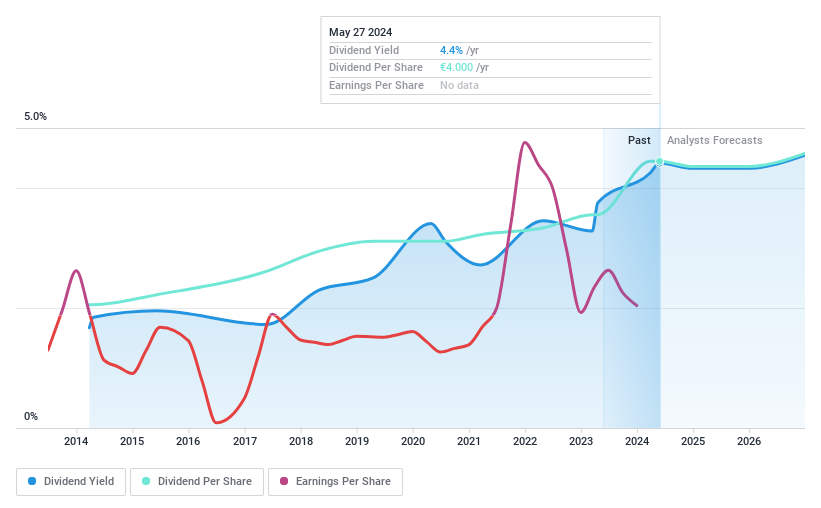

Dividend Yield: 4.5%

Wendel's dividend yield of €4.00 per share in 2023, up 25% from the previous year, reflects a commitment to increasing shareholder returns despite challenges. The company's dividends have shown stability over the past decade but are currently not well covered by earnings, with a high payout ratio of 301.9%. Additionally, while Wendel trades below its estimated fair value by 29.2%, its high debt levels and an earnings growth forecast of 18.95% per year suggest potential financial stress affecting future dividend sustainability.

Click to explore a detailed breakdown of our findings in Wendel's dividend report.

Our expertly prepared valuation report Wendel implies its share price may be lower than expected.

Turning Ideas Into Actions

Unlock our comprehensive list of 33 Top Euronext Paris Dividend Stocks by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:BBENXTPA:CA and ENXTPA:MF

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance