SiTime Corp (SITM) Q1 2024 Earnings: Significant Miss on Analyst Expectations Amidst Revenue Decline

Revenue: Reported at $33.0 million, a decrease of 22% from the previous quarter's $42.4 million, falling short of estimates of $36.48 million.

Net Loss: Recorded at $28.7 million, significantly above the estimated net loss of $0.92 million.

Earnings Per Share (EPS): Reported a net loss per diluted share of $1.26, well above the estimated EPS of -$0.04.

Gross Margin: GAAP gross margin was 53.5% of revenue, while non-GAAP gross margin was slightly higher at 57.9%.

Operating Expenses: Total GAAP operating expenses were $52.7 million, with significant contributions from research and development and selling, general, and administrative expenses.

Cash Reserves: Total cash, cash equivalents, and short-term investments stood at $517.3 million as of March 31, 2024.

Stock-Based Compensation: Included in non-GAAP adjustments, impacting the net loss figures and operating expenses.

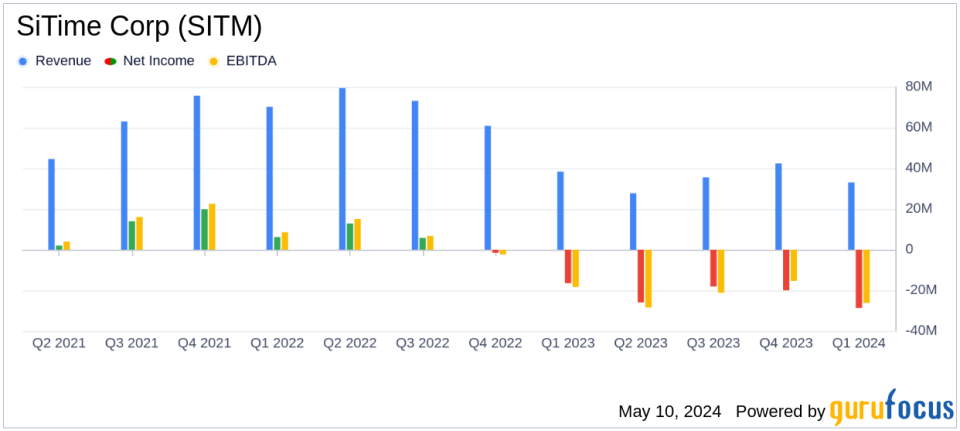

On May 8, 2024, SiTime Corp (NASDAQ:SITM) released its financial results for the first quarter ended March 31, 2024, through an 8-K filing. The company, a leading provider of precision timing chips, reported a net revenue of $33.0 million, marking a 22% decrease from the previous quarter's $42.4 million. This performance fell short of the analyst's revenue estimate of $36.48 million, highlighting significant challenges in the quarter.

Financial Performance Overview

SiTime's financial health saw a downturn this quarter with a GAAP net loss of $28.7 million, or $1.26 per diluted share, a substantial increase from the previous quarter's net loss of $19.997 million. This loss significantly deviated from the estimated earnings per share of -$0.04, underscoring deeper operational challenges. The non-GAAP figures also painted a grim picture, with a net loss of $1.9 million, or $0.08 per diluted share, compared to a net income of $5.54 million in the prior quarter.

The company's gross margin on a GAAP basis was 53.5% of revenue, while non-GAAP gross margin stood slightly better at 57.9%. Despite these margins, operating expenses on a GAAP basis soared to $52.7 million, with research and development, as well as selling, general and administrative expenses, showing notable increases.

Strategic Moves and Market Position

CEO Rajesh Vashist highlighted the expansion of SiTime's product portfolio, including the introduction of Chorus clock generators, as a strategic move to position the company for recovery and growth in subsequent quarters. The company's focus remains on key electronics markets such as data centers, AI, and industrial sectors.

SiTime's balance sheet remains robust with total cash, cash equivalents, and short-term investments of $517.3 million as of March 31, 2024. This financial cushion supports the company's strategic initiatives and provides resilience against ongoing market volatility.

Operational and Market Challenges

The significant revenue decline and increased losses highlight operational inefficiencies and perhaps an underestimation of market challenges. The competitive landscape in the semiconductor industry, coupled with macroeconomic pressures, might have contributed to the underwhelming performance this quarter.

In conclusion, SiTime's Q1 2024 results have shown a notable deviation from expected financial health, with significant impacts on both revenue and profitability. The company's strategic initiatives and strong balance sheet provide a foundation for potential recovery, but addressing the operational challenges will be crucial for turning around performance in upcoming quarters.

For more detailed financial analysis and future updates on SiTime Corp (NASDAQ:SITM), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from SiTime Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance