Sit-Down Dining Q1 Earnings: BJ's (NASDAQ:BJRI) Simply the Best

Let's dig into the relative performance of BJ's (NASDAQ:BJRI) and its peers as we unravel the now-completed Q1 sit-down dining earnings season.

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

The 14 sit-down dining stocks we track reported an ok Q1; on average, revenues missed analyst consensus estimates by 0.9%. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and sit-down dining stocks have held roughly steady amidst all this, with share prices up 2.3% on average since the previous earnings results.

Best Q1: BJ's (NASDAQ:BJRI)

Founded in 1978 in California, BJ’s Restaurants (NASDAQ:BJRI) is a chain of restaurants whose menu features classic American dishes, often with a twist.

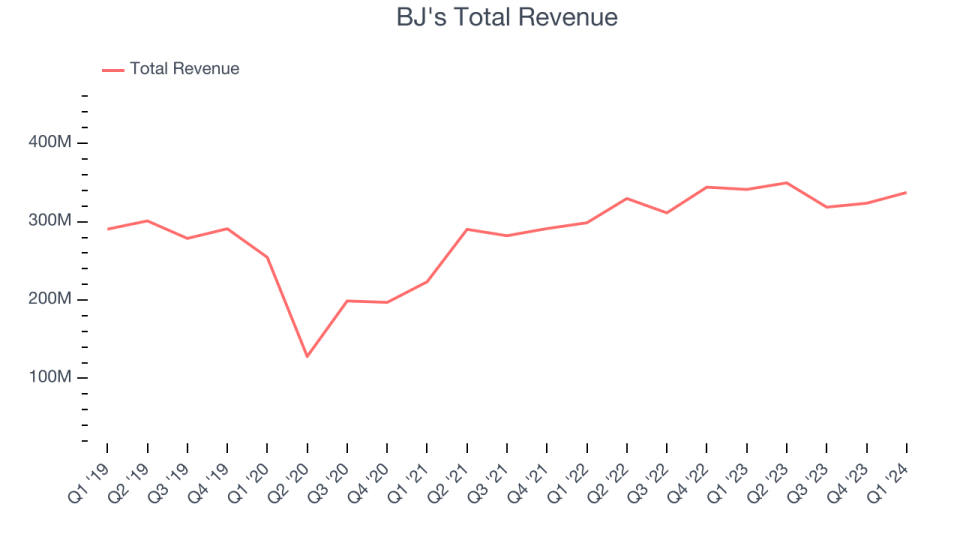

BJ's reported revenues of $337.3 million, down 1.2% year on year, in line with analysts' expectations. It was an exceptional quarter for the company, with an impressive beat of analysts' earnings estimates.

“Our strong first quarter results demonstrate the momentum building in our business from our growth and productivity initiatives, especially when considering the extent of weather impacts early in the quarter,” commented Greg Levin, Chief Executive Officer and President.

The stock is up 6.7% since the results and currently trades at $34.92.

Is now the time to buy BJ's? Access our full analysis of the earnings results here, it's free.

Cracker Barrel (NASDAQ:CBRL)

Known for its country-themed food and merchandise, Cracker Barrel (NASDAQ:CBRL) is a beloved American restaurant and retail chain that celebrates the warmth and charm of Southern hospitality.

Cracker Barrel reported revenues of $817.1 million, down 1.9% year on year, falling short of analysts' expectations by 0.4%. It was a very strong quarter for the company, with a solid beat of analysts' earnings estimates.

The stock is up 12.6% since the results and currently trades at $51.03.

Is now the time to buy Cracker Barrel? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Dine Brands (NYSE:DIN)

Operating a franchise model, Dine Brands (NYSE:DIN) is a casual restaurant chain that owns the Applebee’s and IHOP banners.

Dine Brands reported revenues of $206.2 million, down 3.5% year on year, falling short of analysts' expectations by 2%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

The stock is down 12% since the results and currently trades at $38.41.

Read our full analysis of Dine Brands's results here.

Chuy's (NASDAQ:CHUY)

Known for its ‘Big As Yo' Face’ burritos, Chuy’s (NASDAQ:CHUY) is a casual restaurant chain that specializes in Tex-Mex fare, which combines elements of traditional Mexican cuisine with Southern American cooking.

Chuy's reported revenues of $110.5 million, down 1.8% year on year, falling short of analysts' expectations by 1.1%. It was a solid quarter for the company, with a decent beat of analysts' earnings estimates.

The stock is down 14.9% since the results and currently trades at $25.35.

Read our full, actionable report on Chuy's here, it's free.

Red Robin (NASDAQ:RRGB)

Known for its bottomless steak fries, Red Robin (NASDAQ:RRGB) is a chain of casual restaurants specializing in burgers and general American fare.

Red Robin reported revenues of $388.5 million, down 7% year on year, falling short of analysts' expectations by 1.1%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

Red Robin had the slowest revenue growth among its peers. The stock is up 26% since the results and currently trades at $8.52.

Read our full, actionable report on Red Robin here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance