Simulations Plus (SLP) Launches GPX to Advance PBPK Modeling

Simulations Plus SLP announced the launch of GastroPlus X (GPX), which is its latest platform for physiologically based pharmacokinetics and biopharmaceutics (PBPK/PBBM) modeling and simulation.

The company further added that GPX integrates advanced scientific models, refined algorithms, and machine learning technology to offer a revamped user experience with an intuitive interface, streamlined workflows, and faster processing speeds.

The intuitive design and efficient workflows assist new users, boost productivity for experienced modelers, and improve communication with health authorities. It also features realistic polypharmacy simulations. GPX is positioned to support regulatory interactions, especially after the FDA's new Quantitative Medicine Center of Excellence.

Simulations Plus, Inc. Price and Consensus

Simulations Plus, Inc. price-consensus-chart | Simulations Plus, Inc. Quote

GPX is capable of handling tasks including early discovery high-throughput PK simulations, drug-drug interactions and population predictions. It consolidates these functions into one platform, which significantly reduces time spent on model setup, data management, and reformatting results.

SLP is a leading-edge developer of simulation software for pharmaceutical, chemical and biotechnology companies across the globe. The simulation software is used for drug discovery, development, research and regulatory submissions.

In the second quarter, SLP reported revenues of $18.3 million, increasing 16% year over year. The top line, which also beat the Zacks Consensus Estimate of $17 million, registered healthy growth owing to higher software revenues in the Clinical Pharmacology & Pharmacometrics and Cheminformatics business units.

Growth in services revenues was driven by increasing sales from Quantitative Systems Pharmacology (QSP) and PBPK business units. QSP reported 78% year-over-year revenue growth in the second quarter. QSP unit is gaining from increasing immunology and cancer model projects.

For fiscal 2024, Simulations Plus continues to expect revenues between $66 million and $69 million. This suggests an increase of 10-15% compared with fiscal 2023 revenues.

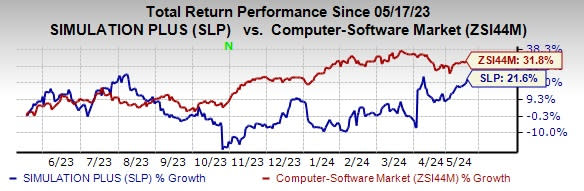

Currently, Simulations Plus carries a Zacks Rank #3 (Hold). Shares of the company have gained 21.6% compared with the industry’s growth of 31.8%

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Woodward WWD, Arista Networks ANET and Super Micro Computer SMCI. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Woodward’s fiscal 2024 earnings per share (EPS) has moved up 9.3% in the past 60 days to $5.76. WWD’s long-term earnings growth rate is 16.3%.

Woodward’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 26.1%. WWD shares have risen 62% in the past year.

The Zacks Consensus Estimate for ANET’s 2024 EPS has increased 0.9% in the past 60 days to $7.53. ANET’s long-term earnings growth rate is 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average earnings surprise of 13.3%. Shares of ANET have gained 127.3% in the past year.

The Zacks Consensus Estimate for Super Micro Computer’s fiscal 2024 EPS has improved 8.3% in the past 60 days to $23.51. SMCI’s long-term earnings growth rate is 52.3%.

SMCI’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 6.9%. Shares of SMCI have risen 481% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simulations Plus, Inc. (SLP) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance