Scotts (SMG) Lowers FY24 EBITDA Guidance, Affirms FCF View

The Scotts Miracle-Gro Company SMG updated its guidance for the fiscal 2024 based on financial results through the end of May, which is considered the peak of its third-quarter lawn and garden season. Despite failing to meet its operating targets for sales and adjusted EBITDA during this period, SMG expects to deliver year-over-year growth in non-GAAP EBITDA and U.S. Consumer segment sales for the fiscal year.

The company projects non-GAAP adjusted EBITDA for the fiscal 2024 to range between $530 million and $540 million. Even though this is lower than the earlier guidance of $575 million for non-GAAP adjusted EBITDA, the revised projection reflects an approximate 20% year-over-year improvement.

Scotts Miracle-Gro also expects non-GAAP gross margin expansion of at least 250 basis points for the fiscal 2024. For the Hawthorne segment, the company maintains its guidance that non-GAAP adjusted EBITDA will be break-even or higher by the end of the year.

The U.S. Consumer segment sales are expected to grow 5-7%, revised from the high single-digit sales growth projected earlier.

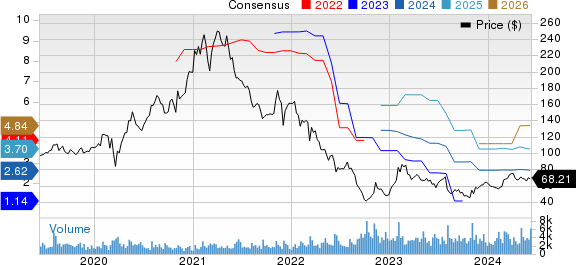

The Scotts Miracle-Gro Company Price and Consensus

The Scotts Miracle-Gro Company price-consensus-chart | The Scotts Miracle-Gro Company Quote

The company stated that it is on track to achieve its free cash flow target of $560 million in fiscal 2024. With this performance, the company expects to fulfill its overall target of attaining a total free cash flow of $1 billion in the fiscal 2023 and fiscal 2024.

SMG aims to meet or exceed the target of lowering debt by $350 million and to exit the year with leverage below five times. Backed by efforts to control expenses and improve free cash flow, Scotts Miracle-Gro remains on track to achieve this goal. It continues to invest in its brands, marketing and other value drivers. The company focuses on improving its financial flexibility to ensure it has the proper resources to manage point of sale and retailer replenishment through the summer and fall.

The Project Springboard cost-saving initiative is expected to deliver run-rate annualized savings of at least $300 million by the end of the fiscal 2024, along with incremental investments in media and innovation.

Scotts Miracle-Gro’s concerted efforts to tightly manage costs while improving operational efficiency and strengthening its balance sheet poise it well for growth.

Scotts Miracle-Gro’s shares have gained 7.8% in the past year against a 13% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Scotts Miracle-Gro currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS, Agnico Eagle Mines Limited AEM and Ecolab Inc. ECL. While CRS sports a Zacks Rank #1 (Strong Buy), ATI and ECL carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CRS’s current-year earnings is pegged at $4.31, indicating a year-over-year rise of 278%. CRS’ earnings beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company’s shares have soared 102.5% in the past year.

The Zacks Consensus Estimate for AEM's current-year earnings is pegged at $3.2, indicating a year-over-year rise of 43.5%. AEM’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the earnings surprise being 16.5%, on average. The stock has appreciated 25.4% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59, indicating a year-over-year rise of 26.5%. ECL beat the consensus estimate in each of the last four quarters, with the earnings surprise being 1.3%, on average. The stock has rallied nearly 33.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

The Scotts Miracle-Gro Company (SMG) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance