Sandstorm Gold's (SAND) Royalties Gives Updates on Assets

Sandstorm Gold Ltd. SAND announced updates on various developments of its diversified royalty portfolio.

First Gold Pour at Greenstone Mine

Sandstorm has a gold stream at the Greenstone mine, which is located in Ontario, Canada, and is fully owned by Equinox Gold Corp. EQX. Per the streaming agreement, SAND can buy 2.375% of the gold produced until 120,333 ounces are delivered, after which it can buy 1.583% of the gold produced.

EQX announced that the first gold pour was achieved at the Greenstone mine on schedule, producing 1,800 ounces of gold from the full recovery circuit. Greenstone has been designed to be one of the world's low-cost open-pit gold mines.

Upbeat Outlook for Woodlawn Copper-Zinc Mine

Woodlawn copper-zinc mine’s operator, Develop Global Limited, announced the results of a Production Restart Study (“PRS”). The PRS provides a pre-tax net present value of A$658 (U.S. $437) million, a 37% increase over the prior provided estimate.

Backed by the financial and operational parameters indicated in the PRS, Develop Global has decided to begin evaluating finance options, which may include selling a minority stake in Woodlawn. According to the mining plan, Woodlawn will produce an average of 12,000 tons of copper and 36,000 tons of zinc in payable metal each year. Woodlawn is estimated to produce 80,000 tons of copper and 218,000 tons of zinc in payable metal over the mine's life.

Sandstorm holds a silver stream on the Woodlawn project, which allows it to purchase an amount of silver equal to 80% of payable silver produced, up to a maximum value of A$27 million ($18 million). Furthermore, SAND owns a second stream at the Woodlawn mine, under which the operator has promised to pay Sandstorm A$1 million ($0.7 million) for each 1 metric tonsof tailings ore processed at Woodlawn, up to a total ceiling of A$10 million ($6.7 million).

Phoenix JV Drilling Program on Target

Bonterra Resources Inc. and Osisko Mining Inc. are part of a definitive earn-in and joint venture agreement called Phoenix JV (formerly known as the Urban-Barry Property). Sandstorm holds a net smelter returns royalty (NSR) of 0.5-3.9% on areas of the Urban-Barry property, which includes both Barry and Moss deposits. Sandstorm also owns a 1% NSR royalty on the adjacent Gladiator (West Arena) gold deposit.

According to the JV agreement, Osisko can acquire up to a 70% stake in the Phoenix JV by paying C$30 million ($22 million) in work expenditure over three years.

Osisko intends to drill more than 35,000 meters on the project by 2024, with around 20,000 meters already drilled as of Apr 15, 2024.

Update on Exploration Program at Houndé Gold Mine

The operator of the Houndé gold mine, Endeavour Mining Corporation, provided an update to its 2024 exploration program at the mine. The initiative focuses on identifying targets at depth in the Kari Area and Vindaloo Deeps, and on adding resources to existing deposits.

Endeavour spent $2.3 million in the first quarter of 2024 on a proposed $7-million exploration program that included 5,328 meters of drilling across 25 drill holes. Additional drilling is also planned for the Koho East and Vindaloo South East deposits to enhance resource classification. Sterilization drilling is scheduled to continue, confirming proposed footprints for later site facilities.

Sandstorm purchased a 2.0% NSR royalty on the Houndé mine in 2017, which includes the Vindaloo, Kari West and Kari Center deposits, as well as the Koho East target.

Updated Reserve Estimates at Fruta del Norte Gold Mine

Ecuador’s Fruta del Norte gold mine has Proven and Probable Reserves of 21.70 metric tons with an average grade of 7.89 g/t containing 5.50 Moz of gold. The operator, Lundin Gold Inc., announced Measured and indicated inclusive resources of 23.53 metric tons with an average grade of 9.24 g/t and a gold content of 6.99 Moz based on a 3.4 g/t gold cut-off.

Sandstorm Gold reported a loss per share of 1 cent in the first quarter of 2024, missing the Zacks Consensus Estimate of earnings of 1 cent. The company posted earnings per share of 5 cents in the year-ago quarter. Sandstorm Gold’s total revenues amounted to $43 million, in line with the Zacks Consensus Estimate. The top line decreased 2.3% year over year.

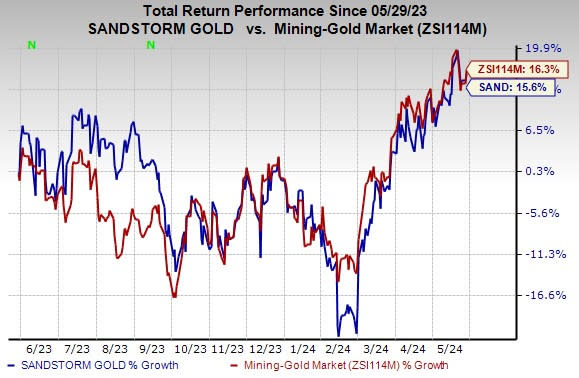

Price Performance

Shares of the company have gained 15.6% in the past year compared with the industry’s growth of 16.3%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Sandstorm Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS and ATI Inc. ATI. CRS sports a Zacks Rank #1 (Strong Buy) at present and ATI has a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $4.18 per share. The consensus estimate for 2024 earnings has moved 6% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 15.1%. CRS shares have gained 134.9% in a year.

The Zacks Consensus Estimate for ATI’s 2024 earnings is pegged at $2.41 per share. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised 3% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 8.3%. The company’s shares have rallied 65.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Sandstorm Gold Ltd (SAND) : Free Stock Analysis Report

Equinox Gold Corp. (EQX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance