Salesforce (NYSE:CRM) Reports Q1 In Line With Expectations But Stock Drops 11%

Customer relationship management software maker Salesforce (NYSE:CRM) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 10.7% year on year to $9.13 billion. On the other hand, next quarter's revenue guidance of $9.23 billion was less impressive, coming in 1.2% below analysts' estimates. It made a non-GAAP profit of $2.44 per share, improving from its profit of $1.69 per share in the same quarter last year.

Is now the time to buy Salesforce? Find out in our full research report.

Salesforce (CRM) Q1 CY2024 Highlights:

Revenue: $9.13 billion vs analyst estimates of $9.15 billion (small miss)

EPS (non-GAAP): $2.44 vs analyst estimates of $2.38 (2.7% beat)

Revenue Guidance for Q2 CY2024 is $9.23 billion at the midpoint, below analyst estimates of $9.34 billion

The company reconfirmed its revenue guidance for the full year of $37.85 billion at the midpoint, but LOWERED full year subscription revenue guidance

Gross Margin (GAAP): 76.3%, up from 74.2% in the same quarter last year

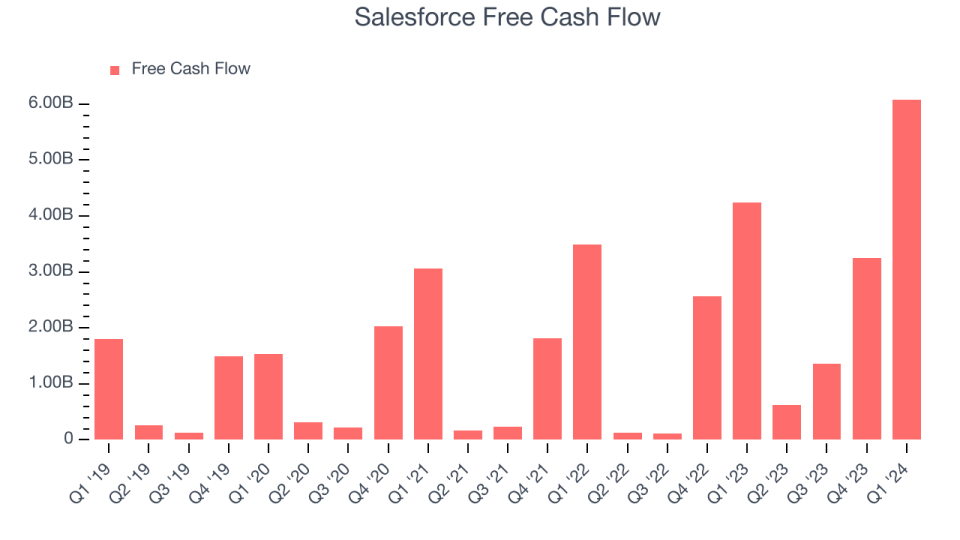

Free Cash Flow of $6.08 billion, up 86.9% from the previous quarter

Billings: $6.18 billion at quarter end, up 3.1% year on year (6.0% miss)

Market Capitalization: $261.7 billion

“Our profitable growth trajectory continues to drive strong cash flow generation. Q1 operating cash flow was $6.25 billion, up 39% year-over-year. Q1 free cash flow was $6.1 billion, up 43% year-over-year,” said Marc Benioff, Chair and CEO, Salesforce.

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce (NYSE:CRM) is a software-as-a-service platform that helps companies access, manage, and share sales information.

Sales Software

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

Sales Growth

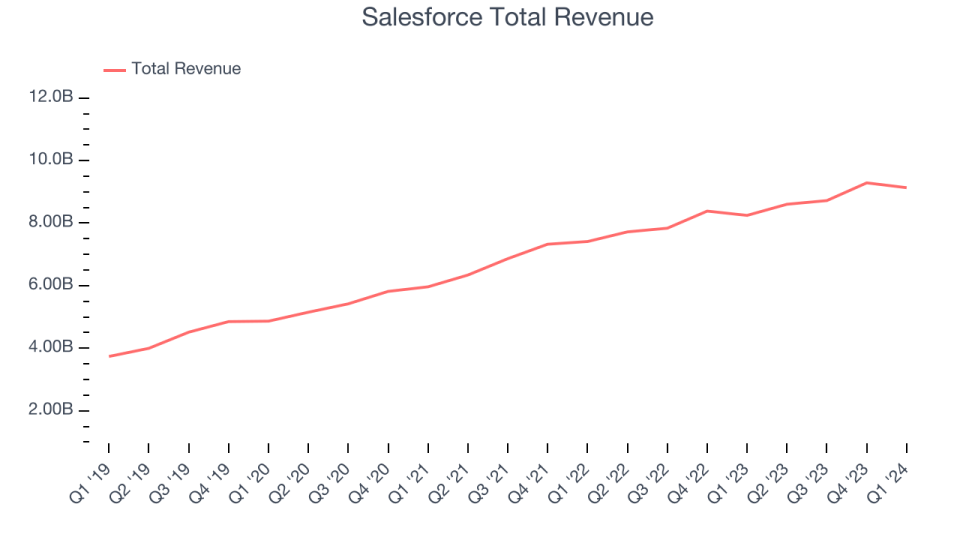

As you can see below, Salesforce's revenue growth has been mediocre over the last three years, growing from $5.96 billion in Q1 2022 to $9.13 billion this quarter.

Even though Salesforce fell short of analysts' revenue estimates, its quarterly revenue growth was still up 10.7% year on year. However, the company's revenue actually decreased by $154 million in Q1 compared to the $567 million increase in Q4 CY2023. Sales also dropped by a similar amount a year ago and management is guiding for revenue to rebound in the coming quarter, which might hint at an emerging seasonal pattern.

Next quarter's guidance suggests that Salesforce is expecting revenue to grow 7.2% year on year to $9.23 billion, slowing down from the 11.4% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 8.5% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Salesforce's free cash flow came in at $6.08 billion in Q1, up 43.2% year on year.

Salesforce has generated $11.33 billion in free cash flow over the last 12 months, an eye-popping 31.7% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Salesforce's Q1 Results

We struggled to find many strong positives in these results. Its revenue guidance for next quarter missed analysts' expectations and its billings missed Wall Street's estimates. Also, full year subscription revenue guidance was lowered. Overall, this was a bad quarter for Salesforce. The company is down 11% on the results and currently trades at $242.21 per share.

Salesforce may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance