Robert Karr Amplifies Stake in Adobe Inc, Marking a Strategic Portfolio Shift

Insight into Joho Capital's Latest 13F Filings for Q1 2024

Robert Karr (Trades, Portfolio), the founder of Joho Capital and a notable Tiger Cub, has recently disclosed his investment activities for the first quarter of 2024 through the latest 13F filing. Since establishing Joho Capital in 1996, Karr has been recognized for his focused investment strategy, primarily targeting new technologies and maintaining a low turnover rate. His investment philosophy emphasizes simplicity and depth, preferring a concentrated portfolio that allows for thorough research and long-term holdings, particularly in Asian equities.

Summary of New Buys

During the first quarter, Robert Karr (Trades, Portfolio) made notable additions to his portfolio by acquiring new stakes in two companies:

Match Group Inc (NASDAQ:MTCH) saw the addition of 186,000 shares, making up 0.94% of the portfolio with a total value of $6.75 million.

Bumble Inc (NASDAQ:BMBL) was also a significant new entry with 550,000 shares, representing 0.87% of the portfolio, valued at approximately $6.24 million.

Key Position Increases

Robert Karr (Trades, Portfolio) strategically increased his holdings in several companies, with the most significant boosts in:

Adobe Inc (NASDAQ:ADBE), where an additional 90,700 shares were purchased, bringing the total to 174,000 shares. This adjustment increased his stake by 108.88%, impacting the portfolio by 6.35% with a total value of $87.8 million.

Shoals Technologies Group Inc (NASDAQ:SHLS) also saw a substantial increase with an additional 3,387,539 shares, bringing the total to 6,423,545 shares. This adjustment represents a 111.58% increase in share count, valued at $71.82 million.

Summary of Sold Out Positions

In Q1 2024, Karr decided to exit completely from two positions:

Rivian Automotive Inc (NASDAQ:RIVN) was completely sold off with all 367,000 shares liquidated, impacting the portfolio by -1.56%.

Intuit Inc (NASDAQ:INTU) also saw a complete exit with 2,638 shares sold, resulting in a -0.3% portfolio impact.

Key Position Reductions

Reductions were also part of the strategic moves in Karr's portfolio:

NEXTracker Inc (NASDAQ:NXT) saw a reduction of 265,000 shares, a -31.67% decrease, impacting the portfolio by -2.25%. The stock traded at an average price of $53.20 during the quarter.

Autodesk Inc (NASDAQ:ADSK) shares were reduced by 3,900, marking a -39.31% decrease and a -0.17% impact on the portfolio. The stock's average trading price was $253.04 during the quarter.

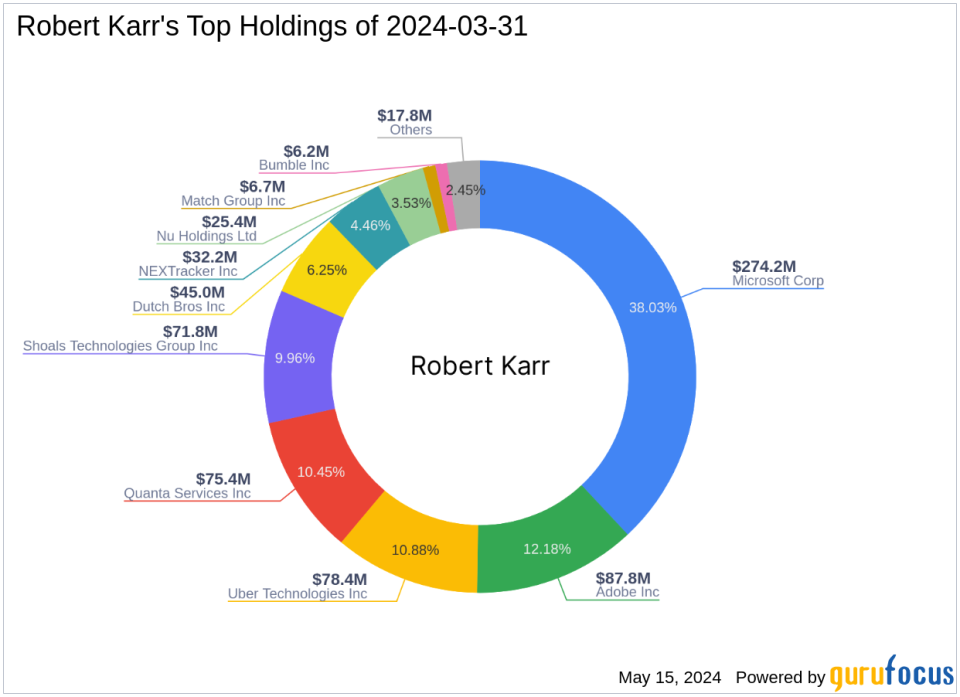

Portfolio Overview

As of the first quarter of 2024, Robert Karr (Trades, Portfolio)'s investment portfolio included 16 stocks. The top holdings were:

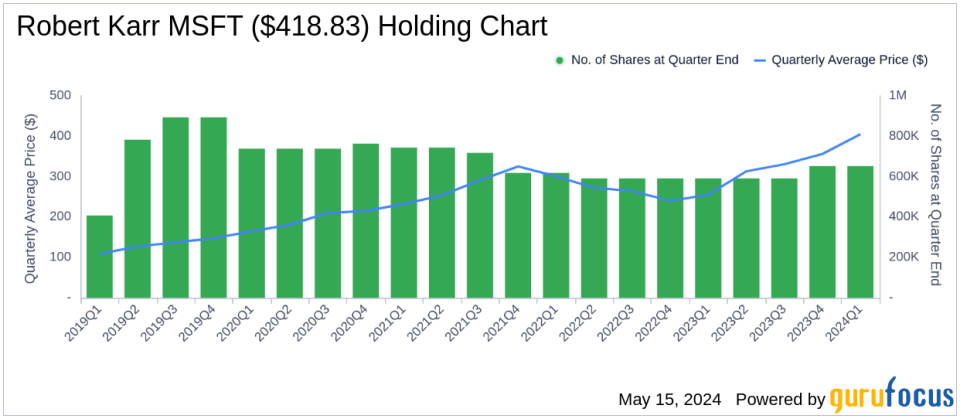

38.03% in Microsoft Corp (NASDAQ:MSFT)

12.18% in Adobe Inc (NASDAQ:ADBE)

10.88% in Uber Technologies Inc (NYSE:UBER)

10.45% in Quanta Services Inc (NYSE:PWR)

9.96% in Shoals Technologies Group Inc (NASDAQ:SHLS)

These holdings are predominantly concentrated in six industries: Technology, Industrials, Consumer Cyclical, Financial Services, Consumer Defensive, and Communication Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance